APS 2012 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

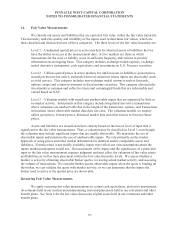

PINNACLE WEST CAPITAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

133

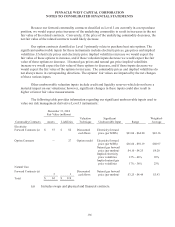

Investments Held in our Nuclear Decommissioning Trust

The nuclear decommissioning trust invests in fixed income securities and equity securities.

Equity securities are held indirectly through commingled funds. The commingled funds are valued

based on the concept of NAV, which is a value primarily derived from the quoted active market prices

of the underlying equity securities. We may transact in these commingled funds on a semi-monthly

basis at the NAV, and accordingly classify these investments as Level 2. The commingled funds, which

are similar to mutual funds, are maintained by a bank and hold investments in accordance with the

stated objective of tracking the performance of the S&P 500 index. Because the commingled fund

shares are offered to a limited group of investors, they are not considered to be traded in an active

market.

Cash equivalents reported within Level 2 represent investments held in a short-term investment

commingled fund, valued using NAV, which invests in U.S. government fixed income securities. We

may transact in this commingled fund on a daily basis at the NAV.

Fixed income securities issued by the U.S. Treasury held directly by the nuclear

decommissioning trust are valued using quoted active market prices and are classified as Level 1. Fixed

income securities issued by corporations, municipalities, and other agencies including mortgage-backed

instruments are valued using quoted inactive market prices, quoted active market prices for similar

securities, or by utilizing calculations which incorporate observable inputs such as yield curves and

spreads relative to such yield curves. These instruments are classified as Level 2. Whenever possible

multiple market quotes are obtained which enables a cross-check validation. A primary price source is

identified based on asset type, class, or issue of securities.

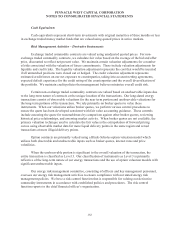

Our trustee provides valuation of our nuclear decommissioning trust assets by using pricing

services that utilize the valuation methodologies described to determine fair market value. We have

internal control procedures designed to ensure this information is consistent with fair value accounting

guidance. These procedures include assessing valuations using an independent pricing source, verifying

that pricing can be supported by actual recent market transactions, assessing hierarchy classifications,

comparing investment returns with benchmarks, and obtaining and reviewing independent audit reports

on the trustee’s internal operating controls and valuation processes. See Note 22 for additional

discussion about our nuclear decommissioning trust.

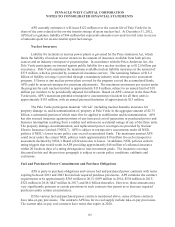

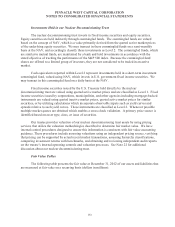

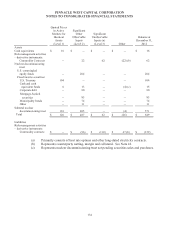

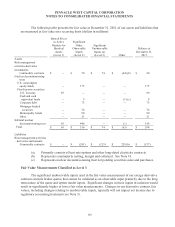

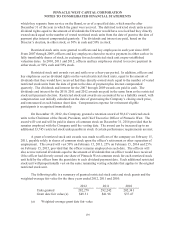

Fair Value Tables

The following table presents the fair value at December 31, 2012 of our assets and liabilities that

are measured at fair value on a recurring basis (dollars in millions):