Capital One 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

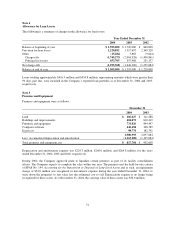

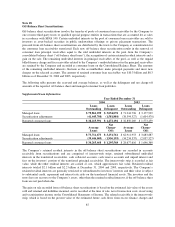

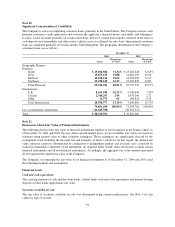

Note 13

Cumulative Other Comprehensive Income

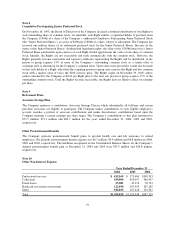

The following table presents the cumulative balances of the components of other comprehensive income, net of

tax, of $8.7 million, $11.7 million and $27.8 million as of December 31, 2004, 2003, and 2002, respectively:

As of December 31

2004 2003 2002

Unrealized (losses) gains on securities $ (16,377) $ 34,735 $ 55,588

Foreign currency translation adjustments 158,882 93,640 22,350

Unrealized gains (losses) on cash flow hedging instruments 2,254 (45,217) (93,504)

Total cumulative other comprehensive income (loss) $144,759 $ 83,158 $(15,566)

During 2004, 2003 and 2002, the Company reclassified $118.0 million, $110.5 million and $101.5 million,

respectively of net losses, after tax, on derivative instruments from cumulative other comprehensive income into

earnings.

During 2004, 2003 and 2002, the Company reclassified $2.6 million, $8.3 million and $4.2 million, respectively

of net gains on sales of securities, after tax, from cumulative other comprehensive income into earnings.

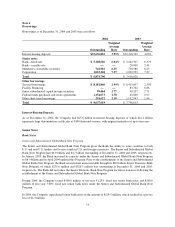

Note 14

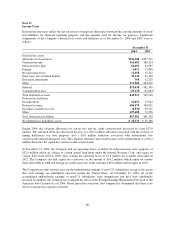

Goodwill

The following table provides a summary of goodwill.

Auto

Finance

Global

Financial

Services Total

Balance at December 31, 2003 $218,957 $136,978 $355,935

Impairment Loss — (3,848) (3,848)

Foreign Currency Translation — 70 70

Balance at December 31, 2004 $218,957 $133,200 $352,157

In March 2004, the company recognized a $3.8 million impairment loss on goodwill related to certain

international operations. This impairment was recorded in other non-interest expense in the consolidated income

statement.

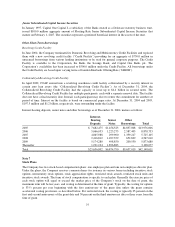

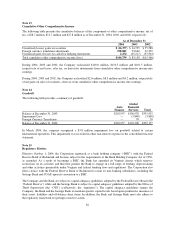

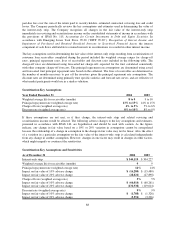

Note 15

Regulatory Matters

Effective October 1, 2004, the Corporation registered as a bank holding company (“BHC”) with the Federal

Reserve Bank of Richmond and became subject to the requirements of the Bank Holding Company Act of 1956,

as amended. As a result of becoming a BHC, the Bank has amended its Virginia charter which removes

restrictions on its activities and therefore permits the Bank to engage in a full range of lending, deposit-taking

and other activities permissible under Virginia and federal banking laws and regulations. The Corporation also

filed a notice with the Federal Reserve Bank of Richmond to retain its non-banking subsidiaries, including the

Savings Bank and COAF, upon its conversion to a BHC.

The Company and the Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board (the

“Federal Reserve”) while and the Savings Bank is subject to capital adequacy guidelines adopted by the Office of

Thrift Supervision (the “OTS”) (collectively, the “regulators”). The capital adequacy guidelines require the

Company, the Bank and the Savings Bank to maintain specific capital levels based upon quantitative measures of

their assets, liabilities and off-balance sheet items. In addition, the Bank and Savings Bank must also adhere to

the regulatory framework for prompt corrective action.

82