APS 2012 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

123

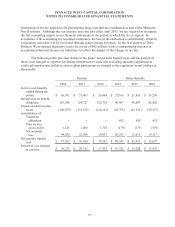

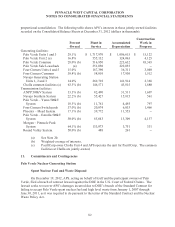

APS currently estimates it will incur $122 million over the current life of Palo Verde for its

share of the costs related to the on-site interim storage of spent nuclear fuel. At December 31, 2012,

APS had a regulatory liability of $46 million that represents amounts recovered in retail rates in excess

of amounts spent for on-site interim spent fuel storage.

Nuclear Insurance

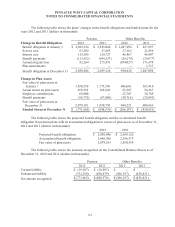

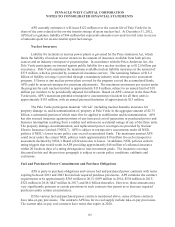

Liability for incidents at nuclear power plants is governed by the Price-Anderson Act, which

limits the liability of nuclear reactor owners to the amount of insurance available from both private

sources and an industry retrospective payment plan. In accordance with the Price-Anderson Act, the

Palo Verde participants are insured against public liability for a nuclear incident up to $12.6 billion per

occurrence. Palo Verde maintains the maximum available nuclear liability insurance in the amount of

$375 million, which is provided by commercial insurance carriers. The remaining balance of $12.2

billion of liability coverage is provided through a mandatory industry wide retrospective assessment

program. If losses at any nuclear power plant covered by the program exceed the accumulated funds,

APS could be assessed retrospective premium adjustments. The maximum assessment per reactor under

the program for each nuclear incident is approximately $118 million, subject to an annual limit of $18

million per incident, to be periodically adjusted for inflation. Based on APS’s interest in the three Palo

Verde units, APS’s maximum potential retrospective assessment per incident for all three units is

approximately $103 million, with an annual payment limitation of approximately $15 million.

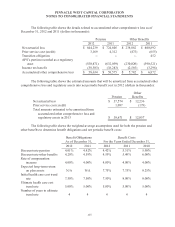

The Palo Verde participants maintain “all risk” (including nuclear hazards) insurance for

property damage to, and decontamination of, property at Palo Verde in the aggregate amount of $2.75

billion, a substantial portion of which must first be applied to stabilization and decontamination. APS

has also secured insurance against portions of any increased cost of generation or purchased power and

business interruption resulting from a sudden and unforeseen accidental outage of any of the three units.

The property damage, decontamination, and replacement power coverages are provided by Nuclear

Electric Insurance Limited (“NEIL”). APS is subject to retrospective assessments under all NEIL

policies if NEIL’s losses in any policy year exceed accumulated funds. The maximum amount APS

could incur under the current NEIL policies totals approximately $18 million for each retrospective

assessment declared by NEIL’s Board of Directors due to losses. In addition, NEIL policies contain

rating triggers that would result in APS providing approximately $48 million of collateral assurance

within 20 business days of a rating downgrade to non-investment grade. The insurance coverage

discussed in this and the previous paragraph is subject to certain policy conditions, sublimits and

exclusions.

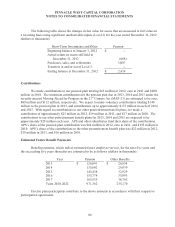

Fuel and Purchased Power Commitments and Purchase Obligations

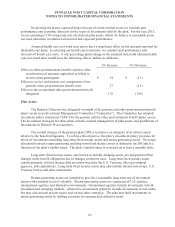

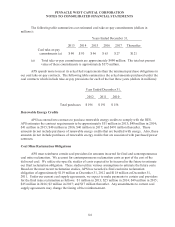

APS is party to purchase obligations and various fuel and purchased power contracts with terms

expiring between 2013 and 2043 that include required purchase provisions. APS estimates the contract

requirements to be approximately $585 million in 2013; $589 million in 2014; $556 million in 2015;

$522 million in 2016; $447 million in 2017; and $6.6 billion thereafter. However, these amounts may

vary significantly pursuant to certain provisions in such contracts that permit us to decrease required

purchases under certain circumstances.

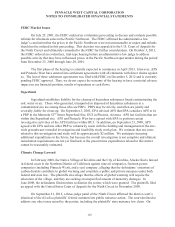

Of the various fuel and purchased power contracts mentioned above, some of those contracts

have take-or-pay provisions. The contracts APS has for its coal supply include take-or-pay provisions.

The current take-or-pay coal contracts have terms that expire in 2024.