Capital One 2004 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

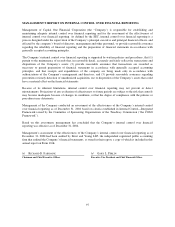

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

Management of Capital One Financial Corporation (the “Company”) is responsible for establishing and

maintaining adequate internal control over financial reporting and for the assessment of the effectiveness of

internal control over financial reporting. As defined by the SEC, internal control over financial reporting is a

process designed under the supervision of the Company’s principal executive and principal financial officers, and

effected by the company’s board of directors, management and other personnel, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements in accordance with

generally accepted accounting principles.

The Company’s internal control over financial reporting is supported by written policies and procedures, that (1)

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and

dispositions of the Company’s assets; (2) provide reasonable assurance that transactions are recorded as

necessary to permit preparation of financial statements in accordance with generally accepted accounting

principles, and that receipts and expenditures of the company are being made only in accordance with

authorizations of the Company’s management and directors; and (3) provide reasonable assurance regarding

prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could

have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect

misstatements. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate because of changes in conditions, or that the degree of compliance with the policies or

procedures may deteriorate.

Management of the Company conducted an assessment of the effectiveness of the Company’s internal control

over financial reporting as of December 31, 2004 based on criteria established in Internal Control—Integrated

Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“the COSO

Framework”).

Based on this assessment, management has concluded that the Company’s internal control over financial

reporting was effective as of December 31, 2004.

Management’s assessment of the effectiveness of the Company’s internal control over financial reporting as of

December 31, 2004 had been audited by Ernst and Young LLP, the independent registered public accounting

firm that audited the Company’s financial statements, as stated in their report, a copy of which is included in this

annual report on Form 10-K.

/s/ R

ICHARD

D. F

AIRBANK

/s/ G

ARY

L. P

ERLIN

Chairman and Chief Executive Officer Executive Vice President and Chief Financial Officer

97