APS 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.50

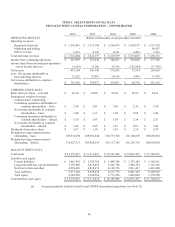

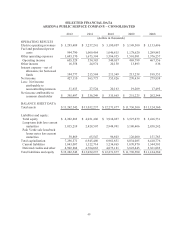

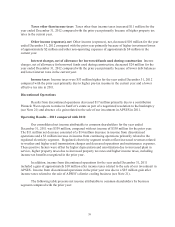

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

INTRODUCTION

The following discussion should be read in conjunction with Pinnacle West’s Consolidated

Financial Statements and APS’s Consolidated Financial Statements and the related Notes that appear in

Item 8 of this report.For information on factors that may cause our actual future results to differ from

those we currently seek or anticipate, see “Forward-Looking Statements” at the front of this report and

“Risk Factors” in Item 1A.

OVERVIEW

Pinnacle West owns all of the outstanding common stock of APS. APS is a vertically-integrated

electric utility that provides either retail or wholesale electric service to most of the state of Arizona,

with the major exceptions of about one-half of the Phoenix metropolitan area, the Tucson metropolitan

area and Mohave County in northwestern Arizona. APS accounts for essentially all of our revenues and

earnings, and is expected to continue to do so.

Areas of Business Focus

Operational Performance, Reliability and Recent Developments.

Nuclear. APS operates and is a joint owner of Palo Verde. In 2012, Palo Verde achieved its

best generation year ever, producing over 31 million megawatt-hours, with an overall station capacity

factor of 92.3%. In 2012, Palo Verde successfully refueled both Unit 2 and Unit 3. APS management

continues to work closely with regulators and others in the nuclear industry to analyze the lessons

learned and address any rulemaking or improvements resulting from the March 2011 events impacting

the Fukushima Daiichi Nuclear Power Station in Japan.

Coal and Related Environmental Matters. APS-operated coal plants, Four Corners and

Cholla, achieved net capacity factors for APS of 71% and 75%, respectively, in 2012. These capacity

factors were lower than in prior years primarily due to lower gas prices resulting in higher production

from our gas fleet. APS is focused on the impacts on its coal fleet that may result from increased

regulation and potential legislation concerning greenhouse gas emissions. Concern over climate change

and other emission-related issues could have a significant impact on our capital expenditures and

operating costs in the form of taxes, emissions allowances or required equipment upgrades for these

plants. APS is closely monitoring its long-range capital management plans, understanding that any

resulting regulation and legislation could impact the economic viability of certain plants, as well as the

willingness or ability of power plant participants to fund any such equipment upgrades.

SCE, a participant in Four Corners, has indicated that certain California legislation may prohibit

it from making emission control expenditures at the plant. On November 8, 2010, APS and SCE

entered into the Asset Purchase Agreement, providing for the purchase by APS of SCE’s 48% interest in

each of Units 4 and 5 of Four Corners. The purchase price is $294 million, subject to certain

adjustments. Completion of the purchase by APS is subject to the receipt of approvals by the ACC, the

CPUC and the FERC. On March 29, 2012, the CPUC issued an order approving the sale. On April 18,

2012, the ACC voted to allow APS to move forward with the purchase. The Asset Purchase Agreement

provides that the purchase price will be reduced by $7.5 million for each month between October 1,