Capital One 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

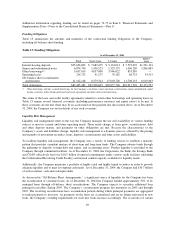

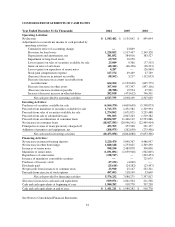

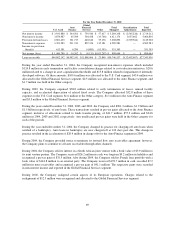

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31 (In Thousands, Except Per Share Data) 2004 2003 2002

Interest Income:

Consumer loans, including past-due fees $4,234,420 $3,932,295 $3,792,461

Securities available for sale 312,374 192,594 184,407

Other 247,626 242,765 203,898

Total interest income 4,794,420 4,367,654 4,180,766

Interest Expense:

Deposits 1,009,545 891,650 811,889

Senior and subordinated notes 486,812 423,826 408,205

Other borrowings 295,085 267,089 241,560

Total interest expense 1,791,442 1,582,565 1,461,654

Net interest income 3,002,978 2,785,089 2,719,112

Provision for loan losses 1,220,852 1,517,497 2,149,328

Net interest income after provision for loan losses 1,782,126 1,267,592 569,784

Non-Interest Income:

Servicing and securitizations 3,643,808 3,211,662 2,805,501

Service charges and other customer-related fees 1,482,658 1,630,185 1,937,735

Interchange 475,810 376,785 447,747

Other 297,881 197,292 275,853

Total non-interest income 5,900,157 5,415,924 5,466,836

Non-Interest Expense:

Salaries and associate benefits 1,642,721 1,570,415 1,557,887

Marketing 1,337,780 1,118,422 1,070,624

Communications and data processing 475,355 448,110 406,071

Supplies and equipment 349,920 344,049 357,953

Occupancy 206,614 185,179 205,531

Other 1,309,829 1,190,548 987,515

Total non-interest expense 5,322,219 4,856,723 4,585,581

Income before income taxes and cumulative effect of accounting change 2,360,064 1,826,793 1,451,039

Income taxes 816,582 675,914 551,395

Income before cumulative effect of accounting change 1,543,482 1,150,879 899,644

Cumulative effect of accounting change, net of taxes of $8,832 — 15,037 —

Net income $1,543,482 $1,135,842 $ 899,644

Basic earnings per share before cumulative effect of accounting change $6.55$ 5.12 $ 4.09

Basic earnings per share after cumulative effect of accounting change $6.55$ 5.05 $ 4.09

Diluted earnings per share before cumulative effect of accounting change $6.21$ 4.92 $ 3.93

Diluted earnings per share after cumulative effect of accounting change $6.21$ 4.85 $ 3.93

Dividends paid per share $0.11$ 0.11 $ 0.11

See Notes to Consolidated Financial Statements.

59