Capital One 2004 Annual Report Download - page 116

Download and view the complete annual report

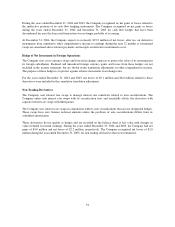

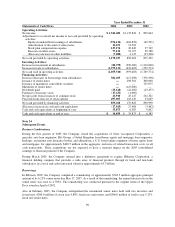

Please find page 116 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consumer loans

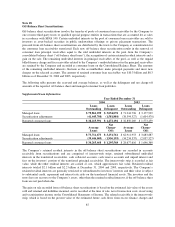

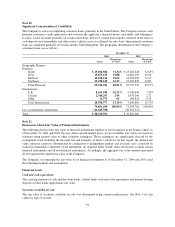

The net carrying amount of consumer loans other than auto loans and installment loans approximates fair value

due to the relatively short average life and variable interest rates on a substantial number of these loans. This

amount excluded any value related to account relationships.

The fair value of auto loans and installment loans was estimated by discounting future cash flows using a rate at

which similar portfolios of loans would be made under current conditions.

Interest receivable

The carrying amount approximates the fair value of this asset due to its relatively short-term nature.

Accounts receivable from securitizations

The carrying amount approximates fair value.

Derivatives

The carrying amount of derivatives approximates fair value and was represented by the estimated unrealized

gains as determined by quoted market prices. This value generally reflects the estimated amounts that the

Corporation would have received to terminate the interest rate swaps, currency swaps and forward foreign

currency exchange (“f/x”) contracts at the respective dates, taking into account the forward yield curve on the

swaps and the forward rates on the currency swaps and f/x contracts. These derivatives are included in other

assets on the balance sheet.

Financial Liabilities

Interest-bearing deposits

The fair value of interest-bearing deposits was calculated by discounting the future cash flows using estimates of

market rates for corresponding contractual terms.

Other borrowings

The carrying amount of federal funds purchased and resale agreements and other short-term borrowings

approximates fair value. The fair value of secured borrowings was calculated by discounting the future cash

flows using estimates of market rates for corresponding contractual terms and assumed maturities when no stated

final maturity was available. The fair value of the junior subordinated capital income securities was determined

based on quoted market prices.

Senior notes

The fair value of senior notes was determined based on quoted market prices.

Interest payable

The carrying amount approximates the fair value of this asset due to its relatively short-term nature.

Derivatives

The carrying amount of derivatives approximates fair value and was represented by the estimated unrealized

losses as determined by quoted market prices. This value generally reflects the estimated amounts that the

Company would have paid to terminate the interest rate swaps, currency swaps and f/x contracts at the

93