APS 2012 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

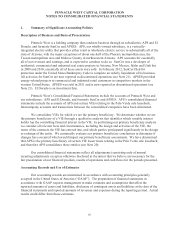

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

94

allows APS to request a change to its base rates during the stay-out period in the event of an

extraordinary event that, in the ACC’s judgment, requires base rate relief in order to protect the public

interest. Nor is APS precluded from seeking rate relief, or any other party to the Settlement Agreement

precluded from petitioning the ACC to examine the reasonableness of APS’s rates, in the event of

significant regulatory developments that materially impact the financial results expected under the terms

of the Settlement Agreement.

Other key provisions of the Settlement Agreement include the following:

• An authorized return on common equity of 10.0%;

• A capital structure comprised of 46.1% debt and 53.9% common equity;

• A test year ended December 31, 2010, adjusted to include plant that is in service as of

March 31, 2012;

• Deferral for future recovery or refund of property taxes above or below a specified 2010

test year level caused by changes to the Arizona property tax rate as follows:

• Deferral of 25% in 2012, 50% in 2013 and 75% for 2014 and subsequent years if

Arizona property tax rates increase; and

• Deferral of 100% in all years if Arizona property tax rates decrease;

• A procedure to allow APS to request rate adjustments prior to its next general rate case

related to APS’s proposed acquisition (should it be consummated) of additional interests

in Units 4 and 5 and the related closure of Units 1-3 of Four Corners;

• Implementation of a “Lost Fixed Cost Recovery” rate mechanism to support energy

efficiency and distributed renewable generation;

• Modifications to the Environmental Improvement Surcharge (“EIS”) to allow for the

recovery of carrying costs for capital expenditures associated with government-

mandated environmental controls, subject to an existing cents per kWh cap on cost

recovery that could produce up to approximately $5 million in revenues annually;

• Modifications to the PSA, including the elimination of the current 90/10 sharing

provision;

• A limitation on the use of the RES surcharge and the DSMAC to recoup capital

expenditures not required under the terms of the 2008 rate case settlement agreement

discussed below;

• Allowing a negative credit that currently exists in the PSA rate to continue until

February 2013, rather than being reset on the anticipated July 1, 2012 rate effective date;