ICICI Bank 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

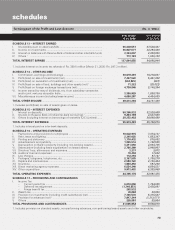

F16

forming part of the Accounts (Contd.)

schedules

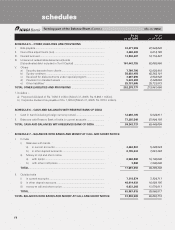

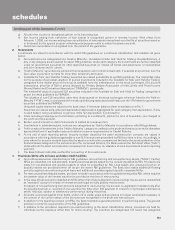

reviewed at each balance sheet date and adjusted to reflect the current management estimates. In cases where the available

information indicates that the loss on the contingency is reasonably possible but the amount of loss cannot be reasonably

estimated, a disclosure is made in the financial statements. In case of remote possibility neither provision nor disclosure is

made in the financial statements.

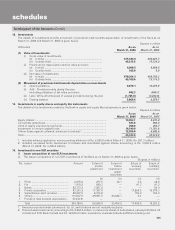

13. Earnings Per Share (“EPS”)

Basic and diluted earnings per share are calculated by dividing the net profit or loss for the year attributable to equity

shareholders by the weighted average number of equity shares outstanding during the year. Diluted earnings per equity

share has been computed using the weighted average number of equity shares and dilutive potential equity shares outstanding

during the period, except where the results are anti-dilutive.

14. Cash and cash equivalents

Cash and cash equivalents include cash in hand, balances with RBI, balances with other banks and money at call and short

notice.

B. NOTES FORMING PART OF THE ACCOUNTS

The following additional disclosures have been made taking into account RBI guidelines in this regard.

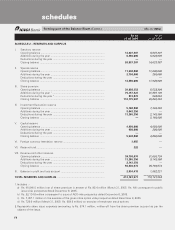

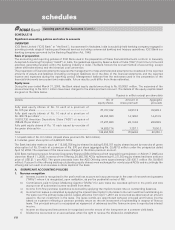

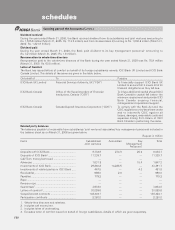

1. Capital adequacy ratio

The capital to risk weighted assets ratio (“CRAR”) as assessed by the Bank on the basis of the financial statements and

guidelines issued by RBI is given in the table below.

Rupees in million

As on As on

March 31, 2006 March 31, 2005

Tier I capital ................................................................................................ 191,815.3 102,463.2

Tier II capital ............................................................................................... 86,610.9 56,566.1

Total capital ................................................................................................ 278,426.2 159,029.3

Total risk weighted assets ......................................................................... 2,085,935.9 1,350,168.1

CRAR (%) ................................................................................................... 13.35% 11.78%

CRAR – Tier I capital (%) ............................................................................ 9.20% 7.59%

CRAR – Tier II capital (%) ........................................................................... 4.15% 4.19%

Amount of subordinated debt raised as Tier II capital during the year ..... 39,730.0 4,500.0

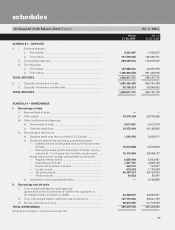

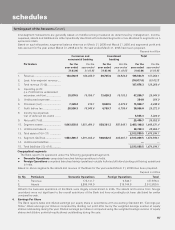

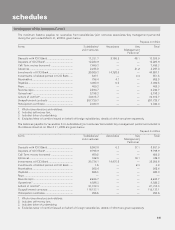

2. Business/information ratios

The business/information ratios for the year ended March 31, 2006, and March 31, 2005 are given in the table below.

Year ended Year ended

March 31, 2006 March 31, 2005

i) Interest income to working funds1.................................................... 7.03% 6.94%

ii) Non-interest income to working funds1............................................ 2.54% 2.52%

iii) Operating profit to working funds1.................................................... 2.39% 2.18%

iv) Return on assets2............................................................................... 1.30% 1.48%

v) Profit per employee (Rs. in million) ................................................... 1.0 1.1

1. For the purpose of computing the ratios, working funds represent the average of total assets as reported to RBI under

Section 27 of the Banking Regulation Act, 1949.

2. For the purpose of computing the ratio, assets represent average total assets as reported to RBI in Form X under Section

27 of the Banking Regulation Act, 1949.

Rupees in million

As on As on

March 31, 2006 March 31, 2005

vi) Business per employee ..................................................................... 90.5 88.0

(average deposits plus average advances)

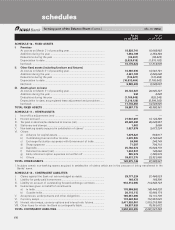

3. Information about business and geographical segments

Consumer and Commercial Banking comprising the retail and corporate banking operations of the Bank.

Investment Banking comprising the treasury activities of the Bank.