Capital One 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

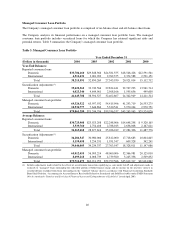

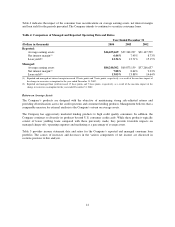

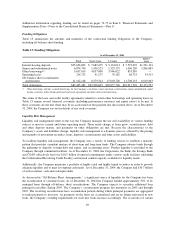

Table 4 indicates the impact of the consumer loan securitizations on average earning assets, net interest margin

and loan yield for the periods presented. The Company intends to continue to securitize consumer loans.

Table 4: Comparison of Managed and Reported Operating Data and Ratios

Year Ended December 31

(Dollars in thousands) 2004 2003 2002

Reported:

Average earning assets $46,655,669 $37,362,297 $31,147,599

Net interest margin(1) 6.44% 7.45% 8.73%

Loan yield(2) 12.36% 13.71% 15.15%

Managed:

Average earning assets $84,240,302 $69,873,159 $57,266,637

Net interest margin(1) 7.88% 8.64% 9.23%

Loan yield(2) 13.05% 13.88% 14.64%

(1) Reported and managed net interest margin increased 12 basis points and 7 basis points, respectively, as a result of the one-time impact of

the change in recoveries assumption for the year ended December 31, 2002.

(2) Reported and managed loan yield increased 15 basis points and 7 basis points, respectively, as a result of the one-time impact of the

change in recoveries assumption for the year ended December 31, 2002.

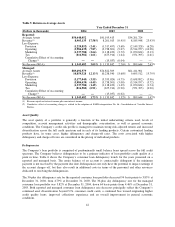

Return on Average Assets

The Company’s products are designed with the objective of maintaining strong risk-adjusted returns and

providing diversification across the credit spectrum and consumer lending products. Management believes that a

comparable measure for external analysis is the Company’s return on average assets.

The Company has aggressively marketed lending products to high credit quality consumers. In addition, the

Company continues to diversify its products beyond U.S. consumer credit cards. While these products typically

consist of lower yielding loans compared with those previously made, they provide favorable impacts on

managed charge-offs, operating expenses and marketing as a percentage of average assets.

Table 5 provides income statement data and ratios for the Company’s reported and managed consumer loan

portfolio. The causes of increases and decreases in the various components of net income are discussed in

sections previous to this analysis.

41