ICICI Bank 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

ISSUANCE OF EQUITY CAPITAL

In fiscal 2006, ICICI Bank successfully concluded a capital raising exercise, raising a total of Rs. 80.01

billion through the first simultaneous public issue in India and American Depositary Share (ADS) issue in

the United States, with a Public Offering Without Listing (POWL) of ADSs in Japan. The public issue in

India was subscribed approximately seven times. The issue was priced at Rs. 525 in the domestic market

and USD 26.75 in the ADS market which represented a discount of under 1% to the last closing price on

stock exchanges in India and the United States, respectively.

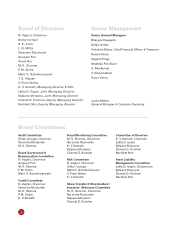

SUBSIDIARY COMPANIES

At March 31, 2006, ICICI Bank had 16 subsidiaries:

Domestic Subsidiaries International Subsidiaries

ICICI Securities Limited ICICI Bank UK Limited

ICICI Venture Funds Management Company Limited ICICI Bank Canada

ICICI Prudential Life Insurance Company Limited ICICI Securities Holdings Inc.(1)

ICICI Lombard General Insurance Company Limited ICICI Securities Inc.(2)

ICICI Home Finance Company Limited(4) ICICI International Limited

ICICI Investment Management Company Limited ICICI Bank Eurasia Limited Liability Company(3)

ICICI Trusteeship Services Limited

ICICI Brokerage Services Limited(1)

Prudential ICICI Asset Management Company Limited(5)

Prudential ICICI Trust Limited(5)

(1) Subsidiary of ICICI Securities Limited

(2) Subsidiary of ICICI Securities Holdings Inc.

(3) Formerly known as Investitsionno-kreditny Bank.

(4) ICICI Distribution Finance Private Limited, a subsidiary of ICICI Bank, merged with ICICI Home Finance Company Limited,

effective August 11, 2005.

(5) Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited became subsidiaries of ICICI

Bank effective August 26, 2005, pursuant to the acquisition of additional 6% of the equity share capital of these companies

by ICICI Bank from Prudential Corporation Holdings Limited.

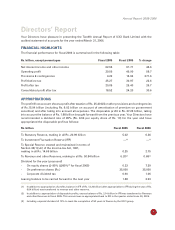

Directors’ Report

Banking Accounts

ICICI Bank offers a

range of banking

accounts tailor-made

for every customer

segment, from children

to senior citizens.

Convenience and ease

of access are the

benefits of ICICI Bank

accounts.

Insurance

The ICICI group offers a range of

insurance products to cover varying

needs ranging from life, pensions

and health, to home, motor and

travel insurance. The products are

made accessible to customers

through a wide network of advisors,

bank partners, corporate agents and

brokers with the added convenience

of being able to buy online.

Trade Services

ICICI Bank offers online

remittances as well as online

processing of Letters of Credit

and Bank Guarantees.

Asset Management

Prudential ICICI Asset

Management Company offers a

wide range of retail mutual fund

products tailored to suit varied

risk and maturity profiles.

Fullfilling a variety of banking and finance needs across customer segments