ICICI Bank 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F35

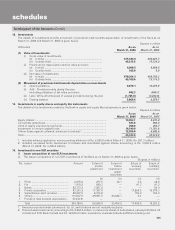

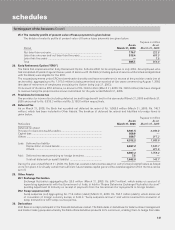

33. Subvention income

The Bank has aligned its accounting policy for subvention income with its accounting policy for direct marketing agency/

associate expenses. Accordingly, subvention income has been accounted for in the period in which it is received instead of

over the period of the loan. As a result of the change in policy, the impact on profit after tax for the year ended March 31,

2006 is not expected to be significant.

34. Provision

RBI has increased the requirement of general provisioning on standard loans (excluding loans to agriculture sector and

small and medium enterprises) to 0.40% compared to 0.25% earlier. In accordance with the revised guidelines on general

provisioning on standard loans, the Bank has made general provision of Rs. 3,390.2 million during the year ended March 31,

2006. The Bank has reassessed its provision requirement on performing loans and non-performing loans on a portfolio

basis during the year ended March 31, 2006. Based on this reassessment, the Bank has written back an amount of

Rs. 1,692.2 million from its existing provisions against non-performing loans, which were in excess of regulatory requirements.

35. Penalties imposed by RBI

The RBI had imposed penalties (ranging from Rs. 0.5 million to Rs. 2.0 million) on certain banks including ICICI Bank on

January 23, 2006 under Section 47A(1)(b) of the Banking Regulation Act, 1949. A penalty of Rs. 0.5 million (March 31, 2005:

Rs. Nil) had been imposed on the Bank citing contravention of RBI instructions relating to opening of accounts, monitoring

of transactions for adherence to Know Your Customer (“KYC”)/Anti Money Laundering (“AML”) norms, and non-adherence

to normal banking practices.

36. Comparative figures

Figures of the previous year have been regrouped to conform to the current year presentation.

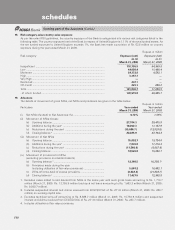

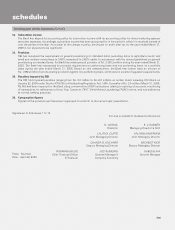

Signatures to Schedules 1 to 18

forming part of the Accounts (Contd.)

schedules

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Deputy Managing Director

JYOTIN MEHTA

General Manager &

Company Secretary

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Joint Managing Director

NACHIKET MOR

Deputy Managing Director

RAKESH JHA

General Manager

VISHAKHA MULYE

Chief Financial Officer

& Treasurer

Place : Mumbai

Date : April 29, 2006

For and on behalf of the Board of Directors