APS 2012 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

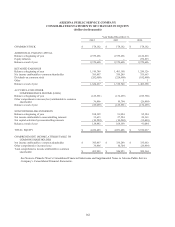

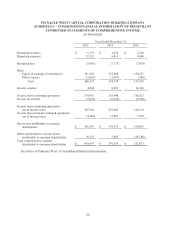

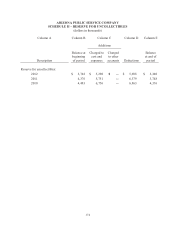

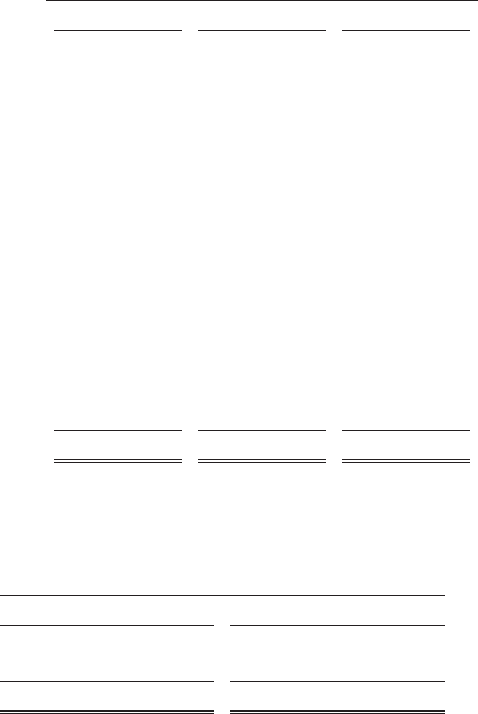

ARIZONA PUBLIC SERVICE COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

167

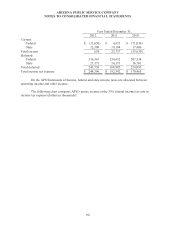

Year Ended December 31,

2012

2011

2010

Federal income tax expense at 35%

statutory rate

$ 235,027

$ 194,710

$ 184,202

Increases (reductions) in tax expense

resulting from:

State income tax net of federal income

tax benefit

25,379

21,139

19,186

Credits and favorable adjustments related

to prior years resolved in current year

--

--

(17,300)

Medicare Subsidy Part-D

483

823

889

Allowance for equity funds used during

construction (see Note 1)

(6,158)

(6,880)

(6,563)

Palo Verde VIE noncontrolling interest

(see Note 20)

(11,065)

(9,633)

(7,057)

Other

730

(7,617)

(2,892)

Income tax expense

$ 244,396

$ 192,542

$ 170,465

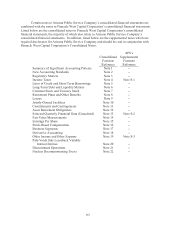

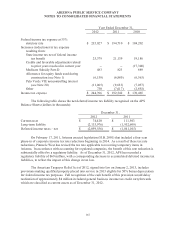

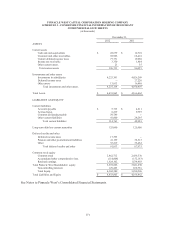

The following table shows the net deferred income tax liability recognized on the APS

Balance Sheets (dollars in thousands):

December 31,

2012

2011

Current asset

$ 74,420

$ 111,503

Long-term liability

(2,133,976)

(1,952,608)

Deferred income taxes – net

$ (2,059,556)

$ (1,841,105)

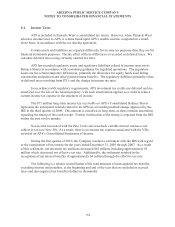

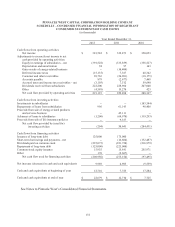

On February 17, 2011, Arizona enacted legislation (H.B. 2001) that included a four year

phase-in of corporate income tax rate reductions beginning in 2014. As a result of these tax rate

reductions, Pinnacle West has revised the tax rate applicable to reversing temporary items in

Arizona. In accordance with accounting for regulated companies, the benefit of this rate reduction is

substantially offset by a regulatory liability. As of December 31, 2012, APS has recorded a

regulatory liability of $69 million, with a corresponding decrease in accumulated deferred income tax

liabilities, to reflect the impact of this change in tax law.

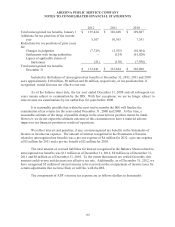

The American Taxpayer Relief Act of 2012, signed into law on January 2, 2013, includes

provisions making qualified property placed into service in 2013 eligible for 50% bonus depreciation

for federal income tax purposes. Full recognition of the cash benefit of this provision would delay

realization of approximately $4 million in federal general business income tax credit carryforwards

which are classified as current assets as of December 31, 2012.