ICICI Bank 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Annual Report 2005-2006

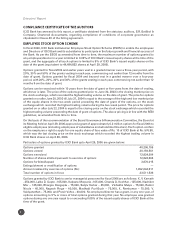

The diluted earnings per share (EPS) pursuant to issue of shares on exercise of options calculated in accordance

with AS-20 was Rs. 32.15 in fiscal 2006 against basic EPS of Rs.32.49. Since the exercise price of ICICI Bank’s

options is the last closing price on the stock exchange which recorded the highest trading volume preceding the

date of grant of options, there is no compensation cost in fiscal 2006 based on the intrinsic value of options.

However, if ICICI Bank had used the fair value of options based on the Black-Scholes model, compensation cost

in fiscal 2006 would have been higher by Rs.524.4 million and proforma profit after tax would have been

Rs. 24.88 billion. On a proforma basis, ICICI Bank’s basic and diluted earnings per share would have been

Rs. 31.82 and Rs. 31.49, respectively. The key assumptions used to estimate the fair value of options are:

Risk-free interest rate 5.122% - 7.167%

Expected life 3 - 10 years

Expected volatility 37.670% - 41.032%

Expected dividend yield 1.978%- 4.060%

In respect of options granted in fiscal 2006, the weighted average price of the underlying share in the

market on the date of grant of option, the weighted average exercise price of the options and the weighted

average fair value of the options were Rs. 362.06 per share, Rs. 362.05 per option and Rs. 130.30 per

option, respectively.

DIRECTORS’ RESPONSIBILITY STATEMENT

The Directors confirm:

1. that in the preparation of the annual accounts, the applicable accounting standards have been followed,

along with proper explanation relating to material departures;

2. that they have selected such accounting policies and applied them consistently and made judgements

and estimates that are reasonable and prudent, so as to give a true and fair view of the state of affairs

of the Bank at the end of the financial year and of the profit or loss of the Bank for that period;

3. that they have taken proper and sufficient care for the maintenance of adequate accounting records, in

accordance with the provisions of the Banking Regulation Act, 1949 and the Companies Act, 1956 for

safeguarding the assets of the Bank and for preventing and detecting fraud and other irregularities; and

4. that they have prepared the annual accounts on a going concern basis.

ACKNOWLEDGEMENTS

ICICI Bank is grateful to the Government of India, RBI and SEBI, for their continued co-operation, support

and advice. ICICI Bank wishes to thank its investors, the domestic and international banking community,

investment bankers, rating agencies and stock exchanges for their support.

ICICI Bank would like to take this opportunity to express sincere thanks to its valued clients and customers

for their continued patronage. The Directors express their deep sense of appreciation of all the employees,

whose outstanding professionalism, commitment and initiative has made the organisation’s growth and

success possible and continues to drive its progress. Finally, the Directors wish to express their gratitude

to the Members for their trust and support.

For and on behalf of the Board

Place : Mumbai N. VAGHUL

Date : June 16, 2006 Chairman

Compliance with the Code of Business Conduct and Ethics

I confirm that all Directors and Senior General Managers have affirmed compliance with ICICI Bank Code

of Business Conduct and Ethics.

K. V. KAMATH

Managing Director & CEO

Place : Mumbai

Date : April 29, 2006