APS 2012 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PINNACLE WEST CAPITAL CORPORATION

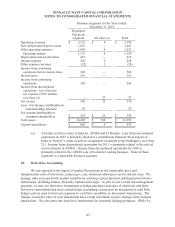

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

146

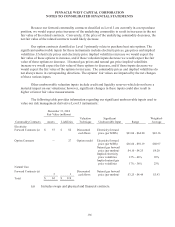

believe the economic hedges mitigate exposure to fluctuations in commodity prices, these

instruments have not been designated as accounting hedges. Contracts that have the same terms

(quantities, delivery points and delivery periods) and for which power does not flow are netted,

which reduces both revenues and fuel and purchased power costs in our Consolidated Statements of

Income, but does not impact our financial condition, net income or cash flows.

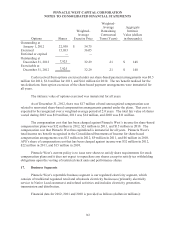

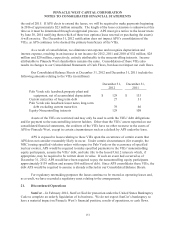

On June 1, 2012, we elected to discontinue cash flow hedge accounting treatment for the

significant majority of our contracts that had previously been designated as cash flow hedges. This

discontinuation is due to changes in PSA recovery (see Note 3), which now allows for 100% deferral

of the unrealized gains and losses relating to these contracts. For those contracts that were de-

designated, all changes in fair value after May 31, 2012 are no longer recorded through OCI, but are

deferred through the PSA. The amounts previously recorded in accumulated OCI relating to these

instruments will remain in accumulated OCI, and will transfer to earnings in the same period or

periods during which the hedged transaction affects earnings or sooner if we determine it is probable

that the forecasted transaction will not occur. Cash flow hedge accounting treatment will continue

for a limited number of contracts that are not subject to PSA recovery.

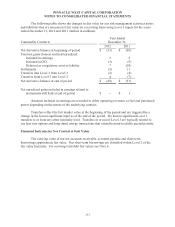

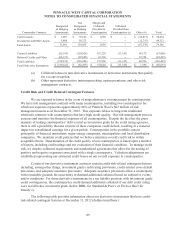

Our derivative instruments, excluding those qualifying for a scope exception, are recorded on

the balance sheet as an asset or liability and are measured at fair value; see Note 14 for a discussion

of fair value measurements. Derivative instruments may qualify for the normal purchases and

normal sales scope exception if they require physical delivery and the quantities represent those

transacted in the normal course of business. Derivative instruments qualifying for the normal

purchases and sales scope exception are accounted for under the accrual method of accounting and

excluded from our derivative instrument discussion and disclosures below.

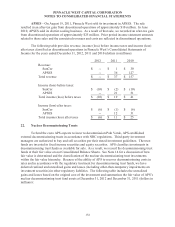

Hedge effectiveness is the degree to which the derivative instrument contract and the hedged

item are correlated and is measured based on the relative changes in fair value of the derivative

instrument contract and the hedged item over time. We assess hedge effectiveness both at inception

and on a continuing basis. These assessments exclude the time value of certain options. For

accounting hedges that are deemed an effective hedge, the effective portion of the gain or loss on the

derivative instrument is reported as a component of OCI and reclassified into earnings in the same

period during which the hedged transaction affects earnings. We recognize in current earnings,

subject to the PSA, the gains and losses representing hedge ineffectiveness, and the gains and losses

on any hedge components which are excluded from our effectiveness assessment. As cash flow

hedge accounting has been discontinued for the significant majority of our contracts, effective

June 1, 2012, effectiveness testing is no longer being performed for these contracts.

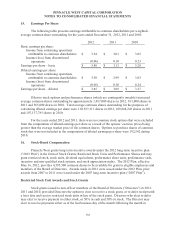

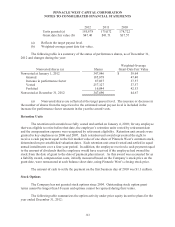

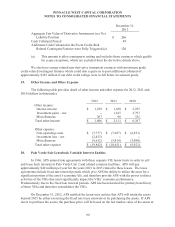

Prior to the Settlement Agreement, for its regulated operations, APS deferred for future rate

treatment approximately 90% of unrealized gains and losses on certain derivatives pursuant to the

PSA mechanism that would otherwise be recognized in income. Due to the Settlement Agreement,

for its regulated operations, APS now defers for future rate treatment 100% of the unrealized gains

and losses for delivery periods after June 30, 2012 on derivatives pursuant to the PSA mechanism

that would otherwise be recognized in income. Realized gains and losses on derivatives are deferred

in accordance with the PSA to the extent the amounts are above or below the Base Fuel Rate (see

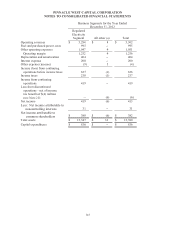

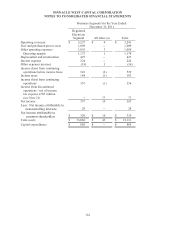

Note 3). Gains and losses from derivatives in the following tables represent the amounts reflected in

income before the effect of PSA deferrals.