ICICI Bank 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F57

The Company’s investment banking subsidiary classifies its investments as short-term and trading or as long-term

investments. The securities held with the intention of holding for short-term and trading are classified as stock in trade and

the securities acquired with the intention of holding till maturity or for a longer period are classified as long-term investments.

The securities held as stock in trade are valued at lower of cost arrived at on weighted average basis or market / fair value

and long-term investments are carried at cost arrived at weighted average basis. Appropriate provision is made for other

than temporary diminution in the value of investments. Commission earned in respect of securities acquired upon devolvement

is reduced from the cost of acquisition.

The Company’s housing finance subsidiary classifies its investments as current investments and long-term investments.

Investments that are readily realisable and intended to be held for not more than a year are classified as current investments,

which are carried at the lower of cost or the market value. All other investments are classified as long-term investments,

which are carried at cost. However a provision for diminution in value is made to recognise any other than temporary

decline in the value of investments. Costs such as brokerage, commission etc. paid at the time of acquisition of investments

are included in investment cost.

In case of the Company’s UK banking subsidiary, premium or discount on investments intended to be held on a continuous

basis, are amortised on an effective interest rate basis through the profit and loss account over the period to maturity.

The Company’s Canadian banking subsidiary classifies its investments into investment account securities or trading account

securities. Investment account securities comprise debt and equity securities, originally purchased with the intention of

holding to maturity or for a predetermined period of time, which may be sold in response to changes in investment objectives

arising from changing market conditions or to meet the liquidity requirements.

The Company’s life insurance subsidiary values its investments in real estate at historical cost subject to provision for

impairment, if any. Revaluation of investments in real estate is done at least once in every three years.

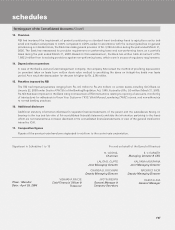

14. Provisions/Write-offs on loans and other credit facilities

The Bank follows the RBI norms for income recognition and asset classification. Accordingly, all loan exposures are classified

into performing and non-performing assets (‘NPA’). NPAs of the Bank are classified into sub-standard, doubtful and loss

assets based on the criteria stipulated by RBI. Provisions are made on sub-standard and doubtful assets at rates prescribed

by RBI. Loss assets and unsecured portion of doubtful assets are provided/written off as per the extant RBI guidelines. RBI

norms also allow banks to create additional floating provisions over and above the specific provisions. The additional

floating provisions are in general based on losses anticipated by the Bank on historical loss experiences or expected

anticipated losses in certain loans. For restructured/rescheduled assets, provision is made by the Bank in accordance with

the guidelines issued by RBI, which requires the present value of the interest sacrifice be provided at the time of restructuring.

In the case of NPAs other than restructured NPA accounts, the account is reclassified as “standard” account if arrears of

interest and principal are fully paid by the borrower. In respect of NPA accounts subjected to restructuring, the account is

reclassified as “standard” account if the borrower demonstrates, over a minimum period of one year, the ability to repay the

loan in accordance with the contractual terms.

Amounts recovered against other debts written off in earlier years and provisions no longer considered necessary in the

context of the current status of the borrower are recognised in the profit and loss account. In addition to the specific

provision on NPAs, the Bank maintains a general provision on performing loans. The general provision meets the requirements

of the RBI guidelines.

In addition to the provisions required to be held according to the asset classification status, provisions are held by the Bank

for individual country exposure (other than for home country). The countries are categorised into seven risk categories

namely insignificant, low, moderate, high, very high, restricted and off-credit and provisioning made on exposures exceeding

90 days on a graded scale ranging from 0.25% to 100%. For exposures with contractual maturity of less than 90 days, 25%

of the normal provision requirement is held. If the country exposure (net) of the Bank in respect of each country does not

exceed 1% of the total funded assets, no provision is maintained on such country exposure.

In the case of the investment-banking subsidiary, the policy of provisioning against NPAs is as per the prudential norms

prescribed by the RBI for non-banking financial companies. As per the policy adopted, the provision against sub-standard

assets are determined, taking into account management’s perception of the higher risk associated with the business of the

company. Certain NPAs are considered as loss assets and full provision has been made against such assets.

schedules

forming part of the Consolidated Accounts (Contd.)