ICICI Bank 2006 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

Annual Report 2005-2006

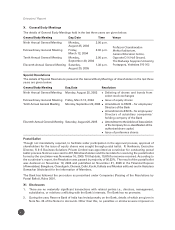

The performance of the ICICI Bank equity share relative to the BSE Sensitive Index (Sensex) and the BSE

Bank Index (Bankex) is given in the following chart:

Share Transfer System

ICICI Bank’s investor services are handled by 3i Infotech Limited (3i Infotech), formerly known as ICICI

Infotech Limited. 3i Infotech operates in the following main areas of business: software consultancy and

development, IT-enabled services, IT infrastructure and network and facilities management services. 3i

Infotech has received the ISO-9001 certification for its transaction processing activities.

ICICI Bank’s equity shares are traded only in dematerialised form. During the year, 2,530,988 equity shares

of ICICI Bank were transferred into electronic mode, involving 37,121 certificates. At March 31, 2006,

98.62% of ICICI Bank’s paid-up equity share capital (including equity shares represented by ADSs

constituting 26.81% of the paid-up equity share capital) comprising 877,563,214 equity shares had been

dematerialised.

Physical share transfers are registered and returned generally within a period of seven days from the

date of receipt, if the documents are correct and valid in all respects.

The number of equity shares of ICICI Bank transferred during the last three years (excluding electronic

transfer of shares in dematerialised form) is given below:

Fiscal 2004 Fiscal 2005 Fiscal 2006

Number of transfer deeds 17,675 8,059 7,994

Number of shares transferred 1,105,135 413,245 437,044

As required under Clause 47(c) of the listing agreements entered into by ICICI Bank with stock exchanges,

a certificate is obtained every six months from a practising Company Secretary, with regard to, inter alia,

effecting transfer, transmission, sub-division, consolidation, renewal and exchange of equity shares and

bonds in the nature of debentures within one month of their lodgement. The certificates are forwarded to

BSE and NSE, where the equity shares are listed, within 24 hours of issuance and also placed before the

Board.

75

100

125

150

175

BSE Sensex

BSE Bankex

ICICI Bank

Apr-05

May-05

Jun-05

Jul-05

Aug-05

Sep-05

Oct-05

Nov-05

Dec-05

Jan-06

Feb-06

Mar-06