APS 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

112

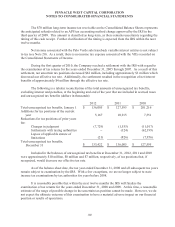

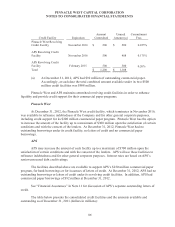

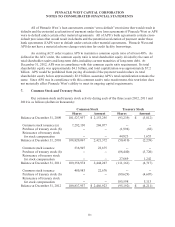

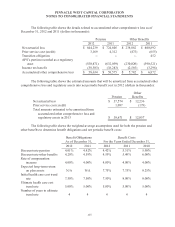

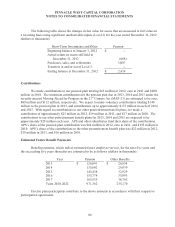

(a) In April 2010, Pinnacle West issued 6,900,000 shares of common stock at an offering

price of $38.00 per share, resulting in net proceeds of approximately $253 million.

Pinnacle West contributed all of the net proceeds from this offering into APS in the form

of equity infusions. APS has used these contributions to repay short-term indebtedness,

to finance capital expenditures and for other general corporate purposes.

(b) Primarily represents shares of common stock withheld from certain stock awards for tax

purposes.

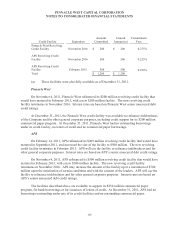

At December 31, 2012, Pinnacle West had 10 million shares of serial preferred stock authorized

with no par value, none of which was outstanding, and APS had 15,535,000 shares of various types of

preferred stock authorized with $25, $50 and $100 par values, none of which was outstanding.

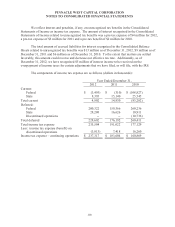

8. Retirement Plans and Other Benefits

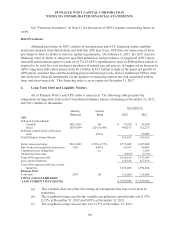

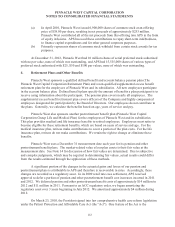

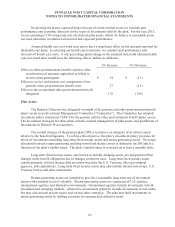

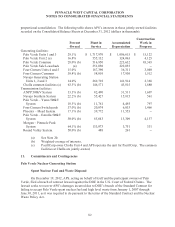

Pinnacle West sponsors a qualified defined benefit and account balance pension plan (The

Pinnacle West Capital Corporation Retirement Plan) and a non-qualified supplemental excess benefit

retirement plan for the employees of Pinnacle West and its subsidiaries. All new employees participate

in the account balance plan. Defined benefit plans specify the amount of benefits a plan participant is to

receive using information about the participant. The pension plan covers nearly all employees. The

supplemental excess benefit retirement plan covers officers of the Company and highly compensated

employees designated for participation by the Board of Directors. Our employees do not contribute to

the plans. Generally, we calculate the benefits based on age, years of service and pay.

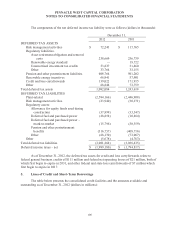

Pinnacle West also sponsors another postretirement benefit plan (Pinnacle West Capital

Corporation Group Life and Medical Plan) for the employees of Pinnacle West and its subsidiaries.

This plan provides medical and life insurance benefits to retired employees. Employees must retire to

become eligible for these retirement benefits, which are based on years of service and age. For the

medical insurance plan, retirees make contributions to cover a portion of the plan costs. For the life

insurance plan, retirees do not make contributions. We retain the right to change or eliminate these

benefits.

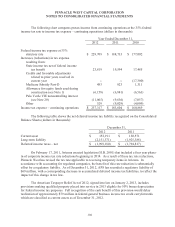

Pinnacle West uses a December 31 measurement date each year for its pension and other

postretirement benefit plans. The market-related value of our plan assets is their fair value at the

measurement date. See Note 14 for discussion of how fair values are determined. Due to subjective

and complex judgments, which may be required in determining fair values, actual results could differ

from the results estimated through the application of these methods.

A significant portion of the changes in the actuarial gains and losses of our pension and

postretirement plans is attributable to APS and therefore is recoverable in rates. Accordingly, these

changes are recorded as a regulatory asset. In its 2009 retail rate case settlement, APS received

approval to defer a portion of pension and other postretirement benefit cost increases incurred in 2011

and 2012. We deferred pension and other postretirement benefit costs of approximately $14 million in

2012 and $11 million in 2011. Pursuant to an ACC regulatory order, we began amortizing the

regulatory asset over 3 years beginning in July 2012. We amortized approximately $4 million during

2012.

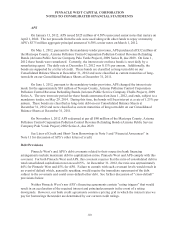

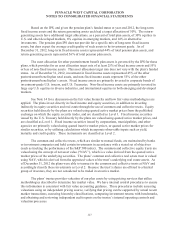

On March 23, 2010, the President signed into law comprehensive health care reform legislation

under the Patient Protection and Affordable Care Act (the “Act”). One feature of the Act is the