APS 2012 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

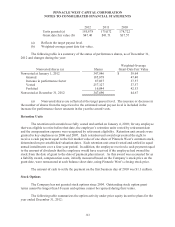

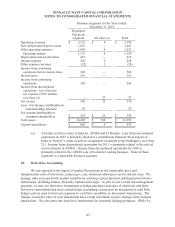

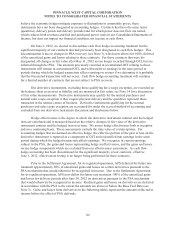

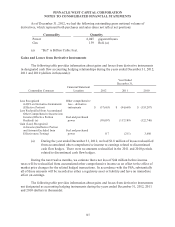

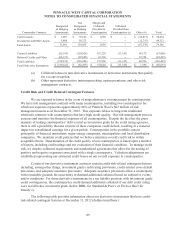

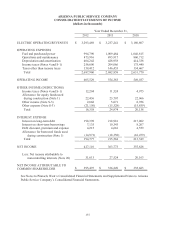

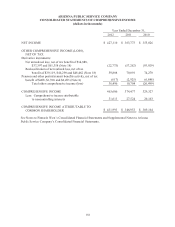

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

150

December 31,

2012

Aggregate Fair Value of Derivative Instruments in a Net

Liability Position

$ 206

Cash Collateral Posted

49

Additional Cash Collateral in the Event Credit-Risk

Related Contingent Features were Fully Triggered (a)

120

(a) This amount is after counterparty netting and includes those contracts which qualify

for scope exceptions, which are excluded from the derivative details above.

We also have energy related non-derivative instrument contracts with investment grade

credit-related contingent features which could also require us to post additional collateral of

approximately $183 million if our debt credit ratings were to fall below investment grade.

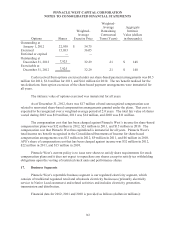

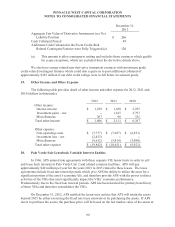

19. Other Income and Other Expense

The following table provides detail of other income and other expense for 2012, 2011 and

2010 (dollars in thousands):

2012

2011

2010

Other income:

Interest income

$ 1,239

$ 1,850

$ 3,255

Investment gains – net

--

1,165

2,797

Miscellaneous

367

96

335

Total other income

$ 1,606

$ 3,111

$ 6,387

Other expense:

Non-operating costs

$ (7,777)

$ (7,037)

$ (6,831)

Investment loss – net

(2,453)

--

--

Miscellaneous

(9,612)

(3,414)

(3,090)

Total other expense

$ (19,842)

$ (10,451)

$ (9,921)

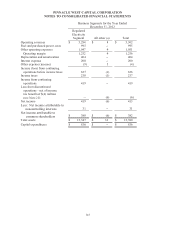

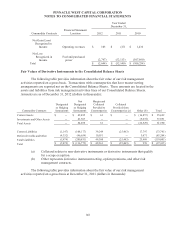

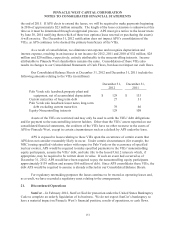

20. Palo Verde Sale Leaseback Variable Interest Entities

In 1986, APS entered into agreements with three separate VIE lessor trusts in order to sell

and lease back interests in Palo Verde Unit 2 and related common facilities. APS will pay

approximately $49 million per year for the years 2013 to 2015 related to these leases. The lease

agreements include fixed rate renewal periods which give APS the ability to utilize the asset for a

significant portion of the asset’s economic life, and therefore provide APS with the power to direct

activities of the VIEs that most significantly impact the VIEs’ economic performance.

Predominately due to the fixed rate renewal periods, APS has been deemed the primary beneficiary

of these VIEs and therefore consolidates the VIEs.

On December 31, 2012, APS notified the lessor trust entities that APS will retain the assets

beyond 2015 by either exercising the fixed rate lease renewals or by purchasing the assets. If APS

elects to purchase the assets, the purchase price will be based on the fair market value of the assets at