ICICI Bank 2006 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

Annual Report 2005-2006

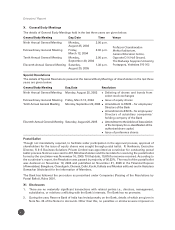

Shareholders of ICICI Bank with more than one per cent holding at March 31, 2006

Name of the Shareholder No. of % to total

shares no. of shares

Deutsche Bank Trust Company Americas (Depositary for ADS holders) 238,604,478 26.81

Life Insurance Corporation of India 73,133,170 8.22

Allamanda Investments Pte. Limited 66,234,627 7.44

Crown Capital Limited 44,029,260 4.95

Bajaj Auto Limited 24,132,703 2.71

Government of Singapore 21,493,507 2.42

Copthall Mauritius Investment Limited 20,812,111 2.34

HWIC Asia Fund 19,928,269 2.24

The New India Assurance Company Limited 15,446,338 1.74

The Growth Fund of America Inc. 14,230,000 1.60

Morgan Stanley and Company International Limited

A/c Morgan Stanley Dean Witter Mauritius Company Limited 14,013,463 1.57

Aberdeen Asset Managers Limited A/c Aberdeen International India

Opportunities Fund (Mauritius) Limited 12,347,980 1.39

Capital World Growth and Income Fund Inc. 12,288,703 1.38

HSBC Global Investment Funds

A/c HSBC Global Investment Funds Mauritius Limited 12,056,645 1.35

General Insurance Corporation of India 10,020,680 1.13

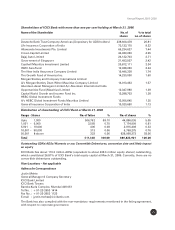

Distribution of shareholding of ICICI Bank at March 31, 2006

Range - Shares No. of folios % No. of shares %

Upto 1,000 506,762 99.10 44,896,036 5.05

1,001 – 5,000 3,565 0.70 7,174,909 0.81

5,001 – 10,000 406 0.08 2,916,408 0.33

10,001 – 50,000 313 0.06 6,768,275 0.76

50,001 & above 322 0.06 828,068,273 93.06

Total 511,368 100.00 889,823,901 100.00

Outstanding GDRs/ADSs/Warrants or any Convertible Debentures, conversion date and likely impact

on equity

ICICI Bank has about 119.3 million ADSs (equivalent to about 238.6 million equity shares) outstanding,

which constituted 26.81% of ICICI Bank’s total equity capital at March 31, 2006. Currently, there are no

convertible debentures outstanding.

Plant Locations – Not applicable

Address for Correspondence

Jyotin Mehta

General Manager & Company Secretary

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex, Mumbai 400 051

Tel No. : + 91-22-2653 1414

Fax No.: + 91-22-2653 1122

E-mail : [email protected]

The Bank has also complied with the non-mandatory requirements mentioned in the listing agreement,

with respect to corporate governance.