ICICI Bank 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

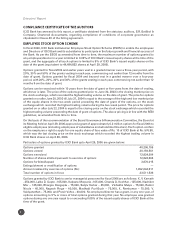

COMPLIANCE CERTIFICATE OF THE AUDITORS

ICICI Bank has annexed to this report, a certificate obtained from the statutory auditors, S.R. Batliboi &

Company, Chartered Accountants, regarding compliance of conditions of corporate governance as

stipulated in Clause 49 of the listing agreement.

EMPLOYEE STOCK OPTION SCHEME

In fiscal 2000, ICICI Bank instituted an Employee Stock Option Scheme (ESOS) to enable the employees

and Directors of ICICI Bank and its subsidiaries to participate in the future growth and financial success of

the Bank. As per the ESOS as amended from time to time, the maximum number of options granted to

any employee/director in a year is limited to 0.05% of ICICI Bank’s issued equity shares at the time of the

grant, and the aggregate of all such options is limited to 5% of ICICI Bank’s issued equity shares on the

date of the grant (equivalent to 44,494,852 shares at April 29, 2006).

Options granted for fiscal 2003 and earlier years vest in a graded manner over a three-year period, with

20%, 30% and 50% of the grants vesting in each year, commencing not earlier than 12 months from the

date of grant. Options granted for fiscal 2004 and beyond vest in a graded manner over a four-year

period, with 20%, 20%, 30% and 30% of the grants vesting in each year, commencing not earlier than 12

months from the date of grant.

Options can be exercised within 10 years from the date of grant or five years from the date of vesting,

whichever is later. The price of the options granted prior to June 30, 2003 is the closing market price on

the stock exchange, which recorded the highest trading volume on the date of grant. The price for options

granted on or after June 30, 2003 till July 21, 2004 is equal to the average of the high and low market price

of the equity shares in the two week period preceding the date of grant of the options, on the stock

exchange which recorded the highest trading volume during the two week period. The price for options

granted on or after July 22, 2004 is equal to the closing price on the stock exchange which recorded the

highest trading volume preceeding the date of grant of options. The above pricing is in line with the SEBI

guidelines, as amended from time to time.

On the basis of the recommendation of the Board Governance & Remuneration Committee, the Board at

its Meeting held on April 29, 2006 approved a grant of approximately 6.3 million options for fiscal 2006 to

eligible employees (including employees of subsidiaries and wholetime Directors). Each option confers

on the employee a right to apply for one equity share of face value of Rs. 10 of ICICI Bank at Rs. 576.80,

which was the last closing price on the stock exchange which recorded the highest trading volume in

ICICI Bank shares on April 28, 2006.

Particulars of options granted by ICICI Bank upto April 29, 2006 are given below:

Options granted 40,206,155

Options vested 20,159,561

Options exercised 12,824,604

Number of shares allotted pursuant to exercise of options 12,824,604

Options forfeited/lapsed 3,870,015

Extinguishment or modification of options —

Amount realised by exercise of options (Rs.) 1,952,644,811

Total number of options in force 23,511,536

Options granted by ICICI Bank to senior managerial personnel for fiscal 2006 are as follows: K. V. Kamath

–250,000, Lalita D. Gupte –165,000, Kalpana Morparia –165,000, Chanda D. Kochhar –125,000, Nachiket

Mor – 125,000, Bhargav Dasgupta – 75,000, Sanjiv Kerkar – 25,000, Vishakha Mulye – 75,000, Ramni

Nirula – 40,000, Nagesh Pinge – 40,000, Madhabi Puri-Buch – 75,000, K. Ramkumar – 75,000, V.

Vaidyanathan – 75,000, and Pravir Vohra – 40,000. No employee/director has a grant, in any one year, of

options amounting to 5% or more of total options granted during that year. No employee was granted

options during any one year equal to or exceeding 0.05% of the issued equity shares of ICICI Bank at the

time of the grant.

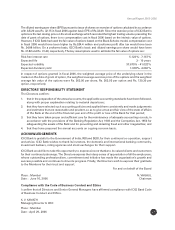

Directors’ Report