APS 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

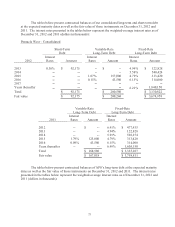

63

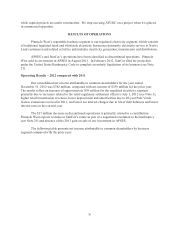

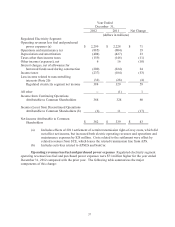

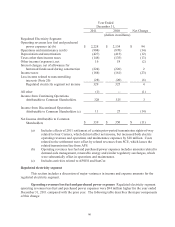

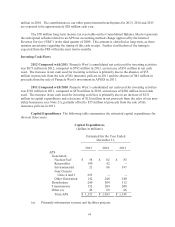

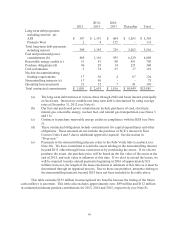

Pinnacle West Consolidated

2012

2011

2010

Net cash flow provided by operating activities

$ 1,171

$ 1,125

$ 750

Net cash flow used for investing activities

(873)

(782)

(576)

Net cash flow used for financing activities

(305)

(420)

(209)

Net decrease in cash and cash equivalents

$ (7) $ (77) $ (35)

Arizona Public Service Company

2012

2011

2010

Net cash flow provided by operating activities

$ 1,176

$ 1,128

$ 695

Net cash flow used for investing activities

(873)

(834)

(747)

Net cash flow provided by (used for) financing activities

(319)

(374)

31

Net decrease in cash and cash equivalents

$ (16) $ (80) $ (21)

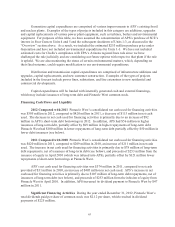

Operating Cash Flows

2012 Compared with 2011 Pinnacle West’s consolidated net cash provided by operating

activities was $1,171 million in 2012, compared to $1,125 million in 2011, an increase of $46 million in

net cash provided. The increase is primarily related to a $77 million reduction of cash collateral posted

and a decrease of $23 million in cash paid for interest in the current year, partially offset by a $26

million increase in property tax payments, a $65 million pension contribution in 2012 (approximately

$12 million of which is reflected in capital expenditures) and other changes in working capital.

2011 Compared with 2010 Pinnacle West’s consolidated net cash provided by operating

activities was $1,125 million in 2011, compared to $750 million in 2010, an increase of $375 million in

net cash provided. The increase is primarily due to the $161 million change in collateral and margin

posted, as a result of changes in commodity prices and expiration of prior hedge contracts, and a $200

million voluntary pension contribution in 2010 (approximately $40 million of which is reflected in

capital expenditures). In addition, APS’s operating cash flows included income tax payments to the

parent company of approximately $81 million in 2010.

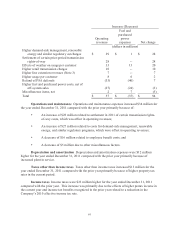

Other Pinnacle West sponsors a qualified defined benefit pension plan and a non-qualified

supplemental excess benefit retirement plan for the employees of Pinnacle West and our subsidiaries.

The requirements of the Employee Retirement Security Act of 1974 (“ERISA”) require us to contribute

a minimum amount to the qualified plan. We contribute at least the minimum amount required under

ERISA regulations, but no more than the maximum tax-deductible amount. The minimum required

funding takes into consideration the value of plan assets and our pension benefit obligations. Under

ERISA, the qualified pension plan was 105% funded as of January 1, 2012 and 101% funded as of

January 1, 2013. The assets in the plan are comprised of fixed-income, equity, real estate, and short-

term investments. Future year contribution amounts are dependent on plan asset performance and plan

actuarial assumptions. We made contributions to our pension plan totaling $65 million in 2012, zero in

2011 and $200 million in 2010. The minimum contributions for the pension plan due in 2013, 2014 and

2015 under the recently enacted Moving Ahead for Progress in the 21st Century Act (MAP-21) are

estimated to be zero, $89 million and $112 million, respectively. We expect to make voluntary

contributions totaling $140 million to the pension plan in 2013, and contributions up to approximately

$175 million in each of 2014 and 2015. With regard to contributions to our other postretirement benefit

plans, we made a contribution of approximately $23 million in 2012, $19 million in 2011, and $17