ICICI Bank 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Annual Report 2005-2006

FINANCIALS AS PER INDIAN GAAP

Summary

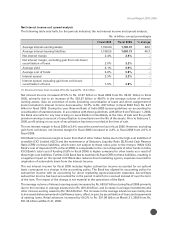

Operating profit (profit before provisions and tax) was Rs. 46.91billion in fiscal 2006 as compared to

Rs.29.56billion in fiscal 2005, reflecting an increase of 58.7% primarily due to a 47.5% increase in net

interest income to Rs. 41.87 billion, 55.3% increase in fee income to Rs. 32.59 billion and 30.5% increase in

treasury income to Rs. 9.28 billion, offset, in part, by a 40.9% increase in operating expenses (excluding

depreciation on leased assets and commission paid to direct marketing agents) to Rs. 35.47 billion.

Provisions and contingencies (excluding provision for tax) increased to Rs. 15.94 billion in fiscal 2006 from

Rs. 4.29 billion in fiscal 2005 primarily due to higher amortisation of premium on government securities in

fiscal 2006 (Rs. 8.02 billion, compared to Rs. 2.76 billion in fiscal 2005) and higher level of write-backs in fiscal

2005. While profit before tax increased 22.6% to Rs. 30.97 billion in fiscal 2006 from Rs. 25.27 billion in fiscal

2005, the reduction in effective tax rate to 18.0% in fiscal 2006 from 20.7% in fiscal 2005 resulted in a 26.7%

increase in profit after tax to Rs. 25.40 billion in fiscal 2006 from Rs. 20.05 billion in fiscal 2005.

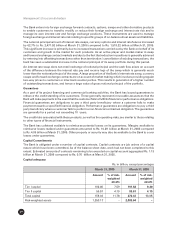

Net interest income increased by 47.5% to Rs. 41.87 billion in fiscal 2006 from Rs. 28.39 billon in fiscal 2005

despite a reduction in income from securitisation of loans, reflecting an increase of 48.0% in average interest-

earning assets.

Fee income increased by 55.3% to Rs. 32.59 billion in fiscal 2006 from Rs. 20.98 billion in fiscal 2005 primarily

due to growth in credit card related fees and third-party product distribution fees, increase in income from

remittances and other fees from international products and services and growth in fees from corporate

customers.

Treasury income increased by 30.5% to Rs. 9.28 billion in fiscal 2006 from Rs. 7.11 billion in fiscal 2005

primarily due to increase in the profit on sale of equity investments.

Operating expenses (excluding depreciation on leased assets and commission paid to direct marketing agents)

increased by 40.9% to Rs. 35.47 billion in fiscal 2006 from Rs. 25.17 billion in fiscal 2005 primarily due to a

46.8% increase in salary expenses.

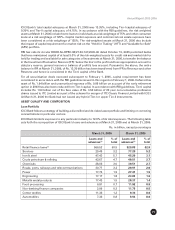

During fiscal 2006, ICICI Bank raised equity capital of about Rs. 80.01 billion to leverage business opportunities

and maintain appropriate regulatory capitalization levels. The expenses of the issue amounting to Rs 0.87

billion have been charged to the share premium account. As a result of the increase in capital during the year,

return on average equity declined to 16.4% in fiscal 2006 from 17.9% in fiscal 2005. The earnings per share

on a weighted average basis increased to Rs. 32.49 per share for fiscal 2006 from Rs. 27.55 per share for fiscal

2005.

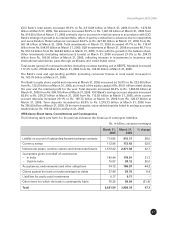

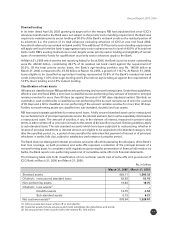

Total assets increased 49.9% to Rs. 2,513.89 billion at March 31, 2006 from Rs. 1,676.59 billion at March 31,

2005 with advances increasing 59.9% to Rs. 1,461.63 billion and investments increasing 41.7% to Rs. 715.47

billion. Retail advances increased 64.2% to Rs. 921.98 billion at March 31, 2006, constituting 63.1% of net

advances compared to 61.4% at March 31, 2005. Advances of international branches increased 101.4% to

Rs. 125.24 billion at March 31, 2006 from Rs. 62.18 billion at March 31, 2005. Total deposits increased 65.4%

to Rs. 1,650.83 billion at March 31, 2006, constituting 77.2% of the total funding (comprising deposits,

borrowings and subordinated debt) compared to 70.5% at March 31, 2005. Deposits of international branches

increased by 149.1% to Rs. 85.70 billion at March 31, 2006 from Rs. 34.40 billion at March 31, 2005.

Management’s Discussion & Analysis