APS 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 APS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

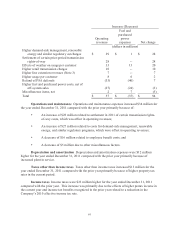

Demand Side Management. In recent years, Arizona regulators have placed an increased focus

on energy efficiency and other demand side management programs to encourage customers to conserve

energy, while incentivizing utilities to aid in these efforts that ultimately reduce the demand for energy.

In December 2009, the ACC initiated an Energy Efficiency rulemaking, with a proposed Energy

Efficiency Standard of 22% cumulative annual energy savings by 2020. The 22% figure represents the

cumulative reduction in future energy usage through 2020 attributable to energy efficiency initiatives.

This ambitious standard became effective on January 1, 2011 and will likely impact Arizona’s future

energy resource needs. The ACC issued an order on April 4, 2012 approving recovery of approximately

$72 million of APS’s energy efficiency and demand side management program costs over a twelve-

month period beginning March 1, 2012. This amount does not include $10 million already being

recovered in general retail base rates.

On June 1, 2012, APS filed its 2013 Demand Side Management Implementation Plan. In 2013,

the standards will require APS to achieve cumulative energy savings equal to 5% of its 2012 retail

energy sales. Later in 2012, APS filed a supplement to its plan that included a proposed budget for

2013 of $87.6 million. APS expects to receive a decision from the ACC in the second quarter of 2013.

Rate Matters. APS needs timely recovery through rates of its capital and operating

expenditures to maintain its financial health. APS’s retail rates are regulated by the ACC and its

wholesale electric rates (primarily for transmission) are regulated by the FERC. On June 1, 2011, APS

filed a rate case with the ACC. APS and other parties to the retail rate case subsequently entered into a

Settlement Agreement detailing the terms upon which the parties have agreed to settle the rate case. See

Note 3 for details regarding the Settlement Agreement terms and for information on APS’s FERC rates.

APS has several recovery mechanisms in place that provide more timely recovery to APS of its

fuel and transmission costs, and costs associated with the promotion and implementation of its demand

side management and renewable energy efforts and customer programs. These mechanisms are

described more fully in Note 3.

As part of APS’s proposed acquisition of SCE’s interest in Units 4 and 5 of Four Corners, APS

and SCE agreed that upon closing of the acquisition (or in 2016 if the closing does not occur), the

companies will terminate an existing agreement that provides transmission capacity for SCE to transmit

its portion of the output from Four Corners to California. APS expects to file a request with FERC

seeking authorization to cancel the existing agreement and defer a $40 million payment to be made by

APS associated with the termination and recover the payment through amortization over a 29-year

period. APS believes the costs associated with the termination of the existing agreement are

recoverable, but cannot predict whether FERC will approve our request; however, if the recovery is

disallowed by FERC, APS would record a charge to its results of operations at the time of the

disallowance.

Financial Strength and Flexibility. Pinnacle West and APS currently have ample borrowing

capacity under their respective credit facilities, and may readily access these facilities ensuring adequate

liquidity for each company. Capital expenditures will be funded with internally generated cash and

external financings, which may include issuances of long-term debt and Pinnacle West common stock.

Other Subsidiaries. The operations of El Dorado are not expected to have any material impact

on our financial results, or to require any material amounts of capital, over the next three years. As a

result of the continuing distressed conditions in the real estate markets, during 2009 our other first-tier

subsidiary, SunCor, undertook a program to dispose of its homebuilding operations, master-planned