ICICI Bank 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F62

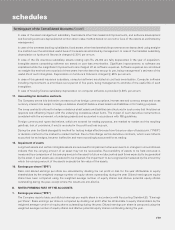

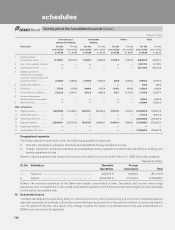

The following balances represent the maximum balance payable to/receivable from related parties during the year ended

March 31, 2005:

Rupees in million

Items/Related Joint Ventures Key Total

Party and Associates Management

Personnel 1

Deposits with ICICI Bank ................................................................ 64.5 196.1 260.6

Advances ........................................................................................ 0.9 19.1 20.0

Investments of ICICI Bank .............................................................. 67.1 Nil 67.1

Investments of related parties in ICICI Bank .................................. Nil 2.3 2.3

Receivables ..................................................................................... Nil Nil Nil

Payables ........................................................................................ Nil Nil Nil

1. Whole- time directors of the Board and their relatives.

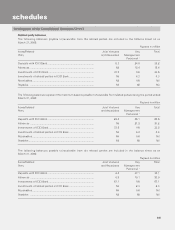

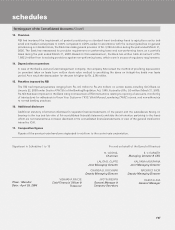

Joint ventures and associates

For the year ended March 31, 2006, TCW/ICICI Investment Partners LLC and TSI Ventures (India) Private Limited have been

classified as joint ventures. For the period ended March 31, 2005, Prudential ICICI Asset Management Company Limited

and Prudential ICICI Trust Limited have been classified as joint ventures. These entities have been accounted as “subsidiaries”

as defined in AS 21 “Consolidated Financial Statement” in the current financial year.

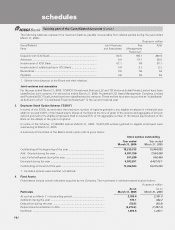

3. Employee Stock Option Scheme (”ESOS”)

In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial year

shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate of all such

options granted to the eligible employees shall not exceed 5% of the aggregate number of the issued equity shares of the

Bank on the date(s) of the grant of options.

In terms of the Scheme, 17,362,584 options (March 31, 2005: 18,215,335 options) granted to eligible employees were

outstanding at March 31, 2006.

A summary of the status of the Bank’s stock option plan is given below:

Stock options outstanding

Year ended Year ended

March 31, 2006 March 31, 2005

Outstanding at the beginning of the year ................................................. 18,215,335 15,964,982

Add: Granted during the year ................................................................... 4,981,780 7,554,500

Less: Forfeited/lapsed during the year ...................................................... 931,280 846,496

Exercised during the year .......................................................................... 4,903,251 4,457,6511

Outstanding at the end of the year ........................................................... 17,362,584 18,215,335

1. Excludes options exercised but not allotted.

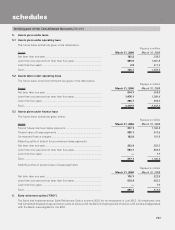

4. Fixed Assets

Fixed assets include certain softwares acquired by the Company. The movement in software assets is given below:

Rupees in million

As on As on

Particulars March 31, 2006 March 31, 2005

At cost as on March 31 of preceding period............................................. 2,784.4 2,381.0

Additions during the year .......................................................................... 615.1 462.2

Deductions during the year ....................................................................... (52.5) (58.8)

Depreciation/amortisation to date ............................................................. (2,274.2) (1,557.3)

Net Block ................................................................................................... 1,072.8 1,227.1

schedules

forming part of the Consolidated Accounts (Contd.)