Capital One 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Provision For Loan Losses

The allowance for loan losses is maintained at an amount estimated to be sufficient to absorb probable principal

losses, net of principal recoveries (including recovery of collateral), inherent in the existing reported loan

portfolio. The provision for loan losses is the periodic cost of maintaining an adequate allowance. Management

believes that, for all relevant periods, the allowance for loan losses was adequate to cover anticipated losses in

the total reported loan portfolio under then current conditions, met applicable legal and regulatory guidance and

was consistent with GAAP. There can be no assurance as to future credit losses that may be incurred in

connection with the Company’s loan portfolio, nor can there be any assurance that the loan loss allowance that

has been established by the Company will be sufficient to absorb such future credit losses. The allowance is a

general allowance applicable to the reported consumer loan portfolio. The amount of allowance necessary is

determined primarily based on a migration analysis of delinquent and current accounts and forward loss curves.

In evaluating the sufficiency of the allowance for loan losses, management also takes into consideration the

following factors: recent trends in delinquencies and charge-offs including bankrupt, deceased and recovered

amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in the composition of the

loan portfolio; economic conditions; legal and regulatory guidance; credit evaluations and underwriting policies;

seasonality; and the value of collateral supporting the loans.

Table 8 sets forth the activity in the allowance for loan losses for the periods indicated. See “Asset Quality,”

“Delinquencies” and “Net Charge-Offs” for a more complete analysis of asset quality.

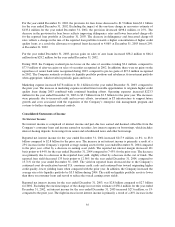

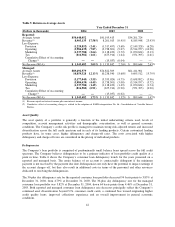

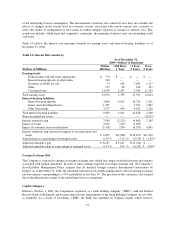

Table 8: Summary of Allowance for Loan Losses

Year Ended December 31

(Dollars in thousands) 2004 2003 2002 2001 2000

Balance at beginning of year $ 1,595,000 $ 1,720,000 $ 840,000 $ 527,000 $ 342,000

Provision for loan losses:

Domestic 1,085,467 1,388,463 2,025,885 1,048,972 705,195

International 135,385 129,034 123,443 71,485 107,666

Total provision for loan losses 1,220,852 1,517,497 2,149,328 1,120,457 812,861

Other (15,284) 3,863 (9,644) 14,800 (549)

Charge-offs:

Domestic (1,614,075) (1,858,176) (1,363,565) (908,065) (693,106)

International (135,198) (146,152) (127,276) (110,285) (79,296)

Total charge-offs (1,749,273) (2,004,328) (1,490,841) (1,018,350) (772,402)

Principal recoveries:

Domestic 410,493 320,349 203,412 176,102 136,334

International 43,212 37,619 27,745 19,991 8,756

Total principal recoveries 453,705 357,968 231,157 196,093 145,090

Net charge-offs (1,295,568) (1,646,360) (1,259,684) (822,257) (627,312)

Balance at end of year $ 1,505,000 $ 1,595,000 $ 1,720,000 $ 840,000 $ 527,000

Allowance for loan losses to loans at end of

year 3.94% 4.86% 6.29% 4.02% 3.49%

Allowance for loan losses by geographic

distribution:

Domestic $ 1,354,849 $ 1,477,314 $ 1,636,405 $ 784,857 $ 451,074

International 150,151 117,686 83,595 55,143 75,926

For the year ended December 31, 2004, the provision for loan losses decreased $296.7 million, or 20%, to $1.2

billion from $1.5 billion for the year ended December 31, 2003. While the Company’s reported loan portfolio

increased 16% to $38.2 billion at December 31, 2004 from $32.9 billion at December 31, 2003, the impact of the

loan growth to the allowance was more than offset by the loan growth being concentrated in higher credit quality

loans, an improvement in collection experience, and improved economic conditions. Evidence of the

improvement in these factors can be seen in the 30-plus day reported delinquency rate which was 3.85% at

44