ICICI Bank 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F54

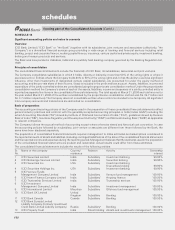

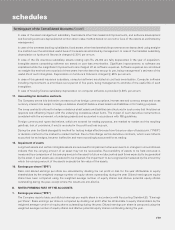

Deferred tax assets are recognised and reassessed at each reporting date, based upon management’s judgement as to

whether realisation is considered certain. Deferred tax assets are recognised on carry forward of unabsorbed depreciation,

tax losses and carry forward capital losses only if there is virtual certainty that such deferred tax asset can be realised

against future profits.

During the year ended March 31, 2006 the Bank has created a deferred tax asset on carry forward capital losses based on

its firm plan, that sufficient future taxable income will be available against which the loss can be set off.

Deferred tax assets and liabilities are computed at individual company level and aggregated for consolidated reporting.

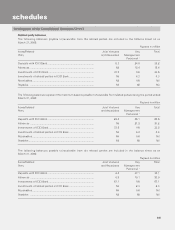

5. Claims and benefits paid

In case of general insurance business, claims comprise claims paid, estimated liability for outstanding claims made following

a loss occurrence reported and estimated liability for claims incurred but not reported (‘IBNR’) and claims incurred but not

enough reported (‘IBNER’). Further, claims incurred also include specific claim settlement costs such as survey / legal fees

and other directly attributable costs. Claims (net of amounts receivable from reinsurers/co-insurers) are recognised on the

date of intimation of the loss. Estimated liability for outstanding claims at the balance sheet date is recorded net of claims

recoverable from/payable to co-insurers/reinsurers and salvage to the extent there is certainty of realisation. Estimated

liability for outstanding claims is determined by the Company on the basis of ultimate amounts likely to be paid on each

claim based on past experience. These estimates are progressively revalidated on availability of further information.

Claims IBNR represents that amount of claims that may have been incurred during the accounting period but have not been

reported or claimed. The IBNR provision also includes provision, if any, required for claims IBNER. Liability for claims IBNR/

claims IBNER is based on an actuarial estimate duly certified by the appointed actuary of the Company. In case of life

insurance business, claims other than maturity claims are accounted for on receipt of intimation. Maturity claims are accounted

when due for payment. Reinsurance on such claims is accounted for in the same period as the related claims. Withdrawals

under linked policies are accounted in the respective schemes.

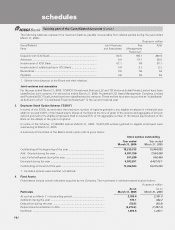

6. Liability for life policies in force

In respect of life insurance business, liability for life policies in force and also policies in respect of which premium has been

discontinued but a liability exists, is determined by the appointed actuary on the basis of an annual review of the life

insurance business, as per the gross premium method in accordance with accepted actuarial practice, requirements of the

IRDA and the Actuarial Society of India. The linked policies sold by the company carry two types of liabilities – unit liability

representing the fund value of policies and non-unit liability for future expenses, meeting death claims, income taxes and

cost of any guarantees.

7. Reserve for unexpired risk

Reserve for unexpired risk is recognised net of reinsurance ceded and represents premium written that is attributable and

to be allocated to succeeding accounting periods for risks to be borne by the company under contractual obligations on

contract period basis or risk period basis, whichever is appropriate. It is calculated on a daily pro-rata basis subject to a

minimum of 50% of the premium, written during the 12 months preceding the balance sheet date for fire, marine, cargo

and miscellaneous business and 100% for marine hull business, in accordance with the provisions of the Insurance Act,

1938.

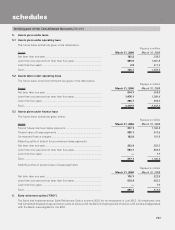

8. Actuarial method and valuation

In case of life insurance business, the actuarial valuation liability on both participating and non-participating policies is

calculated using the gross premium method. The gross premium reserves are calculated using assumptions for interest,

mortality, expense and inflation and in the case of participating policies, the future bonuses together with allowance for

taxation and allocation of profits to shareholders. These assumptions are determined as prudent estimates at the date of

valuation with allowances for adverse deviations.

The interest rates used for valuing the liabilities are in the range of 4.7% to 10.0% per annum (Previous year – 4.0% to

10.0% per annum).

Mortality rates used are based on the published L.I.C. (1994 – 96) Ultimate Mortality Table, adjusted to reflect expected

experience and allowances for adverse deviation. Expenses are provided for at long term expected renewal expense levels.

Unearned premium reserves are held for the unexpired portion of the risk for the general fund liabilities of linked business

and riders thereunder and one year renewable group term insurance.

schedules

forming part of the Consolidated Accounts (Contd.)