APS 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

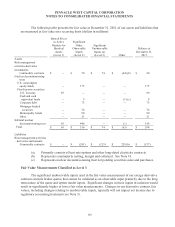

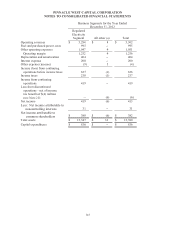

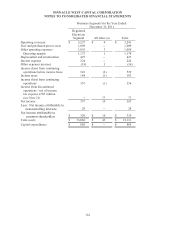

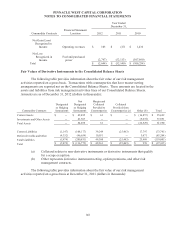

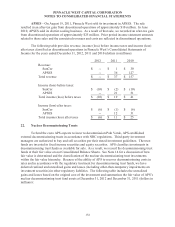

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

145

Business Segments for the Year Ended

December 31, 2010

Regulated

Electricity

Segment All other (a)

Total

Operating revenues

$ 3,181

$ 8

$ 3,189

Fuel and purchased power costs

1,047

--

1,047

Other operating expenses

1,009

4

1,013

Operating margin

1,125

4

1,129

Depreciation and amortization

415

--

415

Interest expense

226

2

228

Other expense (income)

(22)

2

(20)

Income from continuing

operations before income taxes

506

--

506

Income taxes

161

--

161

Income from continuing

operations

345

--

345

Income from discontinued

operations – net of income

tax expense of $16 million

(see Note 21)

-- 25 25

Net income

345

25

370

Less: Net income attributable to

noncontrolling interests

20 -- 20

Net income attributable to

common shareholders

$ 325 $ 25 $ 350

Total assets

$ 12,285

$ 108

$ 12,393

Capital expenditures

$ 666

$ 4

$ 670

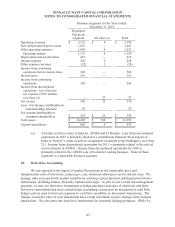

(a) All other activities relate to SunCor, APSES and El Dorado. Loss from discontinued

operations in 2012 is primarily related to a contribution Pinnacle West expects to

make to SunCor’s estate as part of a negotiated resolution to the bankruptcy (see Note

21). Income from discontinued operations for 2011 is primarily related to the sale of

our investment in APSES. Income from discontinued operations for 2010 is

primarily related to the APSES sale of its district cooling business. None of these

segments is a reportable business segment.

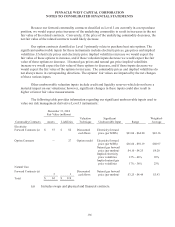

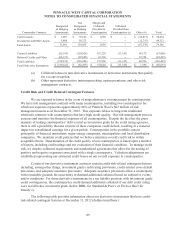

18. Derivative Accounting

We are exposed to the impact of market fluctuations in the commodity price and

transportation costs of electricity, natural gas, coal, emissions allowances and in interest rates. We

manage risks associated with market volatility by utilizing various physical and financial derivative

instruments, including futures, forwards, options and swaps. As part of our overall risk management

program, we may use derivative instruments to hedge purchases and sales of electricity and fuels.

Derivative instruments that meet certain hedge accounting criteria may be designated as cash flow

hedges and are used to limit our exposure to cash flow variability on forecasted transactions. The

changes in market value of such instruments have a high correlation to price changes in the hedged

transactions. We also enter into derivative instruments for economic hedging purposes. While we