APS 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

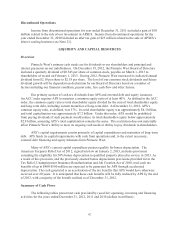

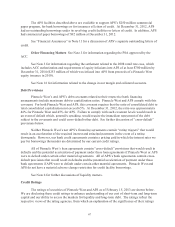

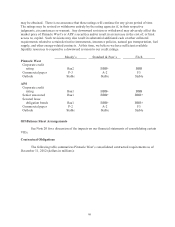

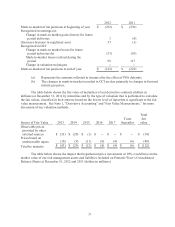

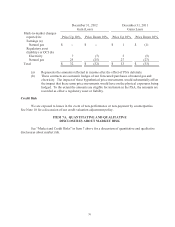

69

2013

2014-

2015

2016-

2017

Thereafter

Total

Long-term debt payments,

including interest: (a)

APS

$ 307

$ 1,191

$ 604

$ 3,283

$ 5,385

Pinnacle West

2

4

125

-

131

Total long-term debt payments,

including interest

309 1,195 729 3,283 5,516

Fuel and purchased power

commitments (b)

489

1,116

955

6,329

8,889

Renewable energy credits (c)

51

81

80

491

703

Purchase obligations (d)

96

29

14

221

360

Coal reclamation

1

74

27

17

119

Nuclear decommissioning

funding requirements

17

36

4

67

124

Noncontrolling interests (e)

17

56

-

-

73

Operating lease payments

21

32

7

41

101

Total contractual commitments

$ 1,001

$ 2,619

$ 1,816

$ 10,449

$15,885

(a) The long-term debt matures at various dates through 2042 and bears interest principally

at fixed rates. Interest on variable-rate long-term debt is determined by using average

rates at December 31, 2012 (see Note 6).

(b) Our fuel and purchased power commitments include purchases of coal, electricity,

natural gas, renewable energy, nuclear fuel, and natural gas transportation (see Notes 3

and 11).

(c) Contracts to purchase renewable energy credits in compliance with the RES (see Note

3).

(d) These contractual obligations include commitments for capital expenditures and other

obligations. These amounts do not include the purchase of SCE’s interest in Four

Corners Units 4 and 5 due to additional approvals required. See discussion in

“Overview.”

(e) Payments to the noncontrolling interests relate to the Palo Verde Sale Leaseback (see

Note 20). We have committed to retain the assets relating to the noncontrolling interest

beyond 2015 either through lease extensions or by purchasing the assets. If we elect to

purchase the assets, the purchase price will be based on the fair value of the assets at the

end of 2015, and such value is unknown at this time. If we elect to extend the leases, we

will be required to make annual payments beginning in 2016 of approximately $23

million; however, the length of the lease extensions is unknown at this time as it must be

determined through an appraisal process. Due to these uncertainties, amounts relating to

the noncontrolling interests beyond 2015 have not been included in the table above.

This table excludes $135 million in unrecognized tax benefits because the timing of the future

cash outflows is uncertain. This table also excludes approximately zero, $89 million and $112 million

in estimated minimum pension contributions for 2013, 2014 and 2015, respectively (see Note 8).