APS 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

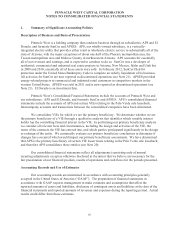

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

93

million in 2017. At December 31, 2012, the weighted-average remaining amortization period for

intangible assets was 6 years.

Investments

El Dorado accounts for its investments using either the equity method (if significant influence)

or the cost method (if less than 20% ownership).

Our investments in the nuclear decommissioning trust fund are accounted for in accordance with

guidance on accounting for certain investments in debt and equity securities. See Note 14 and Note 22

for more information on these investments.

2. New Accounting Standards

During 2012, we adopted amended guidance intended to converge fair value measurement and

disclosure requirements for GAAP and international financial reporting standards (“IFRS”). The

amended guidance clarifies how certain fair value measurement principles should be applied and

requires enhanced fair value disclosures. The adoption of this new guidance resulted in additional fair

value disclosures (see Note 14), but did not impact our financial statement results. !

!

During 2012, we also adopted amended guidance on the presentation of comprehensive income.

As a result of the amended guidance, we have changed our format for presenting comprehensive

income. Previously, components of comprehensive income were presented within changes in equity.

Due to the amended guidance, we now present comprehensive income in a new financial statement

titled “Consolidated Statements of Comprehensive Income”. The adoption of this guidance changed our

format for presenting comprehensive income, but did not impact our financial statement results.

3. Regulatory Matters

Retail Rate Case Filing with the Arizona Corporation Commission

On June 1, 2011, APS filed an application with the ACC for a net retail base rate increase of

$95.5 million. APS requested that the increase become effective July 1, 2012. The request would have

increased the average retail customer bill approximately 6.6%. On January 6, 2012, APS and other

parties to the general retail rate case entered into an agreement (the “Settlement Agreement”) detailing

the terms upon which the parties agreed to settle the rate case. On May 15, 2012, the ACC approved the

Settlement Agreement without material modifications.

Settlement Agreement

The Settlement Agreement provides for a zero net change in base rates, consisting of: (1) a non-

fuel base rate increase of $116.3 million; (2) a fuel-related base rate decrease of $153.1 million (to be

implemented by a change in the Base Fuel Rate for fuel and purchased power costs from $0.03757 to

$0.03207 per kWh; and (3) the transfer of cost recovery for certain renewable energy projects from the

RES surcharge to base rates in an estimated amount of $36.8 million.

APS also agreed not to file its next general rate case before May 31, 2015, and not to request

that its next general retail rate increase be effective prior to July 1, 2016. The Settlement Agreement