Capital One 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

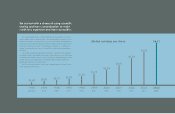

Now bigger and stronger than ever, the U.S. Card division’s $48.6

billion in managed loans contributed $1.4 billion to Capital One’s

bottom line in 2004.

As we’ve diversified, we’ve kept our place in the forefront of the

card industry. Among the top U.S. credit card issuers, Capital One has

one of the highest returns on managed loans and one of the lowest

charge-off rates.

We’ve maintained our superior returns through excellent risk man-

agement, close attention to operating expenses and constant innovation.

For ten years we’ve been creating innovative new products to give

consumers more for their money and to simplify their financial lives.

Our no-fee No HassleSM rewards program, which allows cardholders

to fly on any airline at any time or redeem their points for cash or

merchandise, is widely recognized as best of breed.

The credit card has democratized consumer access to credit. It is

a nearly universal currency. Even though the industry’s high-speed

growth rate has moderated, the card market will remain one of the

biggest markets in consumer finance. Opportunities abound, and

Capital One’s U.S. Card business has the scale, the savvy and the financial

resources to keep on making the most of them.

We put innovation, convenience

and value into every card.

6

u.s. card

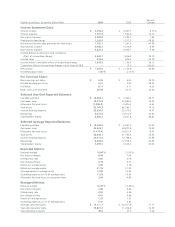

managed loans ($ in billions)

2004

$49

2003

$46

2002

$41

2001

$33

net income ($ in millions)

2004

$1,387

2003

$1,181

2002

$1,001

2001

$774