ICICI Bank 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F36

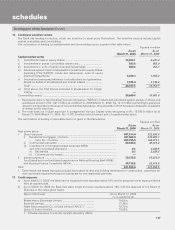

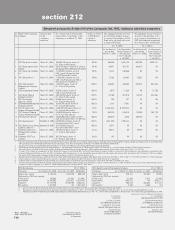

Sr. Name of the subsidiary Financial year No. of equity shares held by ICICI Extent of interest Net aggregate amount of profits/ Net aggregate amount of profits/

No. company of the Bank and/or its nominees in the of ICICI Bank in (losses) of the subsidiary so far as (losses) of the subsidiary so far

subsidiary subsidiary as on March 31, 2006 capital of it concerns the members of ICICI as it concerns the members of

ended on subsidiary Bank and is not dealt with in the ICICI Bank dealt with or provided

accounts of ICICI Bank1for in the accounts of ICICI Bank2

(Rs. in ‘000s) (Rs. in ‘000s)

for the financial for the previous for the financial for the previous

year ended financial years of year ended financial years of

March 31, 2006 the subsidiary March 31, 2006 the subsidiary

since it became since it became

a subsidiary a subsidiary

1 ICICI Securities Limited March 31, 2006 165,884,100 equity shares of 99.9% 780,059 2,406,723 695,290 3,449,721

Rs. 10 each fully paid up

2 ICICI Brokerage Services March 31, 2006 4,500,700 equity shares of Rs. of each, 99.9% 44,367 423,701 166,370 Nil

Limited 3fully paid up held by ICICI Securities Limited

3 ICICI Securities Holdings March 31, 2006 11,700,000 common stock of 99.9% 17,274 (18,858) Nil Nil

Inc. 3USD 1 each fully paid up held

by ICICI Securities Limited

4 ICICI Securities Inc. 3March 31, 2006 11,050,000 common stock of 99.9% 27,783 (6,491) 15,635 Nil

USD 1 each fully paid up held by

ICICI Securities Holdings Inc.

5 ICICI Venture Funds March 31, 2006 1,000,000 equity shares of 100.0% 108,461 435,654 394,514 881,465

Management Company Rs. 10 each fully paid up

Limited

6 ICICI International Limited 4March 31, 2006 90,000 ordinary shares of 100.0% (607) 11,530 Nil 15,782

US$ 10 each fully paid up

7 ICICI Home Finance March 31, 2006 283,750,000 equity shares of 100.0% 67,766 407,616 55,125 305,250

Company Limited 5Rs. 10 each fully paid up

8 ICICI Trusteeship March 31, 2006 50,000 equity shares of 100.0% 200 797 Nil Nil

Services Limited Rs. 10 each fully paid up

9 ICICI Investment Management March 31, 2006 10,000,700 equity shares of 100.0% 3,151 17,961 Nil Nil

Company Limited Rs. 10 each fully paid up

10 ICICI Prudential Life March 31, 2006 1,185,000,000 equity shares of 74.0% (1,390,304) (5,070,670) Nil Nil

Insurance Company Limited Rs. 10 each fully paid up

11 ICICI Lombard General March 31, 2006 245,000,000 equity shares of 74.0% 200,220 248,814 172,050 293,129

Insurance Company Limited Rs.10 each fully paid up

12 ICICI Bank UK Limited 4March 31, 2006 135,000,000 ordinary shares of USD 1 100.0% 460,629 4,020 182,449 Nil

each and 2 ordinary shares of 1 GBP each

13 ICICI Bank Canada 6December 31, 2005 63,500,000 common shares of 100.0% (329,269) (199,322) Nil Nil

Canadian Dollar (CAD) 1 each

14 ICICI Bank Eurasia Limited December 31, 2005 313,100,000 shares of 100.0% 12,457 Nil Nil Nil

Liability Company 6 7 Russian Rouble (RUB) 1 each

15 Prudential ICICI Asset March 31, 2006 18,018,552 equity shares of 51.0% 48,915 Nil 79,029 Nil

Management Company Rs. 10 each, fully paid up

Limited

16 Prudential ICICI Trust March 31, 2006 100,700 equity shares of 50.8% 161 Nil Nil Nil

Limited 8Rs. 10 each, fully paid up

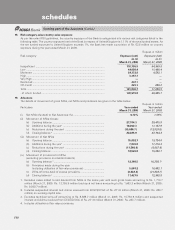

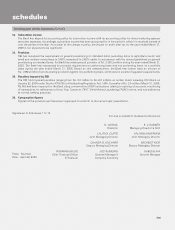

1. The above companies (other than ICICI Bank UK Limited, ICICI Bank Canada, ICICI Bank Eurasia Limited Liability Company, Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited) which

were subsidiaries of erstwhile ICICI Limited have become subsidiaries of the Bank consequent to the merger of erstwhile ICICI Limited with ICICI Bank.

2. The amount received by erstwhile ICICI Limited upto March 29, 2002 as dividend has also been included in the reserves of ICICI Bank.

3. ICICI Brokerage Services Limited and ICICI Securities Holdings Inc. are wholly owned subsidiaries of ICICI Securities Limited. ICICI Securities Inc. is a wholly owned subsidiary of ICICI Securities Holdings Inc.

4. The profits/(losses) of ICICI Bank UK Limited and ICICI International Limited for the year ended March 31, 2006 have been translated into Indian Rupees at the rate of 1 USD = Rs. 44.2729.

5. Pursuant to the scheme of amalgamation of ICICI Distribution Finance Private Limited (IDFL) with ICICI Home Finance Company Limited as consented by the shareholders and subsequently sanctioned by the

Honorable High Court of Bombay on June 30, 2005; the business of IDFL including all its assets and liabilities stood transferred to and vested in the company with retrospective effect from April 1, 2004. Accordingly,

the figures of ICICI Home Finance Company Limited include the figures of IDFL for the previous financial years.

6. The profits/(losses) of ICICI Bank Canada and ICICI Bank Eurasia Limited Liability Company have been translated into Indian Rupees at the closing rate on December 31, 2005 of 1 CAD = Rs. 36.71594 and 1 RUB =Rs. 1.5617 respectively.

7. ICICI Bank Eurasia Limited Liability Company has become a subsidiary of ICICI Bank with effect from May 19, 2005, being the date of its acquisition.

8. Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited have become subsidiaries of ICICI Bank with effect from August 26, 2005.

9. The information furnished for ICICI Bank Canada and ICICI Bank Eurasia Limited Liability Company is from the period January 1, 2005 to December 31, 2005, being their financial year. Please find below key financial

parameters of these companies as on March 31, 2006 and their movement from December 31, 2005 levels.

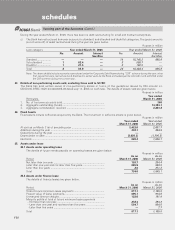

ICICI Bank Canada (Rs. in ‘000s) ICICI Bank Eurasia Limited Liability Company (Rs. in ‘000s)

Particulars As on March 31, 2006 As on Dec. 31, 2005 Movement Particulars As on March 31, 2006 As on Dec. 31, 2005 Movement

Equity share capital 3,145,725 2,459,196 686,529 Equity share capital 503,371 492,381 10,990

(fully held by ICICI Bank Limited) (fully held by ICICI Bank Limited)

Fixed assets 140,483 151,967 (11,484) Fixed assets 27,360 5,912 21,448

Investments 13,700,285 7,620,875 6,079,410 Investments 1,443,211 Nil 1,443,211

Advances 24,141,790 19,158,765 4,983,025 Advances 983,244 365,834 617,410

Borrowings a1,407,904 Nil 1,407,904 Borrowings a3,350 3,280 70

a. Since it is not possible to identify the amount borrowed to meet its current liabilities, the amount shown above represents the total borrowings.

b. The financials parameters of ICICI Bank Canada have been translated into Indian Rupees at 1 CAD = Rs. 38.3625 for the year ended March 2006 and 1 CAD = Rs. 38.7275 for the year ended December 31, 2005.

c. The financials parameters of ICICI Bank Eurasia Limited Liability Company have been translated into Indian Rupees at 1 RUB = Rs. 1.6077 for the year ended March 31, 2006 and 1 RUB = Rs. 1.5726 for the year ended December 31, 2005.

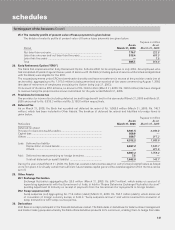

Statement pursuant to Section 212 of the Companies Act, 1956, relating to subsidiary companies

section 212

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Deputy Managing Director

JYOTIN MEHTA

General Manager &

Company Secretary

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Joint Managing Director

NACHIKET MOR

Deputy Managing Director

RAKESH JHA

General Manager

VISHAKHA MULYE

Chief Financial Officer

& Treasurer

Place : Mumbai

Date : April 29, 2006

For and on behalf of Board of Directors