APS 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

116

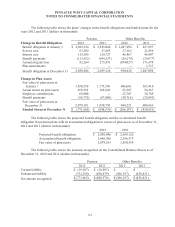

In selecting the pretax expected long-term rate of return on plan assets we consider past

performance and economic forecasts for the types of investments held by the plan. For the year 2013,

we are assuming a 7.0% long-term rate of return on plan assets, which we believe is reasonable given

our asset allocation in relation to historical and expected performance.

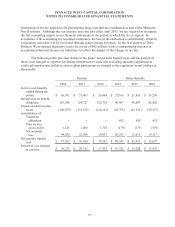

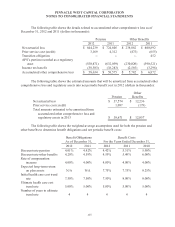

Assumed health care cost trend rates above have a significant effect on the amounts reported for

the health care plans. In selecting our health care trend rates, we consider past performance and

forecasts of health care costs. A one percentage point change in the assumed initial and ultimate health

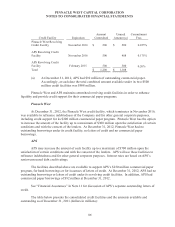

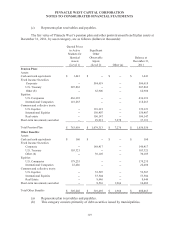

care cost trend rates would have the following effects (dollars in millions):

1% Increase

1% Decrease

Effect on other postretirement benefits expense, after

consideration of amounts capitalized or billed to

electric plant participants

$ 14

$ (11)

Effect on service and interest cost components of net

periodic other postretirement benefit costs

17

(13)

Effect on the accumulated other postretirement benefit

obligation

172

(136)

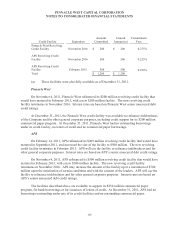

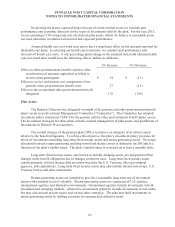

Plan Assets

The Board of Directors has delegated oversight of the pension and other postretirement benefit

plans’ assets to an Investment Management Committee (“Committee”). The Committee has adopted

investment policy statements (“IPS”) for the pension and the other postretirement benefit plans’ assets.

The investment strategies for these plans include external management of plan assets, and prohibition of

investments in Pinnacle West securities.

The overall strategy of the pension plan’s IPS is to achieve an adequate level of trust assets

relative to the benefit obligations. To achieve this objective, the plan’s investment policy provides for

mixes of investments including long-term fixed income assets and return-generating assets. The target

allocation between return-generating and long-term fixed income assets is defined in the IPS and is a

function of the plan’s funded status. The plan’s funded status is reviewed on at least a monthly basis.

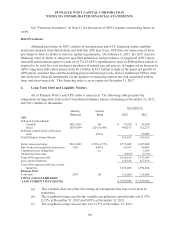

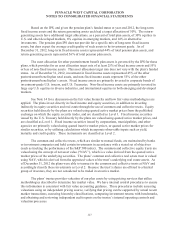

Long-term fixed income assets, also known as liability-hedging assets, are designed to offset

changes in the benefit obligations due to changes in interest rates. Long-term fixed income assets

consist primarily of fixed income debt securities issued by the U.S. Treasury, other government

agencies, and corporations. Long-term fixed income assets may also include interest rate swaps, U.S.

Treasury futures and other instruments.

Return-generating assets are intended to provide a reasonable long-term rate of investment

return with a prudent level of volatility. Return-generating assets are composed of U.S. equities,

international equities, and alternative investments. International equities include investments in both

developed and emerging markets. Alternative investments primarily include investments in real estate,

but may also include private equity and various other strategies. The plan may hold investments in

return-generating assets by holding securities in common and collective trusts.