ICICI Bank 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Annual Report 2005-2006

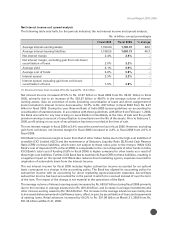

SEGMENTAL INFORMATION

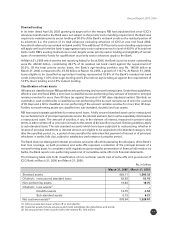

The Bank’s operations are classified into the following segments: commercial banking segment and

investment banking segment. Segment data for previous periods has been reclassified on a comparable

basis.

The consumer & commercial banking segment provides medium-term and long-term project and

infrastructure financing, securitization, factoring, lease financing, working capital finance and foreign

exchange services to clients. Further, it provides deposit and loan products to retail customers. The

investment banking segment includes treasury operations.

Consumer & Commercial Banking Segment

Profit before tax of the consumer and commercial banking segment increased to Rs. 26.55 billion in fiscal

2006 from Rs. 18.95 billion in fiscal 2005.

Net interest income, increased by 51.6% to Rs. 37.51 billion in fiscal 2006 from Rs. 24.74 billion in fiscal

2005, primarily due to an increase in the interest income on advances and investments and a reduction

in the interest expense on borrowings, offset, in part, by an increase in the interest expense on deposits.

Non-interest income increased by 46.7% to Rs. 37.17 billion in fiscal 2006 from Rs. 25.34 billion in fiscal

2005 primarily due to growth in commission and brokerage income. Commission and brokerage income

increased mainly due to growth in credit card related fees and third-party product distribution fees,

increase in income from remittances and other fees from international products and services and growth

in fees from corporate customers.

Non-interest expenses increased by 34.6% to Rs. 40.81 billion in fiscal 2006 from Rs. 30.32 billion in fiscal

2005, primarily due to enhanced operations and the growth in the retail franchise, including maintenance

of ATMs, credit card expenses, call centre expenses and technology expenses.

Provisions for contingencies (excluding provisions for tax) in fiscal 2006 was Rs. 7.32 billion compared to

Rs. 0.81 billion in fiscal 2005 primarily due to increased provisions on standard assets as per RBI guidelines

in fiscal 2006 and higher level of write-backs in fiscal 2005.

Investment Banking Segment

Profit before tax of investment banking segment was Rs. 4.80 billion in fiscal 2006 as compared to

Rs. 6.71 billion in fiscal 2005.

Net interest income increased by 19.2% to Rs. 4.35 billion in fiscal 2006 compared to Rs. 3.65 billion in

fiscal 2005 mainly due to 80.4% rise in interest income from government securities, offset in part by

increase in interest on inter-bank borrowings.

Non-interest income increased by 43.5% to Rs. 12.66 billion in fiscal 2006 from Rs. 8.82 billion in fiscal

2005 primarily due to higher capital gains realised on sale of equity investments.

Non-interest expenses increased by 57.2% to Rs. 3.60 billion in fiscal 2006 from Rs. 2.29 billion in fiscal

2005 primarily due to increase in employee expenses and other administrative expenses.

Provisions increased to Rs. 8.62 billion in fiscal 2006 compared to Rs. 3.47 billion in fiscal 2005. The sharp

increase in provisions reflects the increase in the amount of amortisation of premium on government

securities.

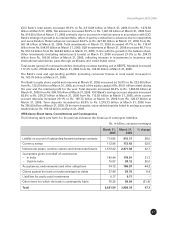

CONSOLIDATED FINANCIALS AS PER INDIAN GAAP

The consolidated profit after tax for fiscal 2006 was Rs. 24.20 billion including the results of operations of

ICICI Bank’s subsidiaries and other consolidating entities. Future bonus provisions and non-amortisation

of expenses by ICICI Prudential Life Insurance Company in line with the insurance company accounting

norms had a negative impact on the Bank’s consolidated profits. Life insurance companies worldwide

require five to seven years to achieve break-even, in view of the business set-up and customer acquisition

costs in the initial years as well as reserving for actuarial liability. The deficit in the initial years is usually

higher for faster growing companies; the profit streams, after break-even is achieved, are expected to be

correspondingly higher.