Capital One 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

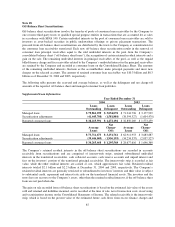

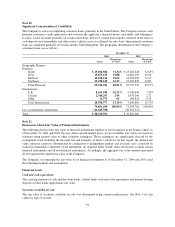

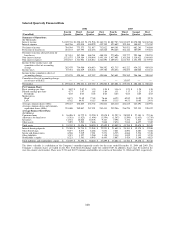

Year Ended December 31

Statements of Cash Flows 2004 2003 2002

Operating Activities:

Net income $ 1,543,482 $1,135,842 $ 899,644

Adjustments to reconcile net income to net cash provided by operating

activities:

Equity in undistributed earnings of subsidiaries (574,134) (404,878) (69,531)

Amortization of discount of senior notes 12,671 12,518 —

Stock plan compensation expense 127,174 49,449 27,749

Decrease in other assets 77,122 53,197 50,788

(Decrease) increase in other liabilities 4,135 (33,328)

Net cash provided by operating activities 1,179,227 850,263 875,322

Investing Activities:

Increase in investment in subsidiaries (80,379) (350,000) (1,210,000)

Increase in loans to subsidiaries (1,975,131) (643,603) (559,774)

Net cash used in investing activities (2,055,510) (993,603) (1,769,774)

Financing Activities:

Increase (decrease) in borrowings from subsidiaries 381,205 (117,698) (376,598)

Issuance of senior notes —298,581 300,000

Issuance of mandatory convertible securities —— 725,075

Maturities of senior notes —(125,000) —

Dividends paid (25,618) (24,282) (23,457)

Purchases of treasury stock (17,232) (4,069) —

Net proceeds from issuances of common stock 23,910 25,147 232,321

Proceeds from exercise of stock options 497,003 118,149 33,649

Net cash provided by financing activities 859,268 170,828 890,990

(Decrease) increase in cash and cash equivalents (17,015) 27,488 (3,462)

Cash and cash equivalents at beginning of year 33,873 6,385 9,847

Cash and cash equivalents at end of year $ 16,858 $ 33,873 $ 6,385

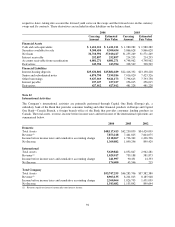

Note 24

Subsequent Events

Business Combinations

During the first quarter of 2005, the Company closed the acquisitions of Onyx Acceptance Corporation, a

specialty auto loan originator; Hfs Group, a United Kingdom based home equity and mortgage loan originator;

InsLogic, an internet auto insurance broker, and eSmartloan, a U.S. based online originator of home equity loans

and mortgages, for approximately $440.5 million in the aggregate, exclusive of related transaction costs, in all

cash transactions. These acquisitions are not expected to have a material impact on the 2005 consolidated

earnings or financial position of the Company.

During March 2005, the Company entered into a definitive agreement to acquire Hibernia Corporation, a

financial holding company that provides a wide array of financial products through its bank and non-bank

subsidiaries, in a stock and cash transaction valued at approximately $5.3 billion.

Borrowings

In February 2005, the Company completed a remarketing of approximately $704.5 million aggregate principal

amount of its 6.25% senior notes due May 17, 2007. As a result of the remarketing, the annual interest rate on the

senior notes was reset to 4.738%. The remarketing was conducted pursuant to the original terms of the Upper

Decs issued in April of 2002.

Also in February 2005, the Company extinguished the remarketed senior notes held with two investors and

issued new, $300.0 million of seven year 4.80% fixed rate senior notes and $300.0 million of twelve year 5.25%

fixed rate senior notes.

96

(7,088)