APS 2012 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

151

the end of 2015. If APS elects to extend the leases, we will be required to make payments beginning

in 2016 of approximately $23 million annually. The length of the lease extensions is unknown at this

time as it must be determined through an appraisal process. APS must give notice to the lessor trusts

by June 30, 2014 notifying them which of these two options (lease renewal or purchasing the assets)

it will exercise. The December 31, 2012 notification does not impact APS’s consolidation of the

VIEs, as APS continues to be deemed the primary beneficiary of the VIEs.

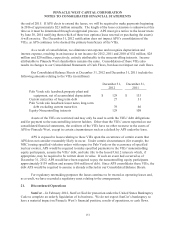

As a result of consolidation, we eliminate rent expense and recognize depreciation and

interest expense, resulting in an increase in net income for 2012, 2011 and 2010 of $32 million, $28

million and $20 million, respectively, entirely attributable to the noncontrolling interests. Income

attributable to Pinnacle West shareholders remains the same. Consolidation of these VIEs also

results in changes to our Consolidated Statements of Cash Flows, but does not impact net cash flows.

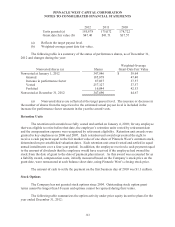

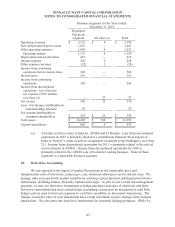

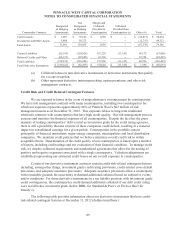

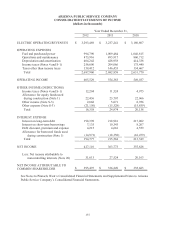

Our Consolidated Balance Sheets at December 31, 2012 and December 31, 2011 include the

following amounts relating to the VIEs (in millions):

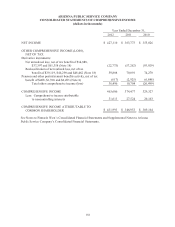

December 31,

2012

December 31,

2011

Palo Verde sale leaseback property plant and

equipment, net of accumulated depreciation

$ 129

$ 133

Current maturities of long term-debt

27

31

Palo Verde sale leaseback lessor notes long-term

debt excluding current maturities

39

66

Equity-Noncontrolling interests

129

108

Assets of the VIEs are restricted and may only be used to settle the VIEs’ debt obligations

and for payment to the noncontrolling interest holders. Other than the VIEs’ assets reported on our

consolidated financial statements, the creditors of the VIEs have no other recourse to the assets of

APS or Pinnacle West, except in certain circumstances such as a default by APS under the lease.

APS is exposed to losses relating to these VIEs upon the occurrence of certain events that

APS does not consider reasonably likely to occur. Under certain circumstances (for example, the

NRC issuing specified violation orders with respect to Palo Verde or the occurrence of specified

nuclear events), APS would be required to make specified payments to the VIEs’ noncontrolling

equity participants, assume the VIEs’ debt, and take title to the leased Unit 2 interests which, if

appropriate, may be required to be written down in value. If such an event had occurred as of

December 31, 2012, APS would have been required to pay the noncontrolling equity participants

approximately $139 million and assume $66 million of debt. Since APS consolidates these VIEs, the

debt APS would be required to assume is already reflected in our Consolidated Balance Sheets.

For regulatory ratemaking purposes the leases continue to be treated as operating leases and,

as a result, we have recorded a regulatory asset relating to the arrangements.

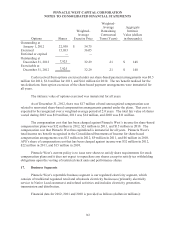

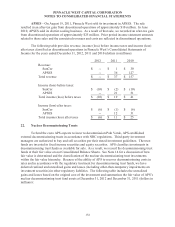

21. Discontinued Operations

SunCor – In February 2012, SunCor filed for protection under the United States Bankruptcy

Code to complete an orderly liquidation of its business. We do not expect SunCor’s bankruptcy to

have a material impact on Pinnacle West’s financial position, results of operations, or cash flows.