APS 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

74

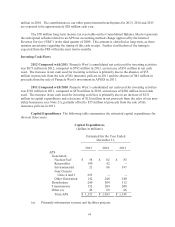

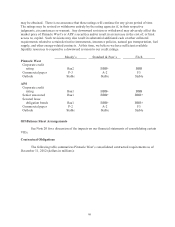

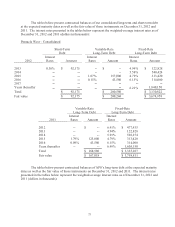

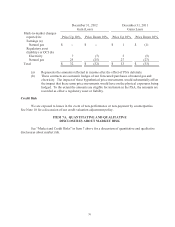

APS – Consolidated

Short-Term

Debt

Variable-Rate

Long-Term Debt

Fixed-Rate

Long-Term Debt

Interest

Interest

Interest

2012

Rates

Amount

Rates

Amount

Rates

Amount

2013

0.38%

$ 92,175

--

$ --

4.94%

$ 122,828

2014

--

--

--

--

5.58%

540,424

2015

--

--

0.13%

32,000

4.79%

313,420

2016

--

--

0.15%

43,580

6.15%

314,000

2017

--

--

--

--

--

--

Years thereafter

--

--

--

--

6.21%

1,840,150

Total

$ 92,175

$ 75,580

$ 3,130,822

Fair value

$ 92,175

$ 75,580

$ 3,674,958

Variable-Rate

Long-Term Debt

Fixed-Rate

Long-Term Debt

Interest

Interest

2011

Rates

Amount

Rates

Amount

2012

--

$ --

6.41%

$ 477,435

2013

--

--

4.94%

122,828

2014

--

--

5.91%

502,274

2015

--

--

4.79%

313,420

2016

0.09%

43,580

6.15%

314,000

Years thereafter

--

--

6.49%

1,605,150

Total

$ 43,580

$ 3,335,107

Fair value

$ 43,580

$ 3,758,811

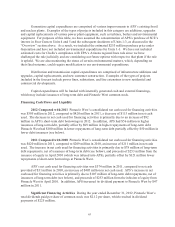

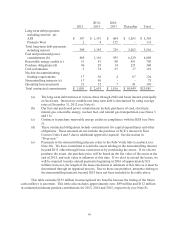

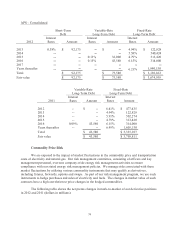

Commodity Price Risk

We are exposed to the impact of market fluctuations in the commodity price and transportation

costs of electricity and natural gas. Our risk management committee, consisting of officers and key

management personnel, oversees company-wide energy risk management activities to ensure

compliance with our stated energy risk management policies. We manage risks associated with these

market fluctuations by utilizing various commodity instruments that may qualify as derivatives,

including futures, forwards, options and swaps. As part of our risk management program, we use such

instruments to hedge purchases and sales of electricity and fuels. The changes in market value of such

contracts have a high correlation to price changes in the hedged commodities.

The following table shows the net pretax changes in mark-to-market of our derivative positions

in 2012 and 2011 (dollars in millions):