ICICI Bank 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F73

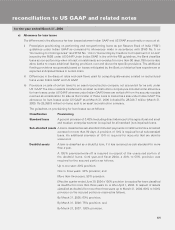

b) Business combinations

The differences arising due to business combinations are primarily on account of:

i) Determination of the accounting acquirer.

ii) Accounting of intangible assets and goodwill.

Under US GAAP, the amalgamation between ICICI Bank Limited and ICICI Limited was accounted for as a

reverse acquisition in fiscal 2003. This means that ICICI Limited was recognised as the accounting acquirer

in the amalgamation, although ICICI Bank was the legal acquirer. On the acquisition date, ICICI held a 46%

ownership interest in ICICI Bank. Accordingly, the acquisition of the balance 54% ownership interest has

been accounted for as a step-acquisition. Under Indian GAAP, ICICI Bank Limited was recognised as the

legal and the accounting acquirer and the assets and liabilities of ICICI Limited were incorporated in the

books of ICICI Bank Limited in accordance with the purchase method of accounting. Further under US

GAAP the amalgamation resulted in goodwill and intangible assets while the amalgamation under Indian

GAAP resulted in a capital reserve (negative goodwill) which was accounted for as Revenue and Other

Reserves according to the scheme of amalgamation.

Further for certain acquisitions made by the Company no goodwill has been accounted for under Indian

GAAP primarily due to accounting for the amalgamation by the pooling of interests method. However under

US GAAP goodwill has been accounted for in accordance with SFAS No. 141 on “Business Combinations”

and SFAS No. 142 on “Goodwill and Other Intangible Assets”.

Under US GAAP subsequent to the adoption of SFAS No. 142, the Company does not amortise goodwill

and intangibles with infinite life but instead tests the same for impairment at least annually. The annual

impairment test under SFAS No. 142 does not indicate an impairment loss for fiscal 2004, fiscal 2005 and

fiscal 2006.

Under US GAAP intangible assets are amortised over their estimated useful lives in proportion to the economic

benefits consumed in each period.

The estimated useful life of intangible assets is as follows:

No. of years

Customer-related intangibles ................................................ 3-10

Other intangibles................................................................... 5

In fiscal 2006, the Company recorded goodwill under US GAAP of Rs. 1,196.8 million in relation to the

acquisitions of software, business process outsourcing and asset management companies in India and

the United States for an aggregate cash consideration of Rs. 1,480.1 million. The revenue and total assets

of the acquired companies are immaterial to the consolidated results of operations and financial position

of the Company. The Company has also entered into a contract with some of the companies acquired, to

pay additional amounts if certain criteria are met.

In fiscal 2005, the Company recorded goodwill under US GAAP of Rs. 2,004.0 million in relation to the

acquisitions of business process outsourcing and research companies in India and United States for an

aggregate cash consideration of Rs. 2,139.6 million. The revenue and total assets of the acquired companies

are immaterial to the consolidated results of operations and financial position of the Company. The Company

has also entered into a contract with some of the companies acquired to pay additional amounts if, certain

criteria are met. Further in one of the acquisitions, the Company has the option to acquire a majority stake

in property companies owned by the seller.

reconciliation to US GAAP and related notes

for the year ended March 31, 2006