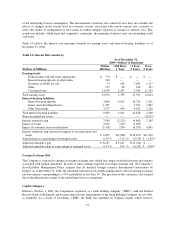

Capital One 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1

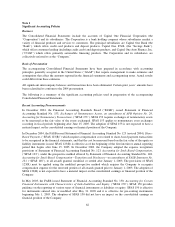

Significant Accounting Policies

Business

The Consolidated Financial Statements include the accounts of Capital One Financial Corporation (the

“Corporation”) and its subsidiaries. The Corporation is a bank holding company whose subsidiaries market a

variety of financial products and services to consumers. The principal subsidiaries are Capital One Bank (the

“Bank”), which offers credit card products and deposit products, Capital One, F.S.B. (the “Savings Bank”),

which offers consumer lending (including credit cards) and deposit products, and Capital One Auto Finance, Inc.

(“COAF”) which offers primarily automobile financing products. The Corporation and its subsidiaries are

collectively referred to as the “Company.”

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting

principles generally accepted in the United States (“GAAP”) that require management to make estimates and

assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results

could differ from these estimates.

All significant intercompany balances and transactions have been eliminated. Certain prior years’ amounts have

been reclassified to conform to the 2004 presentation.

The following is a summary of the significant accounting policies used in preparation of the accompanying

Consolidated Financial Statements.

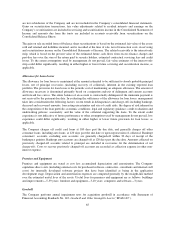

Recent Accounting Pronouncements

In December 2004, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial

Accounting Standard No. 153, Exchanges of Nonmonetary Assets, an amendment of APB Opinion No. 29,

Accounting for Nonmonetary Transactions, (“SFAS 153”). SFAS 153 requires exchanges of nonmonetary assets

to be measured at the fair value of the assets exchanged. SFAS 153 applies to nonmonetary asset exchanges

occurring in fiscal periods beginning after June 15, 2005. The adoption of SFAS 153 is not expected to have a

material impact on the consolidated earnings or financial position of the Company.

In December 2004, the FASB issued Statement of Financial Accounting Standard No. 123 (revised 2004), Share-

Based Payment, (“SFAS 123(R)”) which requires compensation cost related to share-based payment transactions

to be recognized in the financial statements, and that the cost be measured based on the fair value of the equity or

liability instruments issued. SFAS 123(R) is effective as of the beginning of the first interim or annual reporting

period that begins after June 15, 2005. In December 2003, the Company adopted the expense recognition

provisions of Statement of Financial Accounting Standard No. 123, Accounting for Stock Based Compensation,

(“SFAS 123”), under the prospective method allowed by Statement of Financial Accounting Standard No. 148,

Accounting for Stock-Based Compensation—Transition and Disclosure—an amendment of FASB Statement No.

123, (“SFAS 148”), to all awards granted, modified, or settled after January 1, 2003. The provisions of SFAS

123(R) must be applied using the modified prospective method which requires the Company to recognize

compensation expense for the unvested portion of all awards granted prior to January 1, 2003. The adoption of

SFAS 123(R) is not expected to have a material impact on the consolidated earnings or financial position of the

Company.

In May 2003, the FASB issued Statement of Financial Accounting Standard No. 150, Accounting for Certain

Financial Instruments with Characteristics of both Liabilities and Equity, (“SFAS 150”). SFAS 150 provides

guidance on the reporting of various types of financial instruments as liabilities or equity. SFAS 150 is effective

for instruments entered into or modified after May 31, 2003 and it is effective for pre-existing instruments

beginning July 1, 2003. The adoption of SFAS 150 did not have an impact on the consolidated earnings or

financial position of the Company.

62