ICICI Bank 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

Management’s Discussion & Analysis

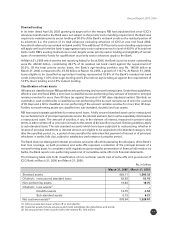

back an amount of Rs. 1.69 billion from its provisions against non-performing loans which were in excess

of the regulatory requirement.

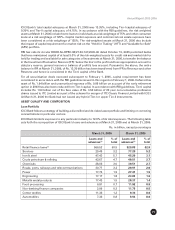

Income tax expense (including wealth tax) increased 6.7% to Rs. 5.57 billion in fiscal 2006 from Rs. 5.22

billion in fiscal 2005 as effective income tax rate decreased to 18.0% in fiscal 2006 from 20.7% in fiscal

2005. The effective income tax rate continued to be lower than the statutory rates for fiscal 2006 primarily

due to exempt interest and dividend income and the charging of certain income at rates other than the

statutory rate, off-set in part, by the disallowance of certain expenses for tax purposes. Further, during

fiscal 2006, the Bank created a deferred tax asset on carry forward capital losses based on its firm plans

that sufficient future taxable capital gains will be available against which the losses can be set off.

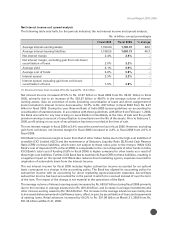

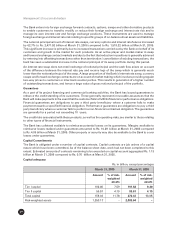

Financial condition

The following table sets forth, for the periods indicated, the summarised balance sheet of ICICI Bank.

Rs. in billion, except percentages

March 31, March 31,

2005 2006 % change

Assets:

Cash, balances with banks & SLR(1) 474.12 681.14 43.7

– Cash & balances with RBI & banks 129.30 170.40 31.8

– Government securities(1) 344.82 510.74 48.1

Advances (net) 914.05 1,461.63 59.9

Debentures & bonds 28.54 18.04 (36.8)

Other investments 131.52 186.69 41.9

Fixed assets (including leased assets) 40.38 39.81 (1.4)

Other assets 87.98 126.58 43.9

Total assets 1,676.59 2,513.89 49.9

Liabilities:

Equity capital and reserves 125.50 222.06 76.9

– Equity capital 7.37 8.90 20.8

– Reserves 118.13 213.16 80.4

Preference capital 3.50 3.50 –

Deposits 998.19 1,650.83 65.4

– Savings deposits 113.92 209.37 83.8

– Current deposits 128.37 165.73 29.1

– Term deposits 755.90 1,275.73 68.8

Borrowings 417.53 486.66 16.6

Of which : Subordinated debt (2) 82.09 101.44 23.6

– Erstwhile ICICI borrowings 193.48 132.25 (31.6)

– Other borrowings 224.05 354.41 58.2

Other liabilities 131.87 150.84 14.4

Total liabilities 1,676.59 2,513.89 49.9

(1) Represents Indian government securities considered towards SLR requirement.

(2) Included in ‘other liabilities’ in Schedule 5 of the balance sheet.

(3) All amounts have been rounded off to the nearest Rs. 10.0 million.