ICICI Bank 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Annual Report 2005-2006

Directed lending

In its letter dated April 26, 2002 granting its approval for the merger, RBI had stipulated that since ICICI’s

advances transferred to the Bank were not subject to the priority sector lending requirement, the Bank was

required to maintain priority sector lending of 50.0% of the Bank’s net bank credit on the residual portion of

its advances (i.e. the portion of its total advances excluding advances of ICICI at year-end fiscal 2002,

henceforth referred to as residual net bank credit). This additional 10.0% priority sector lending requirement

will apply until such time the bank’s aggregate priority sector advances reach a level of 40.0% of its total net

bank credit. RBI’s existing instructions on sub-targets under priority sector lending and eligibility of certain

types of investments/ funds for qualification as priority sector advances apply to the Bank.

At March 31, 2006 which was the last reporting friday for fiscal 2006, the Bank’s priority sector outstanding

were Rs. 432.29 billion, constituting 49.7% of its residual net bank credit against the requirement of

50.0%. Of the total priority sector loans, the Bank’s agri-lending portfolio was Rs. 146.58 billion at

March 31, 2006 compared to Rs. 67.63 billion at March 18, 2005, a growth of 116.7%. At March 31, 2006,

loans eligible to be classified as agriculture lending represented 16.8% of the Bank’s residual net bank

credit comprising 11.6% direct agri-lending and 5.2% indirect agri-lending as against the requirement of

13.5% direct lending and 4.5% indirect lending.

Classification of loan assets

All loans are classified as per RBI guidelines into performing and non-performing loans. Under these guidelines,

effective year-end fiscal 2005, a term loan is classified as non-performing if any amount of interest or principal

remains overdue for more than 90 days (as against the period of 180 days stipulated earlier). Similarly, an

overdraft or cash credit facility is classified as non-performing if the account remains out of order for a period

of 90 days and a bill is classified as non-performing if the account remains overdue for more than 90 days.

Further, non-performing assets are classified into sub-standard, doubtful and loss assets.

RBI has issued separate guidelines for restructured loans. A fully secured standard asset can be restructured

by reschedulement of principal repayments and/or the interest element, but must be separately disclosed as

a restructured asset. The amount of sacrifice, if any, in the element of interest, measured in present value

terms, is either written off or provision is made to the extent of the sacrifice involved. Similar guidelines apply

to sub-standard loans. The sub-standard accounts which have been subjected to restructuring, whether in

respect of principal installment or interest amount are eligible to be upgraded to the standard category only

after the specified period, i.e., a period of one year after the date when first payment of interest or of principal,

whichever is earlier, falls due, subject to satisfactory performance during the period.

The Bank does not distinguish between provisions and write-offs while assessing the adequacy of the Bank’s

loan loss coverage, as both provisions and write-offs represent a reduction of the principal amount of a

non-performing asset. In compliance with regulations governing the presentation of financial information by

banks, the Bank reports non-performing assets net of cumulative write-offs in its financial statements.

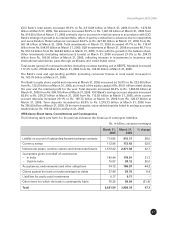

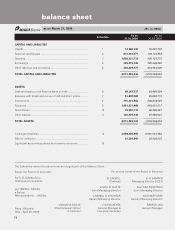

The following table sets forth classification of net customer assets (net of write-offs and provisions) of

ICICI Bank at March 31, 2005 and March 31, 2006.

Rs. in billion

March 31, 2005 March 31, 2006

Standard assets 959.11 1,509.32

Of which: restructured standard loans 62.63 53.16

Non-performing assets 19.83 10.75

Of which: Loss assets(1) ––

Doubtful assets 13.70 4.54

Sub-standard assets 6.13 6.21

Net customer assets(2) 978.94 1,520.07

(1) All loss assets have been written off or provided for.

(2) Customer assets include advances and credit substitutes like debentures and bonds.

(3) All amounts have been rounded off to the nearest Rs. 10.0 million.