ICICI Bank 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F51

forming part of the Consolidated Accounts (Contd.)

schedules

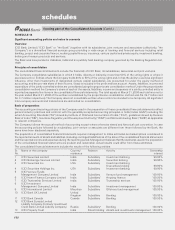

Sr. Name of the company Country/ Relation Activity Ownership

No. residence interest

14 ICICI Eco-net Internet & Technology Fund India Direct holding Venture capital fund 92.03%

15 ICICI Equity Fund India Direct holding Venture capital fund 100.00%

16 ICICI Emerging Sectors Fund India Direct holding Venture capital fund 98.85%

17 ICICI Strategic Investments Fund India Direct holding Venture capital fund 100.00%

18 ICICI Prudential Life Insurance India Jointly Life insurance 74.00%

Company Limited controlled

entity3

19 ICICI Lombard General India Jointly General insurance 74.00%

Insurance Company Limited controlled

entity3

20 Prudential ICICI Asset India Subsidiary4Asset management company

Management Company Limited for Prudential ICICI Mutual fund 50.99%

21 Prudential ICICI Trust Limited India Subsidiary4Trustee company for

Prudential ICICI Mutual fund 50.80%

22 TCW/ICICI Investment Partners LLC. Mauritius Jointly

controlled

entity5Asset and fund management company 50.00%

23 TSI Ventures (India) Private Limited India Jointly

controlled

entity5Real estate consultant 50.00%

1.Effective August 11, 2005, ICICI Distribution Finance Private Limited has merged with ICICI Home Finance Company Limited.

Consequent to the merger ICICI Distribution Finance Private Limited ceases to be a subsidiary of the Bank.

2.ICICI Bank Eurasia Limited Liability Company (formerly Investment Credit Bank Limited Liability Company) has become a

subsidiary of ICICI Bank Limited with effect from May 19, 2005, being the date of its acquisition.

3.Since the year ended March 31, 2005, the financial statements of these jointly controlled entities have been consolidated as

per AS 21 “ Consolidated Financial Statements” consequent to the limited revision to AS 27 “Financial Reporting of Interests in

Joint Ventures”.

4.Effective August 26, 2005, Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited have

become subsidiaries of the Bank. Therefore, these entities have been fully consolidated instead of the proportionate consolidation

method.

5.This investment is accounted as per the proportionate consolidation method.

Pursuant to the resolution passed at the meeting of the Board of Directors of ICICI Venture Funds Management Company

Limited (IVFMCL), held on July 21, 2004, IVFMCL has decided not to carry on activities of non-banking financial companies,

under Section 45-1A(6)(i) and applied to RBI for cancellation of its non-banking financial company certificate. The RBI vide its

order dated December 27, 2004 has, cancelled as surrendered, the certificate of registration granted to IVFMCL. Consequently

the statutory reserve, created in pursuance of section 45-IC of the Reserve Bank of India (Amendment) Act, 1997, amounting to

Rs. 210.0 million has been treated as free reserve and has been included as a part of revenue and other reserves.

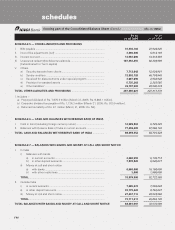

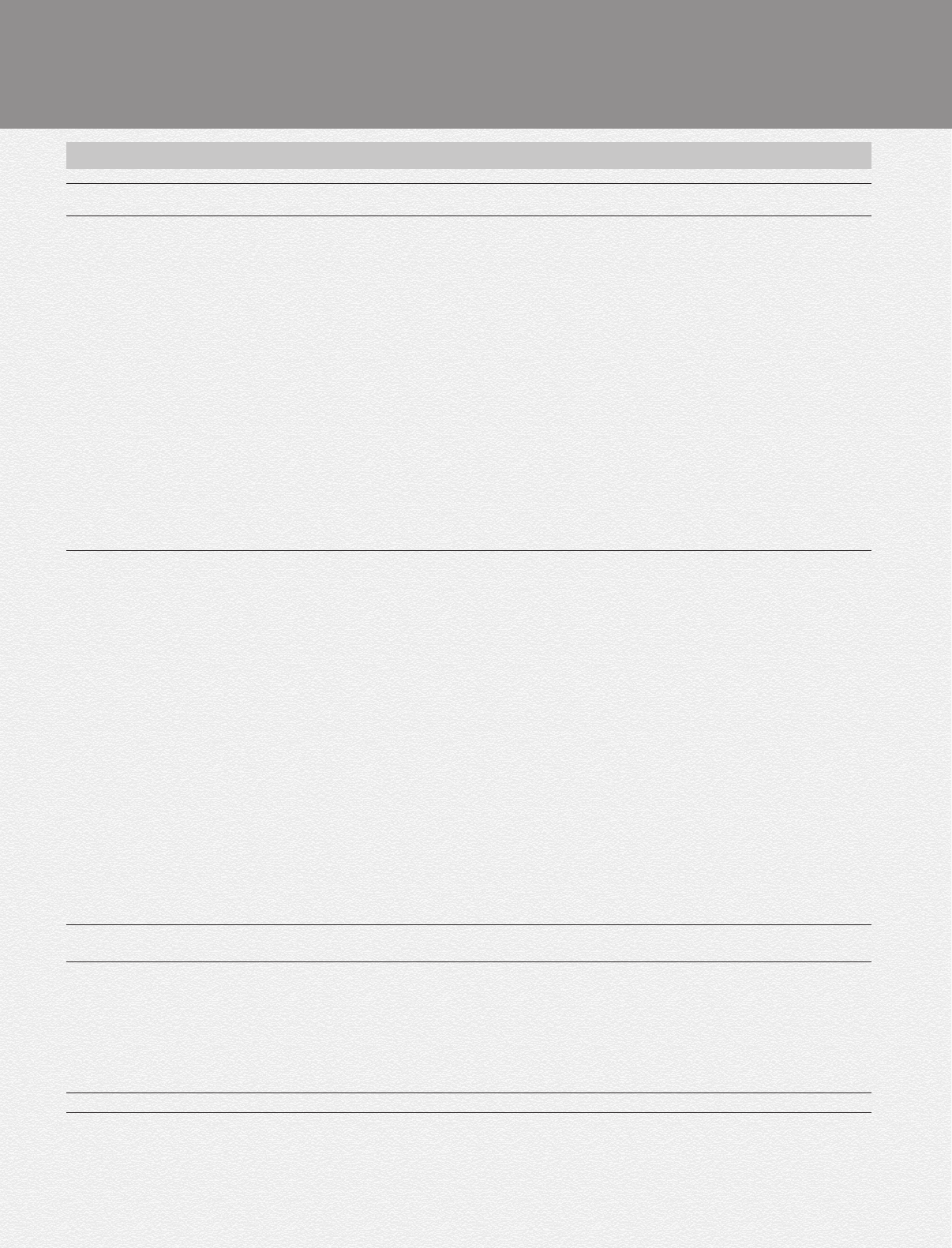

Equity issue of ICICI Bank Limited

During the year ended March 31, 2006, the Bank raised equity capital amounting to Rs. 80,006.1 million. The expenses of the

issue amounting to Rs. 874.1 million have been charged to the share premium account. The details of the equity capital raised

are given in the table below.

Rupees in million except per share data

Details No. of Amount of Aggregate

equity shares share premium proceeds

Fully paid equity shares of Rs. 10 each

at a premium of Rs. 515 per share 67,787,322 34,910.5 35,588.3

Fully paid equity shares of Rs. 10 each

at a premium of Rs. 488.75 per share128,894,060 14,122.0 14,410.9

18,618,730 American Depository Share (“ADS”)

at a price of US$ 26.75 per share 237,237,460 22,134.6 22,506.9

Fully paid equity shares of Rs. 10 each issued by

exercise of the green shoe option 14,285,714 7,357.1 7,500.0

TOTAL 148,204,556 78,524.2 80,006.1

1.Unpaid calls of Rs. 0.3 million (Unpaid share premium Rs. 92.4 million).

2.Includes green shoe option of 2,428,530 ADSs.