ICICI Bank 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F12

forming part of the Accounts (Contd.)

schedules

SCHEDULE 18

Significant accounting policies and notes to accounts

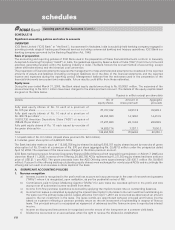

OVERVIEW

ICICI Bank Limited (“ICICI Bank” or “the Bank”), incorporated in Vadodara, India is a publicly held banking company engaged in

providing a wide range of banking and financial services including commercial banking and treasury operations. ICICI Bank is a

banking company governed by the Banking Regulation Act, 1949.

Basis of preparation

The accounting and reporting policies of ICICI Bank used in the preparation of these financial statements conform to Generally

Accepted Accounting Principles (“GAAP”) in India, the guidelines issued by Reserve Bank of India (“RBI”) from time to time and

practices generally prevalent within the banking industry in India. The Bank follows the accrual method of accounting, except

where otherwise stated, and the historical cost convention.

The preparation of financial statements requires the management to make estimates and assumptions considered in the reported

amounts of assets and liabilities (including contingent liabilities) as of the date of the financial statements and the reported

income and expenses during the reporting period. Management believes that the estimates used in the preparation of the

financial statements are prudent and reasonable. Future results could differ from these estimates.

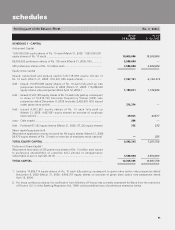

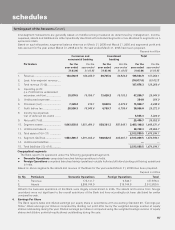

Equity issue

During the year ended March 31, 2006, the Bank raised equity capital amounting to Rs. 80,006.1 million. The expenses of the

issue amounting to Rs. 874.1 million have been charged to the share premium account. The details of the equity capital raised

are given in the table below.

Rupees in million except per share data

Details No. of Amount of Aggregate

equity shares share premium proceeds

Fully paid equity shares of Rs. 10 each at a premium of

Rs. 515 per share ........................................................................ 67,787,322 34,910.5 35,588.3

Fully paid equity shares of Rs. 10 each at a premium of

Rs. 488.75 per share1................................................................................................................... 28,894,060 14,122.0 14,410.9

18,618,730 American Depository Share (“ADS”) at aprice of

US$ 26.75 per share 2.................................................................................................................. 37,237,460 22,134.6 22,506.9

Fully paid equity shares of Rs. 10 each issued by exercise of

the green shoe option ................................................................ 14,285,714 7,357.1 7,500.0

Total 148,204,556 78,524.2 80,006.1

1. Unpaid calls of Rs. 0.3 million (Unpaid share premium Rs. 92.4 million).

2. Includes green shoe option of 2,428,530 ADSs.

The Bank had also made an issue of 115,920,758 equity shares (including 6,992,187 equity shares issued by exercise of green

shoe option) of Rs.10 each at a premium of Rs. 270 per share aggregating Rs. 32,457.8 million under the prospectus dated

April 12, 2004. The expenses of the issue were charged to the share premium account.

ICICI Bank had sponsored an American Depositary Shares (ADSs) Offering which opened for participation on March 7, 2005 and

closed on March 11, 2005. In terms of the Offering, 20,685,750 ADSs representing 41,371,500 equity shares had been sold at a

price of US$ 21.1 per ADS. The gross proceeds from the ADS Offering were approximately US$ 436.7million (Rs.19,099.6

million). Pursuant to this offering existing outstanding equity shares were exchanged for newly issued ADSs and accordingly the

offering did not result in an increase in share capital of the Bank.

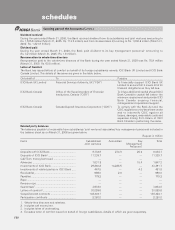

A. SIGNIFICANT ACCOUNTING POLICIES

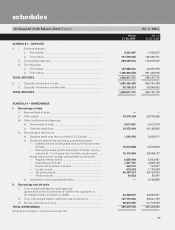

1. Revenue recognition

a) Interest income is recognised in the profit and loss account as it accrues except in the case of non-performing assets

(“NPAs”) where it is recognised, upon realisation, as per the prudential norms of RBI.

b) Commissions paid to Direct Marketing Agents (“DMAs”) for auto loans are recorded upfront in the profit and loss

account net of subvention income received from them.

c) Income from hire purchase operations is accrued by applying the implicit interest rate on outstanding balances.

d) Income from leases is calculated by applying the interest rate implicit in the lease to the net investment outstanding on

the lease over the primary lease period. Leases effective from April 1, 2001 are accounted as advances at an amount

equal to the net investment in the lease. The lease rentals are apportioned between principal and finance income

based on a pattern reflecting a constant periodic return on the net investment of outstanding in respect of finance

lease. The principal amount is recognised as repayment of advances and the finance income is reported as interest

income.

e) Income on discounted instruments is recognised over the tenure of the instrument on a constant yield basis.

f) Dividend is accounted on an accrual basis when the right to receive the dividend is established.