ICICI Bank 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Annual Report 2005-2006

of Rs. 1.39 billion on the Bank’s consolidated profit after tax in fiscal 2006 on account of the above

reasons, the company’s unaudited New Business Achieved Profit (NBAP) for fiscal 2006 was Rs. 5.28

billion compared to Rs. 3.12 billion in fiscal 2005. NBAP is a metric for the economic value of the new

business written during a defined period. It is measured as the present value of all the future profits for

the shareholders, on account of the new business based on standard assumptions of mortality, expenses

and other parameters. Actual experience could differ based on variance from these assumptions especially

in respect of expense overruns in the initial years.

ICICI Lombard General Insurance Company

ICICI Lombard General Insurance Company (ICICI Lombard) enhanced its leadership position among

private sector general insurance companies with a market share of 29% in the private sector in fiscal

2006. ICICI Lombard achieved a profit after tax of Rs. 0.50 billion in fiscal 2006 compared to Rs. 0.48

billion in fiscal 2005 despite claims from floods in major cities and investments in the retail franchise.

About 58% of its gross written premiums comprised of non-corporate business.

Prudential ICICI Asset Management Company

Prudential ICICI Asset Management Company (Prudential ICICI AMC) was the largest mutual fund in India

at May 31, 2006 with assets under management of over Rs. 320.00 billion. Prudential ICICI AMC achieved

a profit after tax of Rs. 0.31 billion in fiscal 2006 compared to Rs. 0.17 billion in fiscal 2005. Prudential ICICI

AMC was the named “Mutual Fund of the Year 2005” by CNBCTV18-CRISIL.

ICICI Securities Limited

ICICI Securities continued to enhance its position in the investment banking and equity broking businesses

while capitalising on opportunities in the fixed income market. ICICI Securities achieved a profit after tax

of Rs. 1.57 billion in fiscal 2006 compared to Rs. 0.64 billion in fiscal 2005.

ICICI Venture Funds Management Company Limited

ICICI Venture Funds Management Company Limited (ICICI Venture) raised two funds and strengthened its

leadership position in private equity in India, with funds under management of over Rs. 63.00 billion. ICICI

Venture achieved a profit after tax of Rs. 0.50 billion in fiscal 2006 compared to Rs. 0.32 billion in fiscal 2005.

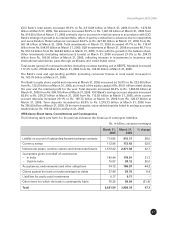

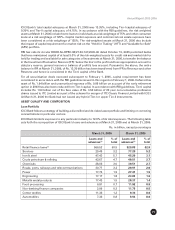

CREDIT RATINGS

ICICI Bank’s credit ratings by various credit rating agencies at March 31, 2006 are given below:

Agency Rating

Moody’s Investor Service (Moody’s) Baa2

Standard & Poor’s (S&P) BB+

Credit Analysis & Research Limited (CARE) CARE AAA

Investment Information and Credit Rating Agency (ICRA) AAA

CRISIL Limited AAA

ORGANISATIONAL EXCELLENCE

The Organisational Excellence Group, headed by a Senior General Manager who reports to the Managing

Director & CEO, is engaged in institutionalising quality across the Bank by building skills and capabilities

in various quality frameworks. The group has evolved a holistic workplace transformation model by

integrating various quality methodologies such as Five S and Six Sigma. The group has been instrumental

in facilitating enterprise-wide deployment of Five S and is catalysing the deployment of quality processes

across the Bank. The group works with business units to leverage quality for business improvements.

The group also supports other ICICI group companies in their quality initiatives.

COMMUNITY DEVELOPMENT

Our social initiatives are designed to enhance the capacities of India’s poor communities to participate in

social, economic and political processes. We believe that improving child health in the early years, ensuring