APS 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

131

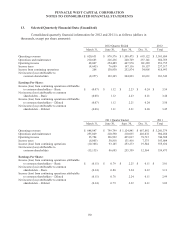

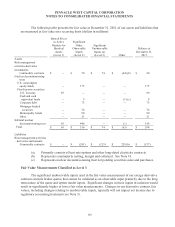

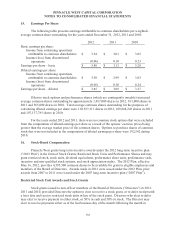

14. Fair Value Measurements

We classify our assets and liabilities that are carried at fair value within the fair value hierarchy.

This hierarchy ranks the quality and reliability of the inputs used to determine fair values, which are

then classified and disclosed in one of three categories. The three levels of the fair value hierarchy are:

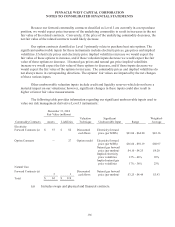

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities that we

have the ability to access at the measurement date. Active markets are those in which

transactions for the asset or liability occur in sufficient frequency and volume to provide

information on an ongoing basis. This category includes exchange-traded equities, exchange-

traded derivative instruments, cash equivalents, and investments in U.S. Treasury securities.

Level 2 – Utilizes quoted prices in active markets for similar assets or liabilities; quoted prices

in markets that are not active; and model-derived valuations whose inputs are observable (such

as yield curves). This category includes non-exchange traded contracts such as forwards,

options, swaps and certain investments in fixed income securities. This category also includes

investments in common and collective trusts and commingled funds that are redeemable and

valued based on NAV.

Level 3 – Valuation models with significant unobservable inputs that are supported by little or

no market activity. Instruments in this category include long-dated derivative transactions

where valuations are unobservable due to the length of the transaction, options, and transactions

in locations where observable market data does not exist. The valuation models we employ

utilize spot prices, forward prices, historical market data and other factors to forecast future

prices.

Assets and liabilities are classified in their entirety based on the lowest level of input that is

significant to the fair value measurement. Thus, a valuation may be classified in Level 3 even though

the valuation may include significant inputs that are readily observable. We maximize the use of

observable inputs and minimize the use of unobservable inputs. We rely primarily on the market

approach of using prices and other market information for identical and/or comparable assets and

liabilities. If market data is not readily available, inputs may reflect our own assumptions about the

inputs market participants would use. Our assessment of the inputs and the significance of a particular

input to the fair value measurement requires judgment and may affect the valuation of fair value assets

and liabilities as well as their placement within the fair value hierarchy levels. We assess whether a

market is active by obtaining observable broker quotes, reviewing actual market activity, and assessing

the volume of transactions. We consider broker quotes observable inputs when the quote is binding on

the broker, we can validate the quote with market activity, or we can determine that the inputs the

broker used to arrive at the quoted price are observable.

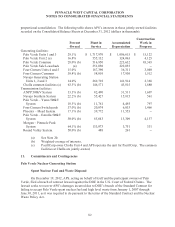

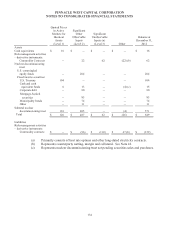

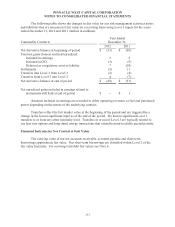

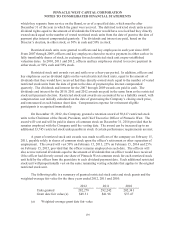

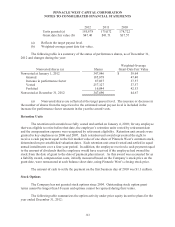

Recurring Fair Value Measurements

We apply recurring fair value measurements to certain cash equivalents, derivative instruments,

investments held in our nuclear decommissioning trust and plan assets held in our retirement and other

benefit plans. See Note 8 for the fair value discussion of plan assets held in our retirement and other

benefit plans.