APS 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

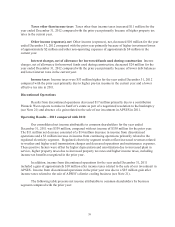

Discontinued Operations

Income from discontinued operations for year ended December 31, 2011 included a gain of $10

million related to the sale of our investment in APSES. Income from discontinued operations for the

year ended December 31, 2010 included an after tax gain of $25 million related to the sale of APSES’s

district cooling business (see Note 21).

LIQUIDITY AND CAPITAL RESOURCES

Overview

Pinnacle West’s primary cash needs are for dividends to our shareholders and principal and

interest payments on our indebtedness. On December 19, 2012, the Pinnacle West Board of Directors

declared a quarterly dividend of $0.545 per share of common stock, payable on March 1, 2013 to

shareholders of record on February 1, 2013. During 2012, Pinnacle West increased its indicated annual

dividend from $2.10 per share to $2.18 per share. The level of our common stock dividends and future

dividend growth will be dependent on declaration by our Board of Directors based on a number of

factors including our financial condition, payout ratio, free cash flow and other factors.

Our primary sources of cash are dividends from APS and external debt and equity issuances.

An ACC order requires APS to maintain a common equity ratio of at least 40%. As defined in the ACC

order, the common equity ratio is total shareholder equity divided by the sum of total shareholder equity

and long-term debt, including current maturities of long-term debt. At December 31, 2012, APS’s

common equity ratio, as defined, was 57%. Its total shareholder equity was approximately $4.1 billion,

and total capitalization was approximately $7.2 billion. Under this order, APS would be prohibited

from paying dividends if such payment would reduce its total shareholder equity below approximately

$2.9 billion, assuming APS’s total capitalization remains the same. This restriction does not materially

affect Pinnacle West’s ability to meet its ongoing cash needs or ability to pay dividends to shareholders.

APS’s capital requirements consist primarily of capital expenditures and maturities of long-term

debt. APS funds its capital requirements with cash from operations and, to the extent necessary,

external debt financing and equity infusions from Pinnacle West.

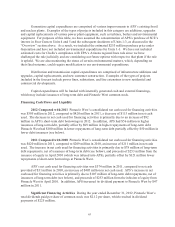

Many of APS’s current capital expenditure projects qualify for bonus depreciation. The

American Taxpayer Relief Act of 2012, signed into law on January 2, 2013, includes provisions

extending the eligibility for 50% bonus depreciation to qualified property placed in service in 2013. As

a result of this provision, and the previously enacted bonus depreciation provisions provided for in the

Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010, total cash tax

benefits of up to $400-$500 million are expected to be generated for APS through accelerated

depreciation. The cash generated is an acceleration of the tax benefits that APS would have otherwise

received over 20 years. It is anticipated that these cash benefits will be fully realized by APS by the end

of 2013, with a majority of the benefit realized as of December 31, 2012.

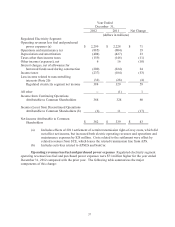

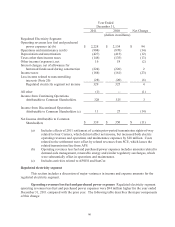

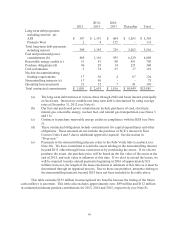

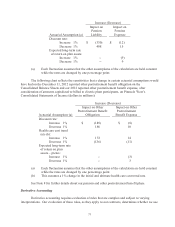

Summary of Cash Flows

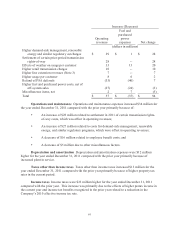

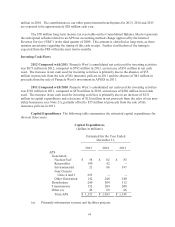

The following tables present net cash provided by (used for) operating, investing and financing

activities for the years ended December 31, 2012, 2011 and 2010 (dollars in millions):