ICICI Bank 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F60

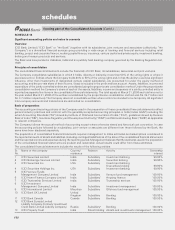

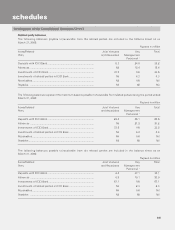

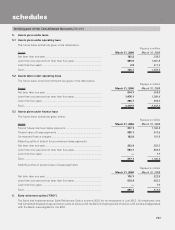

The computation of earnings per share is given below:

Rupees in million except per share data

Year ended Year ended

March 31, 2006 March 31, 2005

Basic

Weighted average no. of equity shares outstanding ..................... 781,693,773 727,728,042

Net profit ......................................................................................... 24,200.9 18,523.3

Basic earnings per share (Rs.) ........................................................ 30.96 25.45

Diluted

Weighted average no. of equity shares outstanding ..................... 789,963,635 733,720,485

Net profit ......................................................................................... 24,200.9 18,523.3

Diluted earnings per share (Rs.) ..................................................... 30.64 25.25

Nominal value per share (Rs.) ......................................................... 10.0 10.0

The dilutive impact is mainly due to options granted to employees by the Bank.

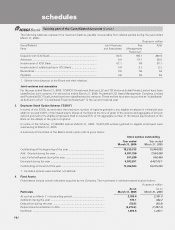

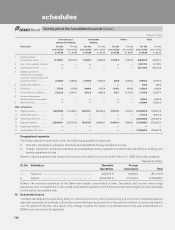

2. Related party transactions

The Company has transactions with its related parties comprising joint ventures, associates and key management personnel.

The following represent the significant transactions between the Company and such related parties:

Lease of premises and facilities

During the year ended March 31, 2006, the Company charged for lease of premises, facilities and other administrative costs

to joint ventures amounting to Rs. Nil (March 31, 2005: Rs. 3.4 million).

Interest received

During the year ended March 31, 2006 the Company received interest from its Key management personnel1 amounting to

Rs. 0.5 million (March 31, 2005: Rs. 0.3 million).

Interest paid

During the year ended March 31, 2006, the Company paid interest to joint ventures amounting to Rs. Nil

(March 31, 2005: Rs. 18.9 million).

Remuneration to whole-time directors

Remuneration paid to the whole-time directors of the Bank during the year ended March 31, 2006 was Rs. 75.9 million

(March 31, 2005: Rs. 60.5million).

Sale of investments

During the year ended March 31, 2006, the Company sold certain investments to joint ventures amounting to Rs. Nil

(March 31, 2005: Rs. 3,637.3 million). On the sales made to joint ventures the Bank accounted for a loss of Rs. Nil

(March 31, 2005: Rs. 14.6 million).

Purchase of investments

During the year ended March 31, 2006, the Company purchased certain investments from its joint ventures amounting to

Rs. 20.2 million (March 31, 2005: Rs. 5,001.2 million).

Custodial charges received

During the year ended March 31, 2006, the Company received custodial charges from its joint ventures amounting to Rs. Nil

(March 31, 2005: Rs. 1.7 million).

Fees

During the year ended March 31, 2006, the Company received cash management services fees from its joint ventures

amounting to Rs. Nil (March 31, 2005: Rs. 14.5 million).

schedules

forming part of the Consolidated Accounts (Contd.)