Capital One 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

momentum

2004 annual report

Table of contents

-

Page 1

momentum 2004 annual report -

Page 2

At Capital One® we're always focused on where we're going, but in celebrating our tenth anniversary in 2004, we paused to look at where we've been. -

Page 3

... best-known brands in consumer finance. Whether people come to us for a credit card, a car loan, a small-business credit line or a certificate of deposit, they know they can count on Capital One to deliver great value without the hassle. The excellence built into Capital One's products is a hallmark... -

Page 4

... leading credit card businesses and are expanding into new financial products and services. One thing that hasn't changed during the past decade is our proprietary Information-Based Strategy (IBS), which combines the power of information, technology, testing and great people to bring customized... -

Page 5

... taking IBS, the strategy that made Capital One a winner in credit cards and auto finance, to new businesses. And, we have a powerful brand and huge customer base to fuel our growth and diversification. Our people have pulled together to make Capital One the strong, diversified Company it is today... -

Page 6

-

Page 7

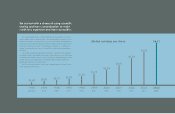

... $642 $363 $470 1999 2000 2001 2002 2003 2004 diluted earnings per share $6.21 $4.85 $3.93 $2.91 $1.72 $2.24 1999 2000 2001 2002 2003 2004 Managed loans are comprised of reported loans and off-balance-sheet securitized... -

Page 8

...74 2.76 21.34 12.92 13.04 4.86 Managed Metrics: Revenue margin Net interest margin Delinquency rate Net charge-off rate Return on average assets Operating expense as a % of average loans Average consumer loans Year-end consumer loans Year-end total accounts 12.89 % 7.88 3.82 4.41 1.73 5.41 $ 73,711... -

Page 9

...Among the top U.S. credit card issuers, Capital One has one of the highest returns on managed loans and one of the lowest charge-off rates. We've maintained our superior returns through excellent risk management, close attention to operating expenses and constant innovation. For ten years we've been... -

Page 10

-

Page 11

... call-center employee who says "No" to every request from a caller have raised the profile of Capital One's distinctive No HassleSM rewards card. With no fee, no blackout dates and no restrictions on which airline the customer flies, the No Hassle rewards card is one more example of our drive to say... -

Page 12

-

Page 13

... entered the business six years ago as part of our long-range strategy of diversifying beyond credit cards. Auto finance is a great fit with Capital One's strengths in direct marketing, risk analysis and information technology - a combination that lets us tailor each loan to the customer's financial... -

Page 14

-

Page 15

... traditional health insurance). And with the 2005 acquisition of eSmartloan, a leading online home-equity lender based in the U.S., we now have an excellent platform for success in the fastest-growing segment of consumer finance. Like our U.S. credit cards and auto loans, our small-business products... -

Page 16

-

Page 17

... careers and the Company's success. Capital One University offers a wide range of training programs in the classroom and online. In the U.S., Canada and the U.K., Capital One has been a regular on numerous best-places-to-work lists, as much for its stimulating work environment as for its community... -

Page 18

-

Page 19

... average annual return on equity for the decade exceeds the 15% for the S&P 500. We've maintained the quality by building a rock-solid financial foundation for Capital One. Management of credit risk and interest-rate risk is highly disciplined. At 4.41%, our total company managed net charge-off rate... -

Page 20

-

Page 21

... Putnam Company Gregor Bailar Executive Vice President and Chief Information Officer James A. Flick, Jr.A, G President and CEO Winnow, Inc. John G. Finneran, Jr. Executive Vice President, Corporate Reputation and Governance; General Counsel and Corporate Secretary; SEC Compliance Officer Patrick... -

Page 22

... Drive Falls Church, Virginia 22042 Principal Investor Contact Michael Rowen Vice President, Investor Relations Capital One Financial Corporation 1680 Capital One Drive McLean, VA 22102 (703) 720-1000 Copies of Form 10-K filed with the Securities and Exchange Commission are available without charge... -

Page 23

Capital One Headquartered in McLean, Virginia, Capital One® Financial Corporation (www.capitalone.com) is a bank holding company whose principal operating subsidiaries, Capital One Bank, Capital One, F.S.B. and Capital One Auto Finance, Inc. offer a variety of consumer financial products. Capital ... -

Page 24

... Employer Identification No.) 1680 Capital One Drive McLean, Virginia (Address of Principal Executive Offices) 22102 (Zip Code) Registrant's telephone number, including area code: (703) 720-1000 Securities registered pursuant to section 12(b) of the act: Title of Each Class Name of Each Exchange... -

Page 25

...10. Directors and Executive Officers of the Corporation Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions Item 14. Principal Accountant Fees and Services Item... -

Page 26

... DECs® securities are listed on the New York Stock Exchange under the symbol COFPRC. Our principal executive office is located at 1680 Capital One Drive, McLean, Virginia 22102 (telephone number (703) 720-1000). The Corporation maintains a website at www.capitalone.com. Documents available on our... -

Page 27

... annual percentage rates, fees and credit limits, rewards programs and other special features. We routinely test new products to develop ones that appeal to different and changing consumer preferences. Our customized products include both products offered to a wide range of consumer credit risk... -

Page 28

... periodic reporting on significant Company risks and mitigation activities and the compliance with corporate risk policies, while the Board Finance Committee oversees liquidity and market risk. The Executive Committee, a committee of senior management chaired by the Chief Executive Officer, provides... -

Page 29

...actions; and provides direction on credit risk management. Asset and Liability Management Committee-provides advice and counsel to the Chief Financial Officer and other executives on the acquisition and deployment of funds, off-balance sheet activities related to the management of interest rate risk... -

Page 30

...credit risk: (1) changing economic conditions, which affect consumers' ability to pay; (2) changing competitive environment, which affects consumer debt loads and borrowing patterns; (3) the Company's underwriting strategies and standards, which drive the selection of customers and the terms offered... -

Page 31

... foreign currency exchange rates. The management of market risk is overseen by the Chief Financial Officer with the advice and guidance from the Asset and Liability Management Committee and its sub-committee on risk management chaired by the Vice President of Global Planning. The Company currently... -

Page 32

...many specialized activities designed to mitigate key operational risks facing the Company. These include a dedicated fraud management department, programs for third party supplier risk management, information security and business continuity planning, development and maintenance of required policies... -

Page 33

... cards to consumers with low-risk and established credit profiles to take advantage of the favorable risk return characteristics of this consumer type. Industry competitors have continuously solicited our customers with these and other interest rate strategies. Management believes the competition... -

Page 34

... Federal Reserve Bank of Richmond and the FDIC. The Savings Bank is a federal savings bank chartered by the Office of Thrift Supervision (the "OTS") and is a member of the Federal Home Loan Bank System. Its deposits are insured by the Savings Association Insurance Fund of the FDIC. The Savings Bank... -

Page 35

... organizations, including the Company, to increase the minimum level of capital held. The Company will continue to closely monitor regulatory action on this matter and assess the potential impact to the Company. FDICIA Among other things, the Federal Deposit Insurance Corporation Improvement Act... -

Page 36

...backed and mortgage related investments, small business related securities, certain state and federal housing investments, education loans and credit card loans) on a monthly basis in nine out of every twelve months. Failure to qualify under the QTL Test could subject the Savings Bank to substantial... -

Page 37

... protect the security of information about their customers, educate their employees about the importance of protecting customer privacy, and allow their customers to remove their names from the solicitation lists they use and share with others. The Corporation and the Bank require business partners... -

Page 38

... Company. Investment in the Corporation, the Bank and the Savings Bank Certain acquisitions of capital stock may be subject to regulatory approval or notice under federal or Virginia law. Investors are responsible for ensuring that they do not, directly or indirectly, acquire shares of capital stock... -

Page 39

... Act applies to all companies that are required to file periodic reports with the Securities and Exchange Commission ("SEC") and contains a number of significant changes relating to the responsibilities of directors and officers and reporting and governance obligations of SEC reporting companies... -

Page 40

... Bank, including credit card lending. The Canadian Branch is not authorized to accept retail deposits from Canadian customers. As in the U.S., in non-U.S. jurisdictions where we operate, we face a risk that the laws and regulations that are applicable to us (or the interpretations of existing laws... -

Page 41

... of smart cards and debit cards. We also compete with providers of other types of financial services and consumer loans such as home equity lines and other mortgage related products that offer consumers debt consolidation. We face similar competitive markets in our auto financing, small business... -

Page 42

... banks, securities firms and insurance companies, may increase competition in the financial services industry. In such a competitive environment, we may lose entire accounts, or may lose account balances, to competing financial institutions, or find it more costly to maintain our existing customer... -

Page 43

... compensated for the credit risk we accept for both high and low risk customers. We face a risk that the models and approaches we use to select, manage, and underwrite our customers may become less predictive of future charge-offs due to changes in the competitive environment or in the economy... -

Page 44

.... We May Face Limited Availability of Financing, Variation in Our Funding Costs and Uncertainty in Our Securitization Financing In general, the amount, type and cost of our funding, including financing from other financial institutions, the capital markets and deposits, directly impacts our expense... -

Page 45

... the activities of our business partners, disruptions in the capital markets, specific events that adversely impact the financial services industry, counter-party availability, changes affecting our assets, our corporate and regulatory structure, interest rate fluctuations, ratings agencies actions... -

Page 46

...rate product alternatives available to our customers. Consequently, their credit card balances may fall and pre-payment rates for installment loan products may rise. We can mitigate this risk by reducing the interest rates we charge or by refinancing installment loan products. However, these changes... -

Page 47

... merchants have filed class action suits, which have been consolidated, against the associations under federal antitrust law relating to certain debit card products. In April 2003, the associations agreed to settle the suit in exchange for payments to plaintiffs by MasterCard of $1 billion and... -

Page 48

...-49; 73-75 We lease our new, 570,000 square foot, headquarters building at 1680 Capital One Drive, McLean, Virginia. The building houses our primary executive offices and Northern Virginia staff, and is leased through December 2010, with the right to purchase at a fixed cost at the end of the lease... -

Page 49

.... We currently lease 1.65 million square feet of office space from which credit, collections, customer service and other operations are conducted, in Virginia, Texas, Idaho, California, Massachusetts, the United Kingdom, Canada, and insignificant space for business development in other locations. We... -

Page 50

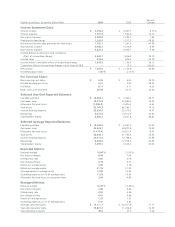

...Selected Average Reported Balances: Liquidity portfolio Consumer loans Allowance for loan losses Total assets Interest-bearing deposits Borrowings Stockholders' equity Reported Metrics: Revenue margin Net interest margin Delinquency rate Net charge-off rate Return on average assets Return on average... -

Page 51

... company. The Corporation's principal subsidiaries are Capital One Bank (the "Bank") which currently offers credit card products and takes retail deposits, Capital One, F.S.B. (the "Savings Bank"), which offers consumer and commercial lending and consumer deposit products, and Capital One Auto... -

Page 52

... cash flows change. Rewards The Company offers credit cards that provide reward program members with various rewards such as airline tickets, free or deeply discounted products or cash rebates, based on purchase volume. The Company establishes a reward liability based on points earned which are... -

Page 53

... Accounting Policies-Accounting for Securitization Transactions," the Company actively engages in off-balance sheet securitization transactions of loans for funding purposes. The Company receives the proceeds from third party investors for securities issued from the Company's securitization vehicles... -

Page 54

... the Company's total managed loans, 52% and 53% were included in off-balance sheet securitizations for the years ended December 31, 2004 and 2003, respectively. Funding Commitments Related to Synthetic Fuel Tax Credit Transaction In June 2004, the Corporation established and consolidated Capital One... -

Page 55

... to "managed" loans outstanding the collectible portion of billed finance charge and fee income on the investors' interest in securitized loans excluded from loans outstanding on the "reported" balance sheet in accordance with Financial Accounting Standards Board Staff Position, "Accounting for... -

Page 56

... 2003. Compensation expense resulted from the discounts provided under the Associate Stock Purchase Plan and the amortization of the estimated fair value of stock options granted during 2003. In July 2003, the Company adopted the provisions of FASB interpretation No. 46(R), Consolidation of Variable... -

Page 57

... in the mix of the managed loan portfolio to higher credit quality, lower yielding loans, an increase in low introductory rate accounts compared to the prior year and reduced pricing on many of the Company's new loans in response to lower funding costs and increased competitive pressure. In addition... -

Page 58

... of the Company's enterprise risk management program and systems to further strengthen internal controls. Consolidated Statements of Income Net Interest Income Net interest income is comprised of interest income and past-due fees earned and deemed collectible from the Company's consumer loans and... -

Page 59

... the prior year. Excluding the one-time impact of the change in recoveries estimate of 12 basis points, the net interest margin decreased 116 basis points for the year ended December 31, 2003. The decrease was primarily due to a decrease in the reported loan yield. The reported loan yield decreased... -

Page 60

... Year Ended December 31 2004 vs. 2003 2003 vs. 2002 Change due to(1) Change due to(1) Increase Yield/ Increase Yield/ (Decrease) Volume Rate (Decrease)(2) Volume Rate (Dollars in thousands) Interest Income: Consumer loans Domestic International Total consumer loans Securities available for sale... -

Page 61

... on the reported loan portfolio resulting from the Company's continued asset diversification beyond U.S. consumer credit cards, a continued bias toward originating higher credit quality, lower yielding loans and ongoing product modifications. Service charges and other customer-related fees decreased... -

Page 62

... charges consisting of $124.8 million in employee termination benefits and facility consolidation costs related to corporate-wide cost reduction initiatives, $20.6 million related to a change in asset capitalization thresholds and $15.8 million related to impairment of internally developed software... -

Page 63

... significant risks and potential returns. Table 3 summarizes the Company's managed consumer loan portfolio. Table 3: Managed Consumer Loan Portfolio Year Ended December 31 2003 2002 2001 (Dollars in thousands) Year-End Balances: Reported consumer loans: Domestic International Total Securitization... -

Page 64

... managed loan yield increased 15 basis points and 7 basis points, respectively, as a result of the one-time impact of the change in recoveries assumption for the year ended December 31, 2002. Return on Average Assets The Company's products are designed with the objective of maintaining strong risk... -

Page 65

...be a primary indicator of loan portfolio credit quality at a point in time. Table 6 shows the Company's consumer loan delinquency trends for the years presented on a reported and managed basis. The entire balance of an account is contractually delinquent if the minimum payment is not received by the... -

Page 66

... reported and managed net charge-off rates decreased 196 and 145 basis points, to 3.78% and 4.41%, respectively when compared with the prior year. The decrease in net charge-off rates principally relates to the Company's continued asset diversification beyond U.S. consumer credit cards, a continued... -

Page 67

... by the Company will be sufficient to absorb such future credit losses. The allowance is a general allowance applicable to the reported consumer loan portfolio. The amount of allowance necessary is determined primarily based on a migration analysis of delinquent and current accounts and forward... -

Page 68

... in higher credit quality loans and an improvement in collection experience. Reportable Segments The Company manages its business by three distinct operating segments: U.S. Card, Auto Finance and Global Financial Services. The U.S. Card, Auto Finance and Global Financial Services segments are... -

Page 69

...auto receivables agreement; however, the Company plans to continue to sell auto receivables through other channels. For the year ended December 31, 2004, the Auto Finance segment's net charge-off rate was 3.28%, down 134 basis points from the prior year. Net charge-offs of Auto Finance segment loans... -

Page 70

... is available to the Corporation, the Bank, the Savings Bank and Capital One Bank (Europe) plc. The Corporation's availability has been increased to $500.0 million under the Credit Facility. All borrowings under the Credit Facility are based on varying terms of London InterBank Offering Rate ("LIBOR... -

Page 71

... which the Corporation from time to time may offer and sell senior or subordinated debt securities, preferred stock, common stock, common equity units and stock purchase contracts. The Company continues to expand its retail deposit gathering efforts through both direct and broker marketing channels... -

Page 72

...borrowings includes secured borrowings for the Company's on-balance sheet auto loan securitizations, junior subordinated capital income securities, federal funds purchased and resale agreements and other short-term borrowings. The terms of the lease and credit facility agreements related to certain... -

Page 73

... investment securities and money market instruments in addition to alternative funding sources to fund increases in loan receivables and meet its other liquidity needs. The Federal Deposit Insurance Corporation Improvement Act of 1991 limits the use of brokered deposits to "well-capitalized" insured... -

Page 74

... of foreign currency exchange rates is limited to certain intercompany obligations related to international operations. These derivatives expose the Company to certain credit risks. The Company has established policies and limits, as well as collateral agreements, to manage credit risk related to... -

Page 75

... associated with foreign operations. In order to limit earnings exposure to foreign exchange risk, the Company's Asset/Liability Management Policy requires that all material foreign currency denominated transactions be hedged. As of December 31, 2004, the estimated reduction in 12-month earnings... -

Page 76

... Bank's, on-balance sheet assets were treated as subprime for purposes of the Subprime Guidelines. The Company currently expects to operate each of the Bank and Savings Bank in the future with a total riskbased capital ratio of at least 12%. The Corporation has a number of alternatives available... -

Page 77

... contributions from its Auto Finance and Global Financial Services segments. The Company anticipates its managed loan growth rate in 2005 to be between 12 and 15 percent, with a higher growth rate in its diversification businesses than in its U.S. Card business. The Company's earnings are a function... -

Page 78

... of efficiency gains related to, among other things, servicing higher balance, higher credit quality accounts. Managed Loan Growth The Company expects managed loans to grow between 12 and 15 percent in 2005, with a higher growth rate in its diversification businesses than in its U.S. Card business... -

Page 79

... The Company's strategy for its U.S. Card segment is to offer compelling, value-added products to its customers. The Company expects balanced growth across the various credit risk segments of its credit card portfolio in 2005. The competitive environment is currently intense for credit card products... -

Page 80

...a position as a home equity originator and a proprietary scalable technology platform. In January 2005, the Company acquired InsLogic, an insurance brokerage firm. This acquisition will allow the Company to leverage its direct marketing capabilities by offering consumers insurance brokerage services... -

Page 81

... Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance for loan losses Net loans Accounts receivable from securitizations Premises and equipment, net Interest receivable Other Total... -

Page 82

... interest income after provision for loan losses Non-Interest Income: Servicing and securitizations Service charges and other customer-related fees Interchange Other Total non-interest income Non-Interest Expense: Salaries and associate benefits Marketing Communications and data processing Supplies... -

Page 83

... options Amortization of deferred compensation Common stock issuable under incentive plan Other items, net Balance, December 31, 2003 Comprehensive income: Net income Other comprehensive income, net of income tax: Unrealized losses on securities, net of income tax benefit of $29,048 Foreign currency... -

Page 84

... activities: Cumulative effect of accounting change Provision for loan losses Depreciation and amortization, net Impairment of long-lived assets Losses (gains) on sales of securities available for sale Gains on sales of auto loans Losses (gains) on repurchase of senior notes Stock plan compensation... -

Page 85

..., Capital One, F.S.B. (the "Savings Bank"), which offers consumer lending (including credit cards) and deposit products, and Capital One Auto Finance, Inc. ("COAF") which offers primarily automobile financing products. The Corporation and its subsidiaries are collectively referred to as the "Company... -

Page 86

... on the Accounting Treatment of Accrued Interest Receivable Related to Credit Card Securitizations (the "AIR Advisory") issued jointly by the Office of the Comptroller of the Currency, The Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation and the Office of... -

Page 87

...of a loan. Deferred fees (net of deferred costs) were $302.5 million and $319.8 million as of December 31, 2004 and 2003, respectively. Rewards The Company offers credit cards that provide reward program members with various rewards such as airline tickets, free or deeply discounted products or cash... -

Page 88

... for loan losses, as applicable. The Company charges off credit card loans at 180 days past the due date, and generally charges off other consumer loans, including auto loans, at 120 days past the due date or upon repossession of collateral. Bankrupt consumers' accounts, excluding auto accounts, are... -

Page 89

... tax rates and laws that will be in effect when the differences are expected to reverse. Segments The accounting policies of operating and reportable segments, as defined by the Statement of Financial Accounting Standard No. 131, Disclosures about Segments of an Enterprise and Related Information... -

Page 90

... Issued to Employees ("APB 25") and related Interpretations in accounting for its stock-based compensation plans. No compensation cost has been recognized for the Company's fixed stock options for years prior to 2003, as the exercise price of all such options equals or exceeds the market value of... -

Page 91

... from the consolidated financial results. See Note 1, Significant Accounting Policies, for the accounting policies of the reportable segments. For the Year Ended December 31, 2004 Global Financial Total Securitization Services Other Managed Adjustments U.S. Card Auto Finance Total Reported Net... -

Page 92

U.S. Card Auto Finance For the Year Ended December 31, 2002 Global Financial Total Securitization Services Other Managed Adjustments Total Reported Net interest income Non-interest income Provision for loan losses Non-interest expenses Income tax provision (benefit) Net income (loss) Loans ... -

Page 93

...) charge for the cumulative effect of a change in accounting principle related to the adoption of FIN 46 was included in non-interest expense and reported in the Other category for segment reporting for the year ended December 31, 2003. Note 3 Securities Available for Sale Securities available for... -

Page 94

...the securities would not be settled at a price less than the amortized cost of the Company's investment. Since the decline in market value is attributable to changes in interest rates and not credit quality and because the Company has the ability and intent to hold these investments until a recovery... -

Page 95

... of year Provision for loan losses Other Charge-offs Principal recoveries Net charge-offs Balance at end of year Loans totaling approximately $416.9 million and $454.8 million, representing amounts which were greater than 90 days past due, were included in the Company's reported loan portfolio... -

Page 96

... 6.25 7.37 Interest-bearing deposits Senior notes Bank-fixed rate Bank-variable rate Mandatory convertible securities Corporation Total Other borrowings Secured borrowings Facility Financing Junior subordinated capital income securities Federal funds purchased and resale agreements Other short-term... -

Page 97

... of the Company, maintained fourteen agreements to transfer pools of consumer loans accounted for as secured borrowings at December 31, 2004. The agreements were entered into between 2001 and 2004, relating to the transfers of pools of consumer loans totaling $14.8 billion. Principal payments on the... -

Page 98

...and incentive stock awards. The form of stock compensation is specific to each plan. Generally the exercise price of each stock option will equal or exceed the market price of the Company's stock on the date of grant, the maximum term will be ten years, and vesting is determined at the time of grant... -

Page 99

...Company's stock-based compensation plans as of December 31, 2004, 2003 and 2002: Available For Issuance Plan Name 2004 Stock Incentive Plan(1) 2002 Non-Executive Officer Stock Incentive Plan(2) 1999 Stock Incentive Plan(2) 1994 Stock Incentive Plan(2) 1999 Non-Employee Directors Stock Incentive Plan... -

Page 100

...in 2004, 2003 and 2002, respectively. 2005 CEO Grant In December 2004, the Company's Board of Directors approved a compensation package for the Company's Chief Executive Officer (CEO). This package included 566,000 stock options which were granted at the fair market value at the date of grant. These... -

Page 101

... common or treasury stock of the Company at 85% of the current market price. Shares may also be acquired on the market. An aggregate of 3.0 million common shares has been authorized for issuance under the 2002 Associate Stock Purchase Plan, of which 1.6 million shares were available for issuance as... -

Page 102

... 29, 2005, unless earlier redeemed by the Company at $0.01 per Right prior to the time any person or group acquires 15% of the outstanding common stock. Until the Rights become exercisable, the Rights have no dilutive effect on earnings per share. Note 9 Retirement Plans Associate Savings Plan The... -

Page 103

... Unearned income Stock incentive plan Foreign Net operating losses State taxes, net of federal benefit Derivative instruments Other Subtotal Valuation allowance Total deferred tax assets Deferred tax liabilities: Securitizations Deferred revenue Securities available for sale Other Total deferred tax... -

Page 104

... in Thousands) Numerator: Income before change in accounting principle Cumulative effect of accounting change Net income Denominator: Denominator for basic earnings per shareWeighted-average shares Effect of dilutive securities: Stock options Restricted stock and units Contingently issuable shares... -

Page 105

... of goodwill. Auto Finance $218,957 - - $218,957 Global Financial Services Total $136,978 $355,935 (3,848) (3,848) 70 70 $133,200 $352,157 Balance at December 31, 2003 Impairment Loss Foreign Currency Translation Balance at December 31, 2004 In March 2004, the company recognized a $3.8 million... -

Page 106

... Guidelines, the Company has treated as subprime all loans in the Bank's and Savings Bank's targeted subprime programs to customers either with a FICO score of 660 or below or with no FICO score. The Bank and Savings Bank hold on average 200% of the total risk-based capital requirement that would... -

Page 107

... of credit at any time. Lease Commitments Certain premises and equipment are leased under agreements that expire at various dates through 2012, without taking into consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance premiums... -

Page 108

...as a defendant in twelve putative class action securities cases. All twelve actions were filed in the United States District Court for the Eastern District of Virginia. Each complaint also named as "Individual Defendants" several of the Corporation's executive officers. On October 1, 2002, the Court... -

Page 109

... American Express Travel Related Services Company, Inc., on November 15, 2004, filed a lawsuit against the associations and several member banks under United States federal antitrust law. The lawsuit alleges, among other things, that the associations and member banks implemented and enforced illegal... -

Page 110

... to substantial credit, repayment and interest rate risks on the transferred financial assets. The investors and the trusts have no recourse to the Company's assets, other than the retained residual interests, if the off-balance sheet loans are not paid when due. The gain on sale recorded from... -

Page 111

... strip. The Company recognizes all changes in the fair value of the interest-only strip immediately in servicing and securitizations income on the consolidated statements of income in accordance with the provisions of SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. In... -

Page 112

... collateral agreements may be required as well. Market risk is the adverse effect that a change in interest rates, currency, or implied volatility rates has on the value of a financial instrument. The Company manages the market risk associated with interest rate and foreign exchange contracts by... -

Page 113

... interest rate risk management strategies. Fair Value Hedges The Company has entered into forward exchange contracts to hedge foreign currency denominated investments against fluctuations in exchange rates. The purpose of the Company's foreign currency hedging activities is to protect the Company... -

Page 114

...protect against adverse movements in exchange rates. For the years ended December 31, 2004 and 2003, net losses of $9.1 million and $6.0 million related to these derivatives were included in the cumulative translation adjustment. Non-Trading Derivatives The Company uses interest rate swaps to manage... -

Page 115

... amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximate fair value. Securities available for sale The fair value of securities available for sale was determined using current market prices. See Note 3 for fair values by... -

Page 116

... The fair value of interest-bearing deposits was calculated by discounting the future cash flows using estimates of market rates for corresponding contractual terms. Other borrowings The carrying amount of federal funds purchased and resale agreements and other short-term borrowings approximates... -

Page 117

...015 481,228 The Company's international activities are primarily performed through Capital One Bank (Europe) plc, a subsidiary bank of the Bank that provides consumer lending and other financial products in Europe and Capital One Bank-Canada Branch, a foreign branch office of the Bank that provides... -

Page 118

... between domestic and foreign operations. Note 23 Capital One Financial Corporation (Parent Company Only) Condensed Financial Information The following Parent Company Only financial statements are provided in accordance with Regulation S-X of the Securities and Exchange Commission which requires... -

Page 119

... of 2005, the Company closed the acquisitions of Onyx Acceptance Corporation, a specialty auto loan originator; Hfs Group, a United Kingdom based home equity and mortgage loan originator; InsLogic, an internet auto insurance broker, and eSmartloan, a U.S. based online originator of home equity loans... -

Page 120

...the independent registered public accounting firm that audited the Company's financial statements, as stated in their report, a copy of which is included in this annual report on Form 10-K. /s/ RICHARD D. FAIRBANK /s/ GARY L. PERLIN Chairman and Chief Executive Officer Executive Vice President... -

Page 121

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Capital One Financial Corporation as of December 31, 2004 and 2003, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the three years in the... -

Page 122

... the Company changed its method of accounting for variable interest entities and accounting for stock based compensation. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Capital One Financial Corporation... -

Page 123

... per share Dividends Market prices High Low Average common shares (000s) Average common shares and common equivalent shares (000s) Average Balance Sheet Data: (In Millions) Consumer loans Allowance for loan losses Securities Other assets Total assets Interest-bearing deposits Other borrowings Senior... -

Page 124

..., 2004 pursuant to Exchange Act Rules 13a-14 and 13a-15. These controls and procedures for financial reporting are the responsibility of the Corporation's management. Based upon that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that the Company's disclosure controls... -

Page 125

... Our Directors and Executive Officers-Compensation of the Board," "Compensation of Executive Officers" and "Report of the Compensation Committee on Executive Compensation," and is incorporated herein by reference. Item 12. Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 126

... and 2002 Consolidated Statements of Changes in Stockholders' Equity-Years ended December 2004, 2003 and 2002 Consolidated Statements of Cash Flows-Years ended December 31, 2004, 2003 and 2002 Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm, Ernst... -

Page 127

... subject to the liabilities of that section. The Corporation makes available to investors, free of charge, its reports to the SEC pursuant to the Securities Exchange Act of 1934, including its Reports on Forms 8-K, 10-Q and 10-K, through the Company's website at www.capitalone.com/about/invest... -

Page 128

... the undersigned, thereunto duly authorized. CAPITAL ONE FINANCIAL CORPORATION By: /s/ RICHARD D. FAIRBANK Richard D. Fairbank Chairman of the Board, Chief Executive Officer and President Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 129

... Amendment Number 2 to Rights Agreement dated as of October 18, 2001 between Capital One Financial Corporation and EquiServe Trust Company, N.A. (as successor to First Trust Company of New York) as Rights Agent (incorporated by reference to Exhibit 99.1 of the Corporation's Report on Form 8-K, filed... -

Page 130

...'s Report on Form 8-K, filed on April 23, 2002). 1995 Associate Stock Purchase Plan (incorporated by reference to Exhibit 10.1.1 of the 2002 Form 10-K). 2002 Associate Stock Purchase Plan (incorporated by reference to Exhibit 4.1 of the Corporation's Form S-8 filed with the Securities and Exchange... -

Page 131

...Non-Employee Directors Stock Incentive Plan Deferred Share Units Award Agreement between Capital One Financial Corporation and certain of its Directors. (incorporated by reference to Exhibit 10.3 of the Corporation's quarterly report on Form 10-Q for the period ending September 30, 2004). Employment... -

Page 132

...to the Amended and Restated Change of Control Employment Agreement, between certain senior executive officers and Capital One Financial Corporation (incorporated by reference to Exhibit 10.10.1 of the 2003 Form 10-K). Capital One Financial Corporation Excess Savings Plan, as amended (incorporated by... -

Page 133

... Corporation's Report on Form 8-K, filed December 23, 2004). Form of Restricted Stock Award Agreement between Capital One Financial Corporation and certain of its executives or associates pursuant to the Company's 2004 Stock Incentive Plan. Form of Nonstatutory Stock Option Agreement between Capital... -

Page 134

-

Page 135

-

Page 136

-

Page 137

1680 Capital One Drive McLean, VA 22102 703 720-1000 www.capitalone.com