Capital One 2004 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

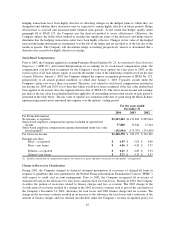

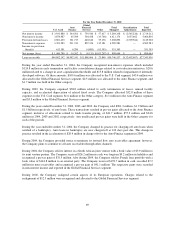

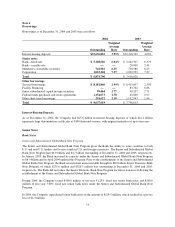

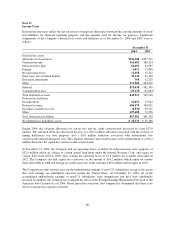

Note 4

Allowance for Loan Losses

The following is a summary of changes in the allowance for loan losses:

Year Ended December 31

2004 2003 2002

Balance at beginning of year $ 1,595,000 $ 1,720,000 $ 840,000

Provision for loan losses 1,220,852 1,517,497 2,149,328

Other (15,284) 3,863 (9,644)

Charge-offs (1,749,273) (2,004,328) (1,490,841)

Principal recoveries 453,705 357,968 231,157

Net charge-offs (1,295,568) (1,646,360) (1,259,684)

Balance at end of year $ 1,505,000 $ 1,595,000 $ 1,720,000

Loans totaling approximately $416.9 million and $454.8 million, representing amounts which were greater than

90 days past due, were included in the Company’s reported loan portfolio as of December 31, 2004 and 2003,

respectively.

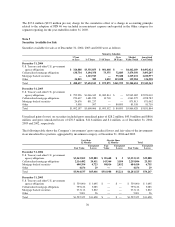

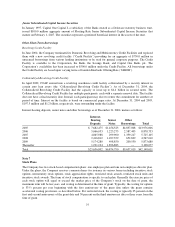

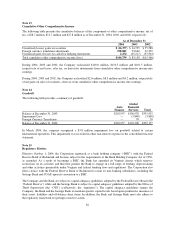

Note 5

Premises and Equipment

Premises and equipment were as follows:

December 31

2004 2003

Land $ 106,627 $ 111,288

Buildings and improvements 604,072 610,419

Furniture and equipment 731,026 844,447

Computer software 440,494 348,789

In process 98,774 182,741

1,980,993 2,097,684

Less: Accumulated depreciation and amortization (1,163,289) (1,195,084)

Total premises and equipment, net $ 817,704 $ 902,600

Depreciation and amortization expense was $224.3 million, $260.6 million, and $264.8 million, for the years

ended December 31, 2004, 2003 and 2002, respectively.

During 2004, the Company approved plans to liquidate certain premises as part of its facility consolidation

efforts. The Company expects to complete the sales within one year. The premises met the held-for-sale criteria

of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets and as such, an impairment

charge of $54.0 million was recognized in non-interest expense during the year ended December 31, 2004, to

write down the properties to fair value less the estimated cost to sell. Depreciation expense is no longer being

recognized for these assets. As of December 31, 2004, the carrying value of these assets was $56.9 million.

72