APS 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

CRITICAL ACCOUNTING POLICIES

In preparing the financial statements in accordance with GAAP, management must often make

estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, expenses and

related disclosures at the date of the financial statements and during the reporting period. Some of those

judgments can be subjective and complex, and actual results could differ from those estimates. We

consider the following accounting policies to be our most critical because of the uncertainties,

judgments and complexities of the underlying accounting standards and operations involved.

Regulatory Accounting

Regulatory accounting allows for the actions of regulators, such as the ACC and the FERC, to

be reflected in our financial statements. Their actions may cause us to capitalize costs that would

otherwise be included as an expense in the current period by unregulated companies. Regulatory assets

represent incurred costs that have been deferred because they are probable of future recovery in

customer rates. Regulatory liabilities generally represent expected future costs that have already been

collected from customers. Management continually assesses whether our regulatory assets are probable

of future recovery by considering factors such as applicable regulatory environment changes and recent

rate orders to other regulated entities in the same jurisdiction. This determination reflects the current

political and regulatory climate in the state and is subject to change in the future. If future recovery of

costs ceases to be probable, the assets would be written off as a charge in current period earnings. We

had $1.2 billion of regulatory assets and $847 million of regulatory liabilities on the Consolidated

Balance Sheets at December 31, 2012.

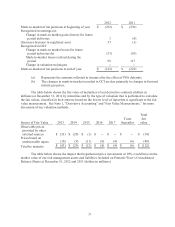

Included in the balance of regulatory assets at December 31, 2012 is a regulatory asset of $780

million for pension and other postretirement benefits. This regulatory asset represents the future

recovery of these costs through retail rates as these amounts are charged to earnings. If these costs are

disallowed by the ACC, this regulatory asset would be charged to OCI and result in lower future

earnings.

See Notes 1 and 3 for more information.

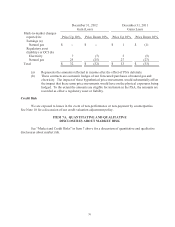

Pensions and Other Postretirement Benefit Accounting

Changes in our actuarial assumptions used in calculating our pension and other postretirement

benefit liability and expense can have a significant impact on our earnings and financial position. The

most relevant actuarial assumptions are the discount rate used to measure our liability and net periodic

cost, the expected long-term rate of return on plan assets used to estimate earnings on invested funds

over the long-term, and the assumed healthcare cost trend rates. We review these assumptions on an

annual basis and adjust them as necessary.

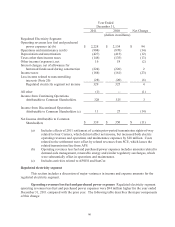

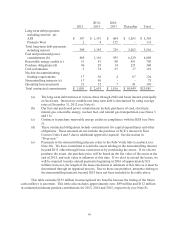

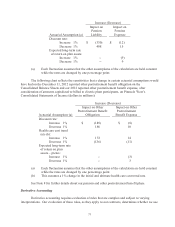

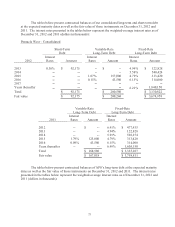

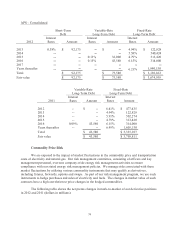

The following chart reflects the sensitivities that a change in certain actuarial assumptions would

have had on the December 31, 2012 reported pension liability on the Consolidated Balance Sheets and

our 2012 reported pension expense, after consideration of amounts capitalized or billed to electric plant

participants, on Pinnacle West’s Consolidated Statements of Income (dollars in millions):